Korean Dermocosmetics Manufacturing: Cosvision's Skin Barrier Technology Analysis Through Aestura Products

BeauticsLab

October 20, 2025

Table of Contents

One OEM Manufacturer Behind Aestura Dermocosmetics🔗

In Olive Young's dermocosmetics category, Cosvision manufactures products sold under the Aestura brand. This mid-sized Korean OEM manufacturer specializes in dermocosmetics production.

This analysis is based on October 2025 Olive Young dermocosmetics category data. We analyzed ingredient formulations across Cosvision's Aestura product line.

Analysis Scope:

- Aestura brand dermocosmetics product portfolio

- TOP 3 products: Atobarrier365 Cream, Hydro Soothing Cream, Hydro Essence

- Ingredient data analysis and common ingredient pattern identification

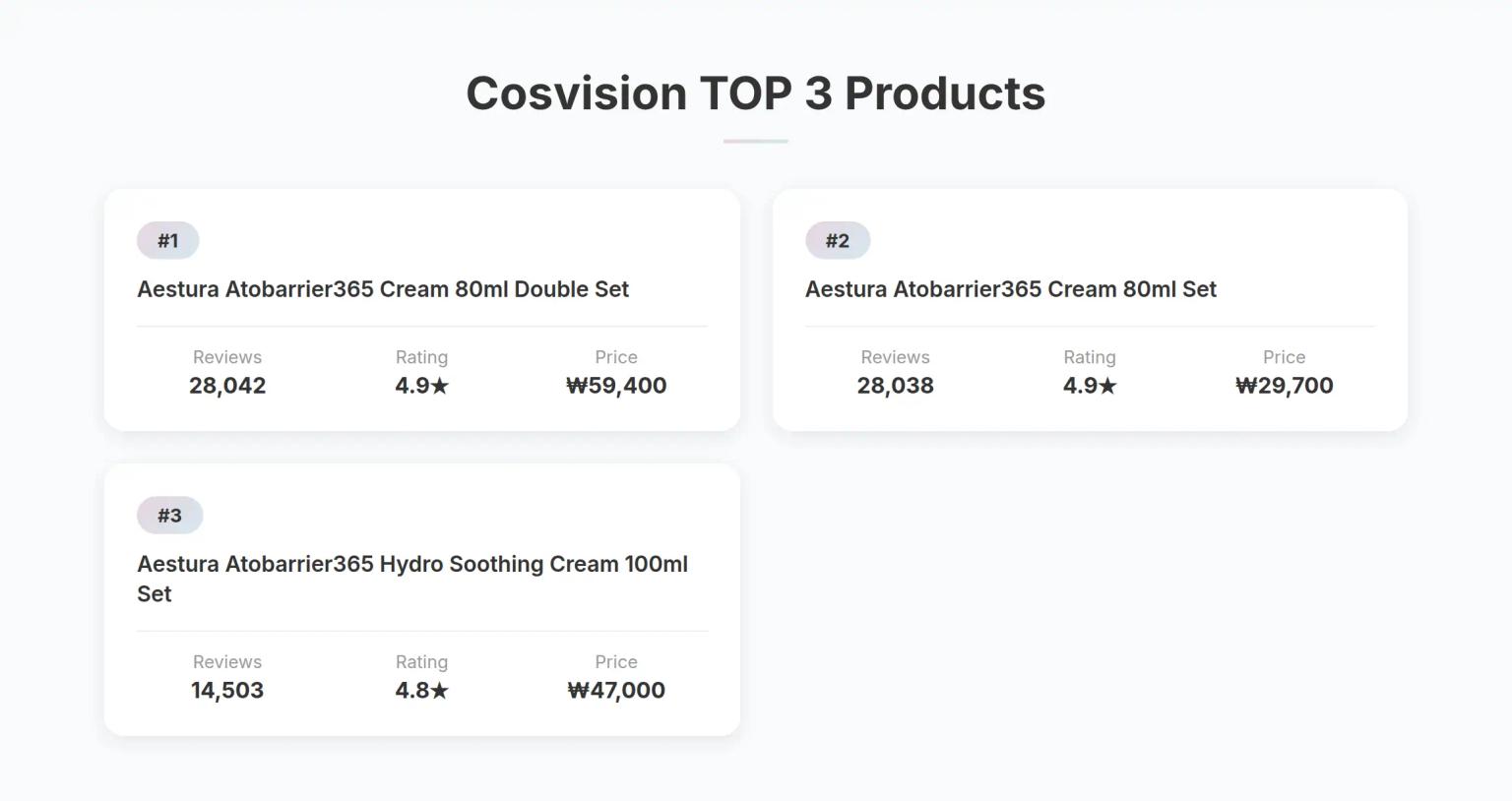

Cosvision's Dermocosmetics Product Portfolio🔗

| Rank | Brand | Product | Reviews | Rating | Price |

|---|---|---|---|---|---|

| #1 | Aestura | Atobarrier365 Cream 80ml Double Set | 28,042 | 4.9 | ₩59,400 |

| #2 | Aestura | Atobarrier365 Cream 80ml Set | 28,038 | 4.9 | ₩29,700 |

| #3 | Aestura | Atobarrier365 Hydro Soothing Cream 100ml Set | 14,503 | 4.8 | ₩47,000 |

All TOP 3 products belong to the Atobarrier365 line. Cosvision demonstrates specialized manufacturing capabilities in sensitive skin barrier care.

