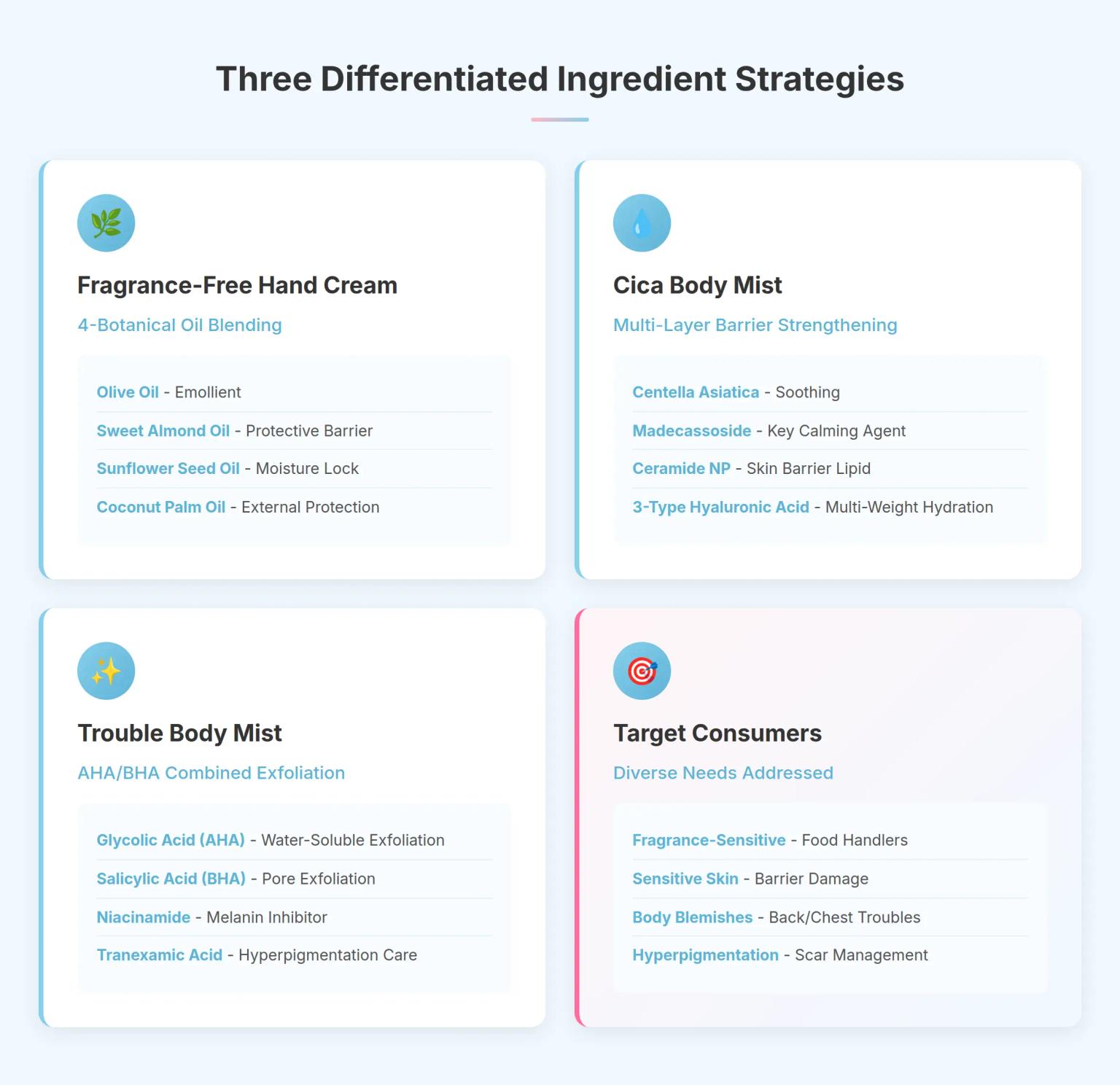

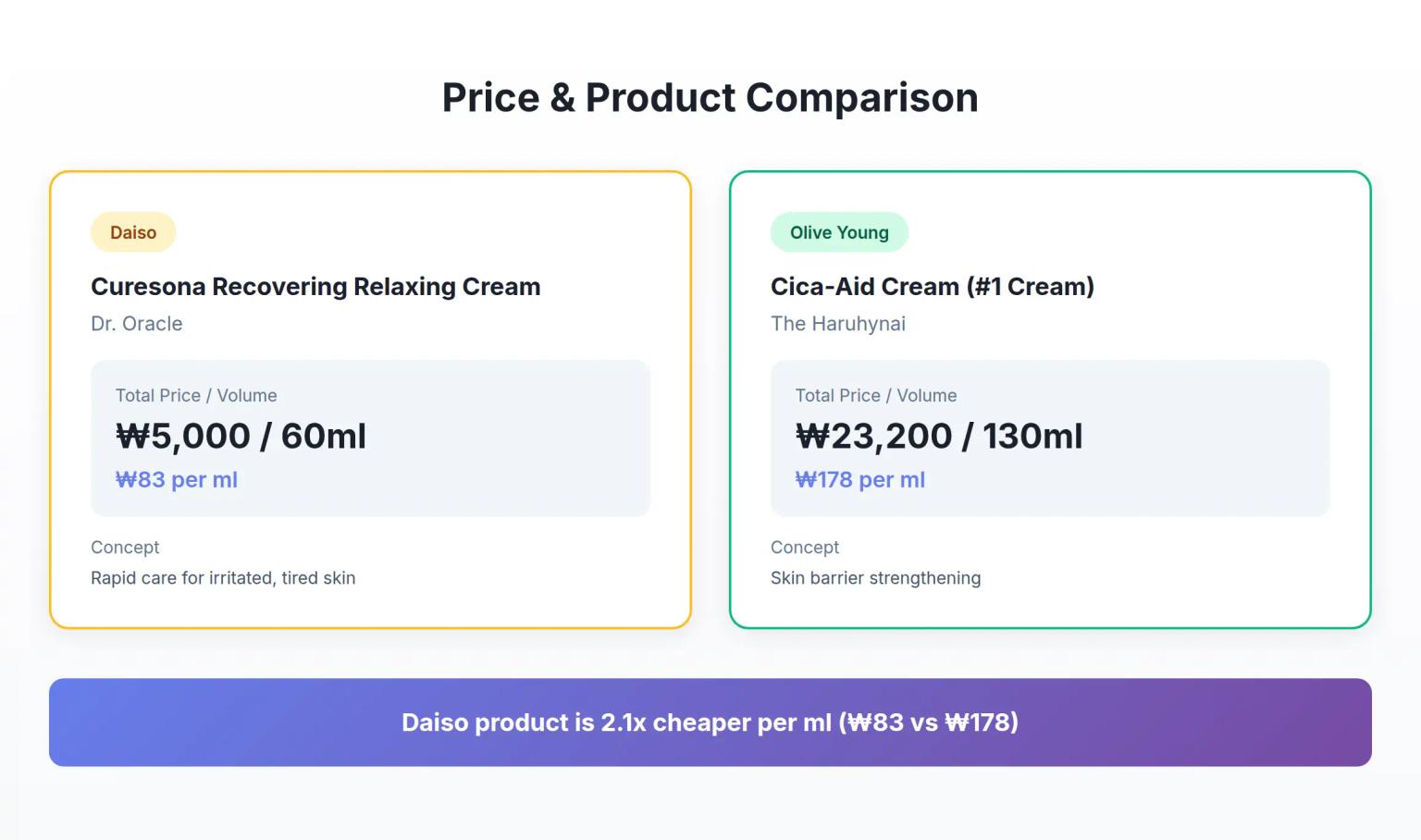

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

