Korean Skincare Manufacturing: Neopharm's Multi-Brand Phytosterol Strategy

BeauticsLab

October 27, 2025

Table of Contents

The Hidden Manufacturer Behind Korean Barrier Care🔗

Have you noticed Atopalm, Zeroid, and Real Barrier at Olive Young? These seemingly independent brands are all manufactured by Neopharm, a Korean OEM/ODM company operating 7 brands with 83 products as of week 43, 2025.

This analysis is based on Olive Young data from October 2025. We analyzed ingredient formulations across Neopharm's product portfolio.

Analysis Scope:

1. Neopharm's Brand Portfolio and Price Positioning🔗

Neopharm segments brands by price point, each with distinct ingredient strategies targeting different consumer segments.

| Brand | Products | Avg. Price | Tier | Target |

|---|---|---|---|---|

| Zeroid | 19 | ₩27,839 | Premium | Sensitive skin |

| Atopalm | 36 | ₩24,432 | Mid-tier | Atopic/Baby care |

| Real Barrier | 11 | ₩21,660 | Mid-tier | Barrier strengthening |

| Dermatory | 15 | ₩14,927 | Mass | Body care/Acne |

Price-tier Positioning:

- Premium (₩28K range): Zeroid - Dermatological dermocosmetics

- Mid-tier (₩22K-₩23K range): Atopalm, Real Barrier - Daily barrier care

- Mass (₩15K range): Dermatory - Body care focused

2. Brand-Specific Ingredient Differentiation: Ceramide vs Phytosterol🔗

Neopharm's most distinctive characteristic is the clear differentiation in ceramide and phytosterol usage strategies across brands.

What is Phytosterol? Phytosterols are plant-derived sterol compounds that strengthen skin barrier function and prevent moisture loss. They offer similar barrier-enhancing effects to ceramides, particularly effective for sensitive and dry skin. Structurally similar to cholesterol but plant-based, they demonstrate high skin compatibility. Approximately 320 products at Olive Young contain this popular ingredient.

| Brand | Total Products | Ceramide Products (Ratio) | Phytosterol Products (Ratio) | Strategy |

|---|---|---|---|---|

| Zeroid | 19 | 0 (0%) | 11 (58%) | Phytosterol only |

| Real Barrier | 11 | 5 (45%) | 7 (64%) | Balanced hybrid |

| Atopalm | 36 | 0 (0%) | 18 (50%) | Phytosterol only |

| Dermatory | 15 | 1 (7%) | 4 (27%) | Minimal usage |

Strategy Classification:

-

Phytosterol Purists: Zeroid, Atopalm

- Zeroid: 0% ceramide, 58% phytosterol

- Atopalm: 0% ceramide, 50% phytosterol

- Zero ceramide usage with exclusive phytosterol-based barrier care

- Combined with proprietary MLE technology (Atopalm)

-

Balanced Strategy: Real Barrier (45% ceramide, 64% phytosterol)

- Active utilization of both ceramide and phytosterol

- Emphasizes synergy between both ingredients

-

Minimal Hybrid: Dermatory (7% ceramide, 27% phytosterol)

- Body care focused with minimal usage of both ingredients

Across Neopharm's portfolio, 40 out of 83 products (48.2%) contain phytosterol.

3. Seven Exclusive Ingredients: Neopharm's Proprietary Compounds🔗

Neopharm uses 7 ingredients that no other manufacturer at Olive Young employs, representing their core technological differentiation.

| Ingredient Name (Korean) | English Name | Product Count | Primary Brand | Function |

|---|---|---|---|---|

| 팔미토일팔미타마이드엠이에이 | Palmitoyl Palmitamide MEA | 21 | Atopalm | MLE core |

| N-데카노일세린올 | N-Decanoyl Serinol | 21 | Atopalm | MLE core |

| 메틸카프로오일타이로지네이트 | Methyl Caproyl Tyrosinate | 16 | Zeroid (12), Atopalm (4) | Zeroid signature |

| 푸코실락토오스 | Fucosyllactose | 10 | Atopalm | Prebiotic |

| 겨우살이열매추출물 | Viscum Album (Mistletoe) Fruit Extract | 8 | Atopalm (7), Real Barrier (1) | Botanical |

| 폴리글리세릴-5스테아레이트 | Polyglyceryl-5 Stearate | 6 | Atopalm | Emulsifier |

| 해바라기오일데실에스터 | Helianthus Annuus Seed Oil Decyl Esters | 6 | Atopalm | Oil ester |