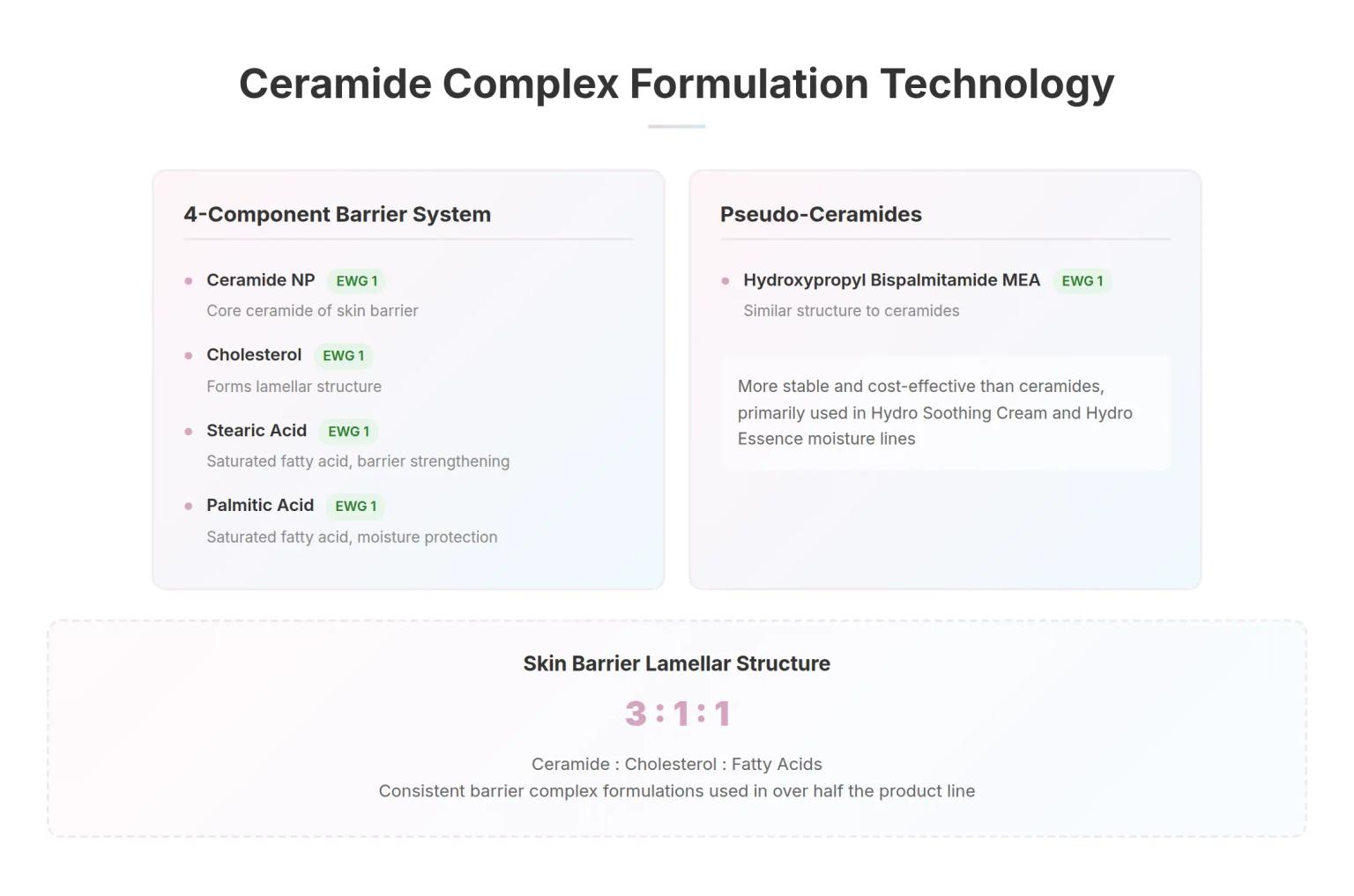

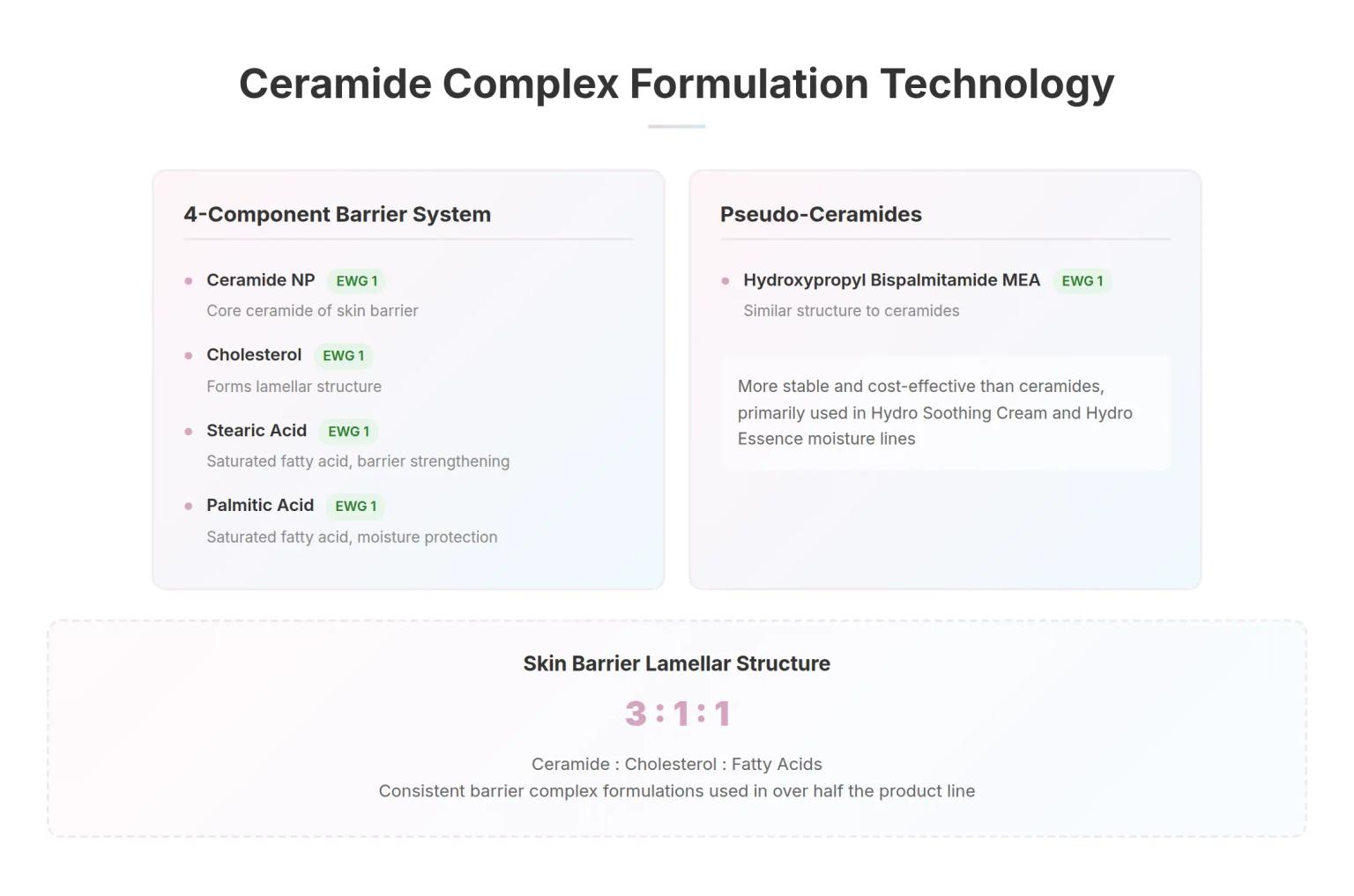

1. Ceramide Complex Formulation Technology🔗

Atobarrier365 Cream's 4-Component Barrier System🔗

The #1 product, Atobarrier365 Cream, features a complex blend of three key ingredients that constitute the skin barrier structure.