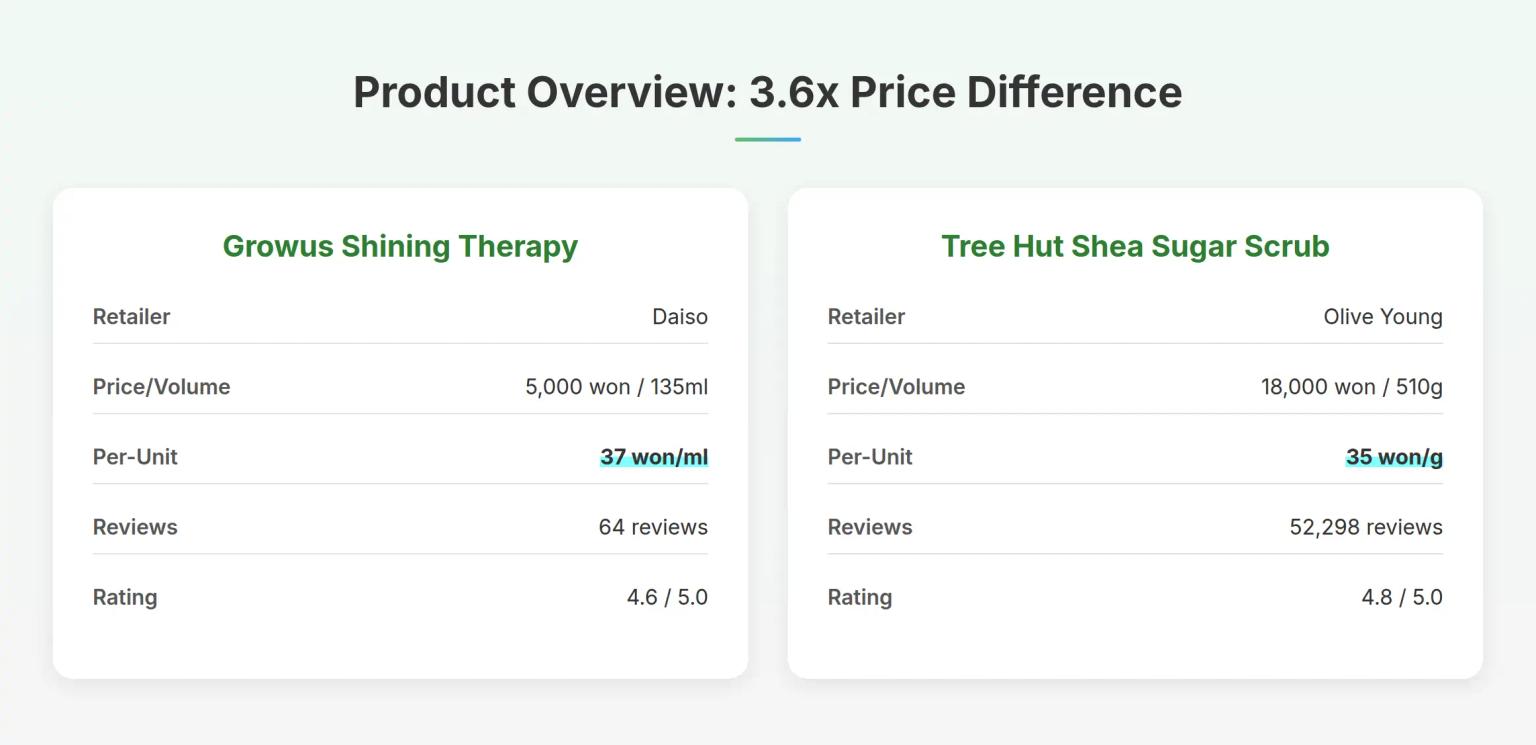

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.