Ceramide + Cholesterol + 2 Fatty Acids:

- Ceramide NP (EWG Grade 1): Core ceramide of skin barrier

- Cholesterol (EWG Grade 1): Forms lamellar structure with ceramide

- Stearic Acid (EWG Grade 1): Saturated fatty acid, barrier strengthening

- Palmitic Acid (EWG Grade 1): Saturated fatty acid, moisture protection

The skin barrier consists of a lamellar structure with ceramide, cholesterol, and fatty acids stacked in a 3:1:1 ratio. Cosvision replicates this structure by formulating all three components. More than half of the product line contains cholesterol, stearic acid, and palmitic acid, demonstrating consistent application of barrier complex formulations.

Pseudo-Ceramides:

- Hydroxypropyl Bispalmitamide MEA (EWG Grade 1): Used in multiple products

This is a synthetic ingredient with a structure similar to ceramides. More stable and cost-effective than ceramides, it's primarily used in moisture lines like Hydro Soothing Cream and Hydro Essence.

2. Natural Moisturizing Factor (NMF) Complex Technology🔗

Hydro Soothing Cream - 11-Type NMF Components🔗

Cosvision's Hydro line incorporates Natural Moisturizing Factor (NMF) components naturally present in skin.

11-Type Composition:

- 8 Amino Acids: Arginine, Threonine, Citrulline, Alanine, Serine, Lysine HCl, Histidine HCl, Glutamic Acid

- 2 Sugars: Sucrose, Glycogen

- 1 PCA: Pyrrolidone Carboxylic Acid

NMF is a moisture-binding substance in the skin's stratum corneum, consisting of amino acids (40%), PCA (12%), sugars (8.5%), and other components. It attracts and retains skin moisture. Cosvision formulates these 11 components to rapidly replenish skin moisture.

Trehalose: A sugar used by desert organisms to maintain moisture in extreme environments. It activates aquaporins, water channels in skin cell membranes, helping moisture penetrate deep into the skin.

Hydro Essence - 30-Type NMF Components🔗

Hydro Essence uses a 30-type complex that replicates the component ratio of NMF more precisely.

30-Type Composition:

- 18 Amino Acids: Glutamic Acid, Aspartic Acid, Leucine, Serine, Glycine, Proline, Threonine, Valine, Isoleucine, Cysteine, Methionine, Histidine, Alanine, Lysine, Arginine, Tyrosine, Phenylalanine, Creatine

- 5 Minerals: Sodium Chloride, Sodium Glycerophosphate, Calcium Gluconate, Magnesium Gluconate, Potassium Magnesium Aspartate

- 1 Sugar: Glucose

- 4 PCA and Organic Acids: PCA, Lactic Acid, Citric Acid, Uric Acid

- 2 Others: Urea, Acetyl Glucosamine

This is 2.7 times more ingredients than the 11-type complex, replicating NMF more precisely. The 18 amino acids represent approximately 40% of skin's natural NMF components.

3. Niacinamide Application Across Product Lines🔗

Cosvision's Most Used Functional Ingredient🔗

Niacinamide (EWG Grade 1) is the core functional ingredient formulated in approximately 70% of Cosvision's products.

Three Effects of Niacinamide:

- Barrier Strengthening: Promotes ceramide synthesis

- Brightening: Inhibits melanin production

- Skin Texture Improvement: Promotes keratinocyte renewal

When ceramide complex formulations and niacinamide are used together, synergy occurs. Niacinamide promotes the skin's own ceramide production, while externally supplied ceramides immediately reinforce the barrier.

Key Findings🔗

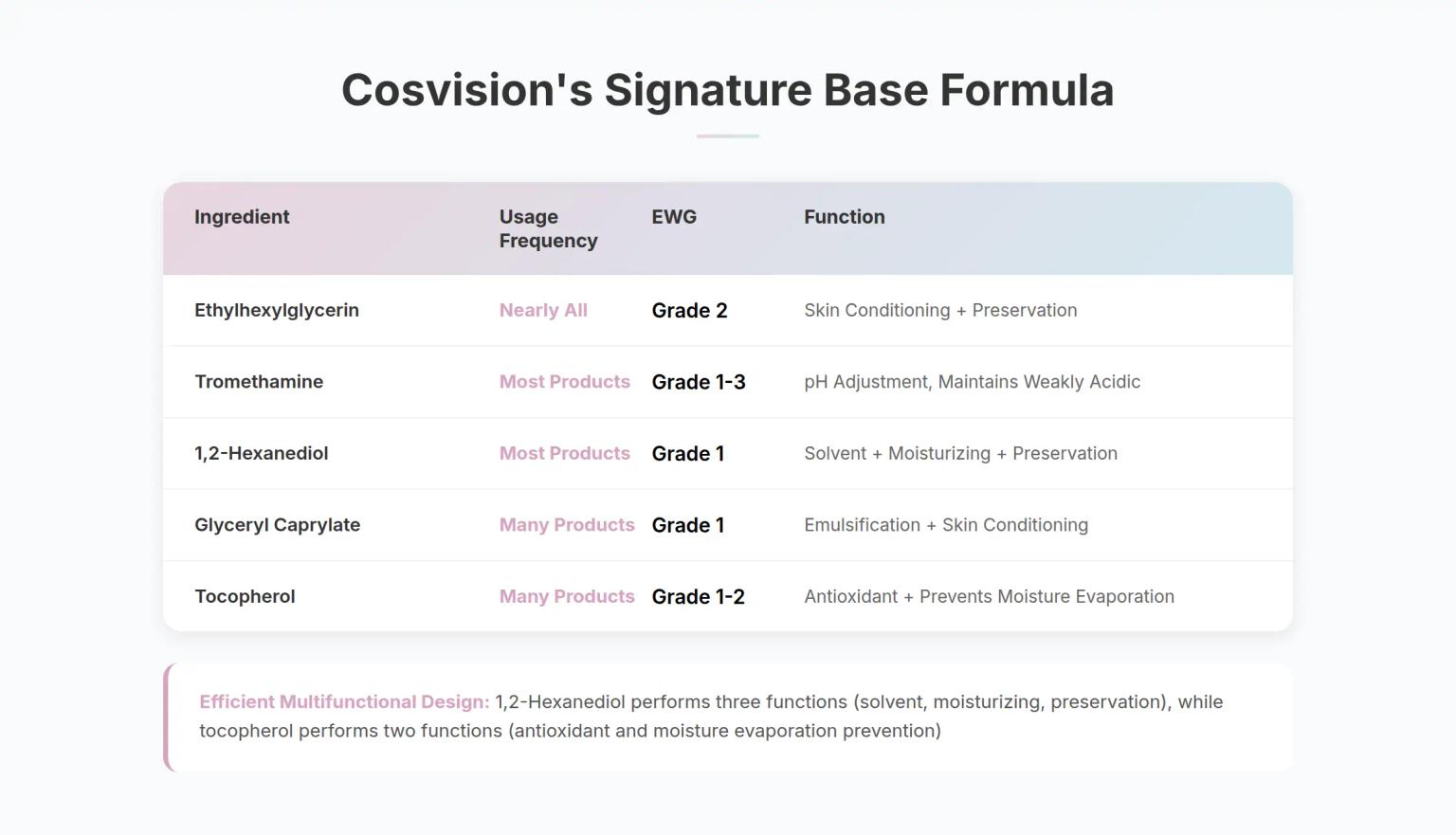

Cosvision's Signature Base Formula🔗

Cosvision formulates ethylhexylglycerin in nearly all products. This is a multifunctional ingredient that serves both skin conditioning and preservation roles.

| Ingredient | Usage Frequency | EWG | Function |

|---|---|---|---|

| Ethylhexylglycerin | Nearly All | Grade 2 | Skin Conditioning + Preservation |

| Tromethamine | Most Products | Grade 1-3 | pH Adjustment, Maintains Weakly Acidic |

| 1,2-Hexanediol | Most Products | Grade 1 | Solvent + Moisturizing + Preservation |

| Glyceryl Caprylate | Many Products | Grade 1 | Emulsification + Skin Conditioning |

| Tocopherol | Many Products | Grade 1-2 | Antioxidant + Prevents Moisture Evaporation |

This is an efficient design where single ingredients perform multiple roles. 1,2-Hexanediol serves three functions (solvent, moisturizing, preservation), while tocopherol performs two functions (antioxidant and moisture evaporation prevention).

Safe Ingredient Design🔗

Most of the 30 core ingredients used repeatedly in more than 10 products are EWG Grade 1.

EWG Grade 1 Ingredients:

- Ceramide NP, Cholesterol, Stearic Acid, Palmitic Acid

- Hydroxypropyl Bispalmitamide MEA (Pseudo-ceramide)

- Niacinamide, 1,2-Hexanediol, Glyceryl Caprylate

These formulations are safe for sensitive and atopic skin.

Efficient Product Portfolio🔗

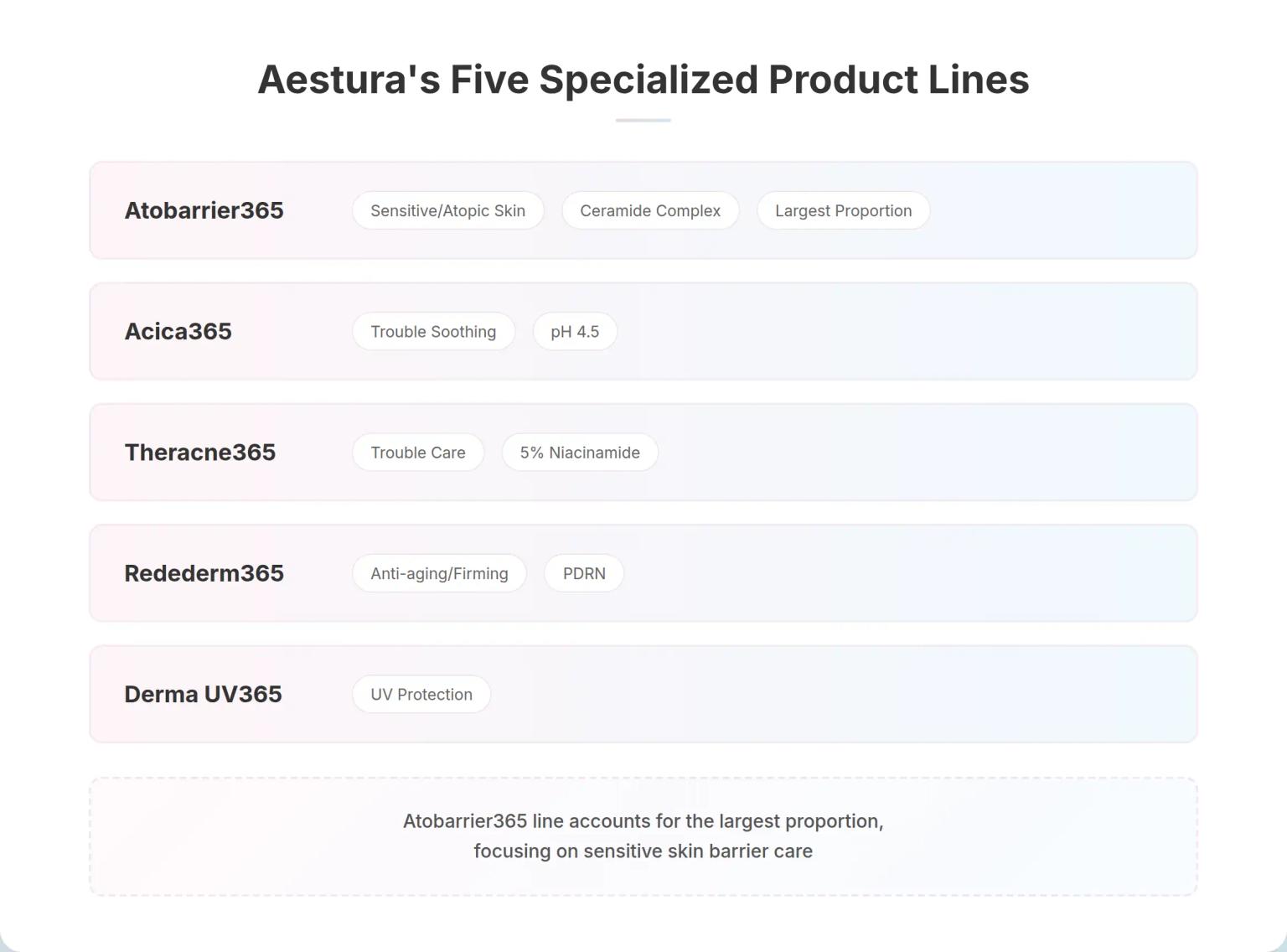

Cosvision organizes Aestura products into five specialized lines.

Five-Line Strategy:

- Atobarrier365: Sensitive/atopic skin, ceramide complex

- Acica365: Trouble soothing, pH 4.5

- Theracne365: Trouble care, 5% niacinamide

- Redederm365: Anti-aging/firming, PDRN

- Derma UV365: UV protection

The Atobarrier365 line accounts for the largest proportion, focusing on sensitive skin barrier care.

Frequently Asked Questions🔗

Q. What is the difference between Ceramide NP and pseudo-ceramides?A. Ceramide NP has the same structure as natural ceramides in the skin barrier. Pseudo-ceramides (Hydroxypropyl Bispalmitamide MEA) are synthetic ingredients with a structure similar to ceramides, more stable and cost-effective than ceramides. Cosvision uses Ceramide NP in cream formulations and pseudo-ceramides in moisture formulations, differentiating according to product characteristics.

Q. What is the difference between 11-type and 30-type NMF?A. The 11-type is used in Hydro Soothing Cream and consists of 8 amino acids, 2 sugars, and 1 PCA. The 30-type is used in Hydro Essence and includes 18 amino acids, 5 minerals, and sugars/PCA/organic acids, replicating the component ratio of natural NMF more precisely. The soothing cream focuses on rapid moisture replenishment, while the essence focuses on sustained moisture retention.

Q. How is 120-hour moisture retention possible?A. Atobarrier365 Cream formulates Ceramide NP, cholesterol, and fatty acids in a lamellar structure similar to skin lipids. This structure stably remains in the skin barrier stratum corneum, preventing moisture evaporation and blocking external irritants. Human application test results showed moisturizing effects lasting 120 hours (5 days) after a single application, with skin sensitivity improving 51% after 4 weeks of use.

This analysis was created based on BeauticsLab AI in October 2025.

Related Articles

Discover more insights on similar topics.

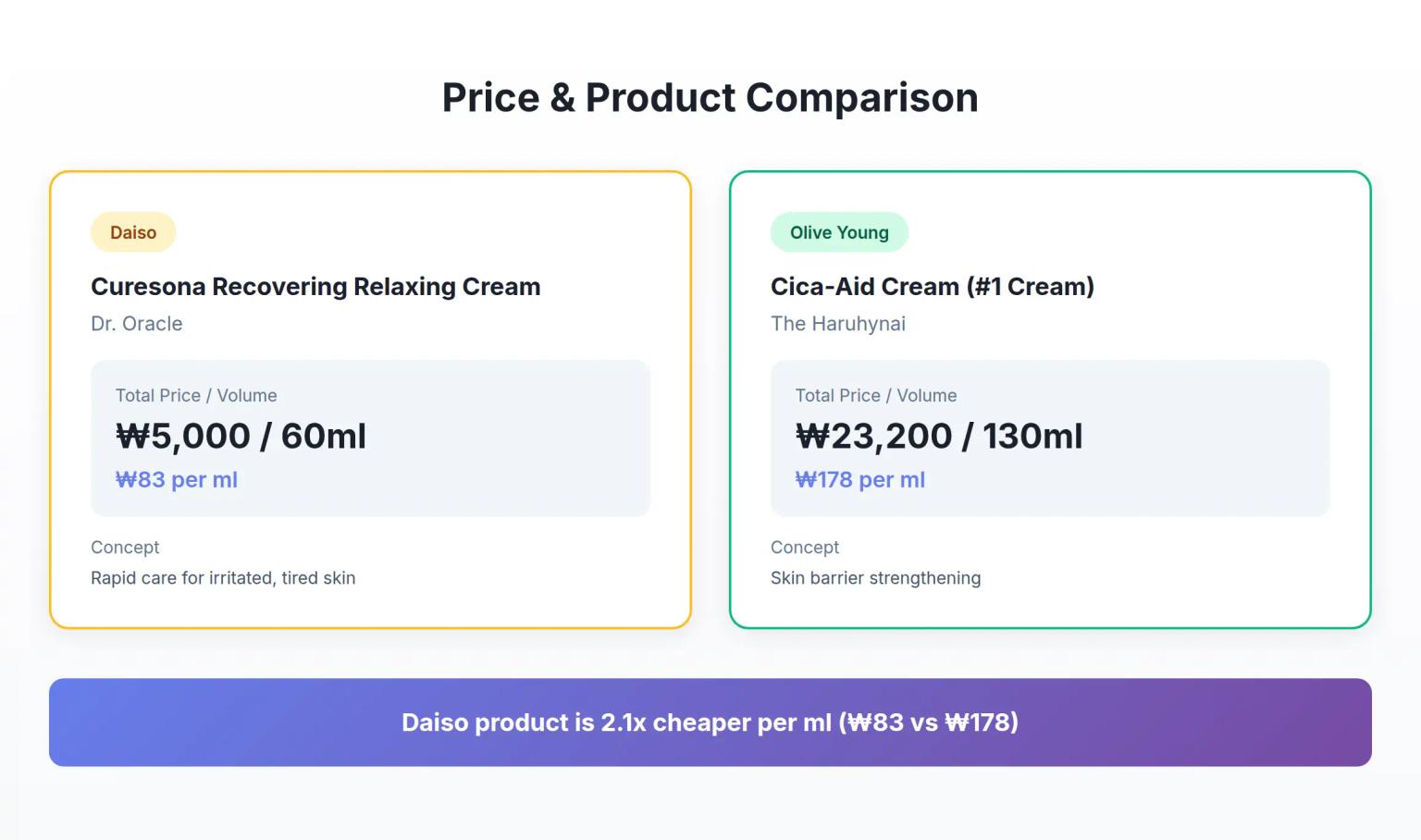

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

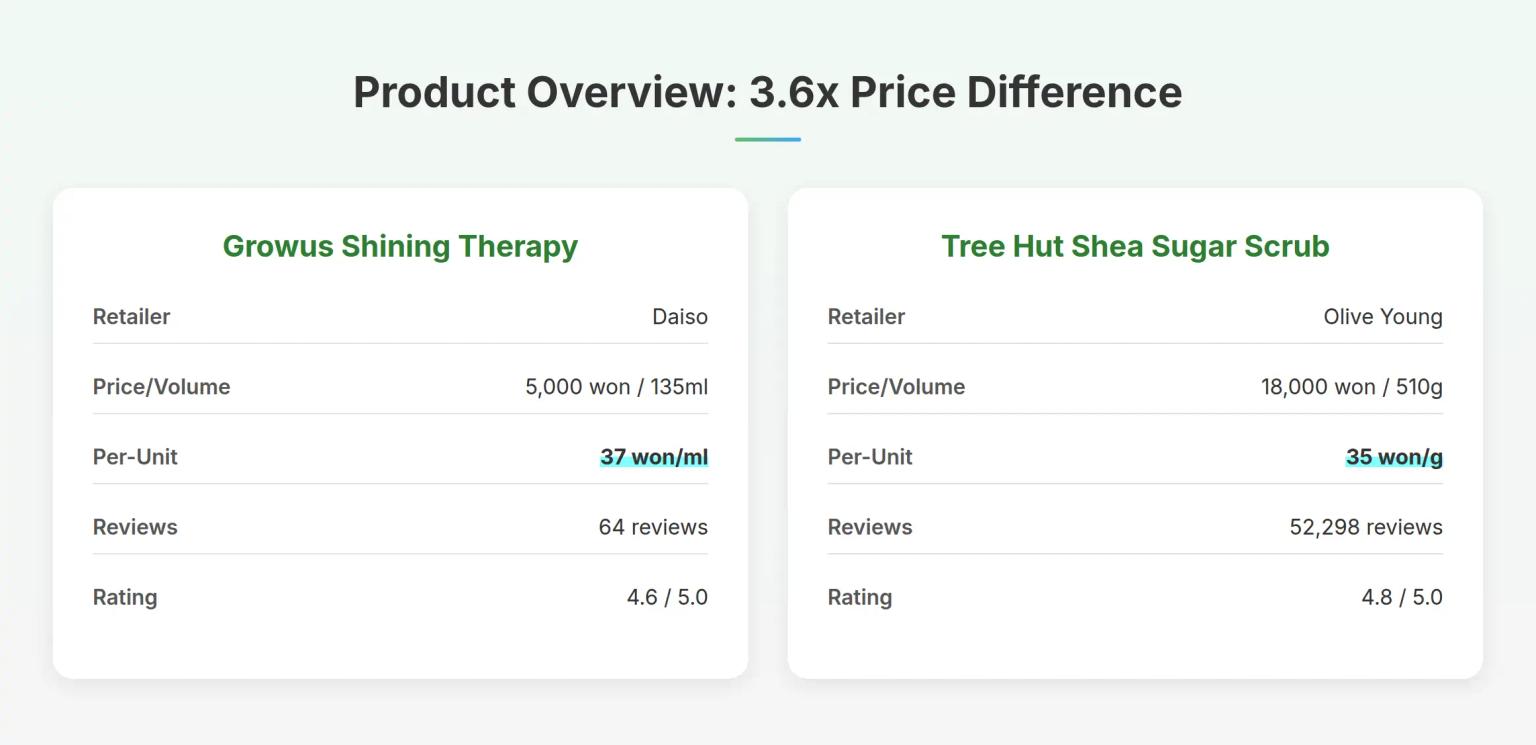

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.