Key Insights:

- Two MLE core ingredients (Palmitoyl Palmitamide MEA, N-Decanoyl Serinol) appear in 21 Atopalm products

- Methyl Caproyl Tyrosinate serves as Zeroid's signature ingredient (12 products)

- Fucosyllactose (prebiotic) is Atopalm's exclusive microbiome-supporting ingredient

4. Atopalm's MLE Technology: Multi-Lamellar Emulsion System🔗

Atopalm's proprietary MLE (Multi-Lamellar Emulsion) technology represents Neopharm's core technological differentiation. This system mimics the skin's natural barrier structure.

What is MLE Technology? MLE (Multi-Lamellar Emulsion) is a patented technology that creates layered emulsion structures similar to the skin's natural lipid bilayers. Instead of relying on ceramides, MLE formulations use phytosterol combined with Neopharm's exclusive ingredients to strengthen skin barrier function.

MLE Product Examples:

| Product | Total Ingredients | Phytosterol | Ceramide |

|---|---|---|---|

| Atopalm MLE Cream 100ml | 51 types | ○ | × |

| Atopalm MLE Lotion 200ml | 34~42 types | ○ | × |

| Atopalm MLE Cream Stick Balm 10g | 27 types | ○ | × |

MLE Technology Characteristics:

- Ceramide-free formulation strategy

- Phytosterol + proprietary compounds system

- Multi-layered structure mimicking skin's natural barrier

- Specifically designed for atopic and sensitive skin

5. Manufacturing Strategy: Purpose-Built Formulation Architecture🔗

Neopharm's multi-brand strategy demonstrates a sophisticated manufacturing approach where ingredient selection is not arbitrary but purpose-built for each brand's positioning and target consumer.

Three-Tier Strategic Framework:

-

Premium Dermocosmetics (Zeroid)

- 100% phytosterol strategy with no ceramide

- Highest price point (₩27,839)

- Medical-grade positioning for sensitive skin

-

Daily Barrier Care (Atopalm, Real Barrier)

- Atopalm: Phytosterol-only + MLE technology for atopic care

- Real Barrier: Balanced ceramide-phytosterol hybrid

- Mid-tier pricing (₩21K-₩24K)

-

Mass Body Care (Dermatory)

- Minimal ceramide-phytosterol usage

- Body care and acne-focused formulations

- Mass-tier pricing (₩14,927)

Market Implications:

This multi-brand strategy allows Neopharm to:

- Capture different price segments without brand cannibalization

- Test ingredient strategies across different consumer groups

- Maintain manufacturing efficiency while offering portfolio diversity

- Build ingredient IP through exclusive compound development

The clear ingredient differentiation across brands (0% to 45% ceramide usage) demonstrates that Korean OEM/ODM companies employ formulation as a strategic tool rather than a purely technical consideration.

Frequently Asked Questions🔗

Q. Why does Neopharm manufacture multiple competing brands?A. Multi-brand manufacturing allows segmentation by price point, target consumer, and ingredient strategy without brand cannibalization. Each brand targets distinct consumer needs: Zeroid for medical-grade sensitive care, Atopalm for atopic/baby care, Real Barrier for barrier strengthening, and Dermatory for mass body care.

Q. What's the difference between ceramide and phytosterol?A. Both strengthen skin barrier function, but phytosterol is plant-derived while ceramide can be synthetic or natural. Neopharm strategically chooses phytosterol for brands like Zeroid and Atopalm, possibly due to gentler profiles for sensitive skin, cost considerations, or IP strategy around their proprietary MLE technology.

Q. Why does Atopalm use MLE technology instead of ceramides?A. MLE (Multi-Lamellar Emulsion) technology represents Atopalm's core differentiation. Instead of relying on ceramides, the patented system uses phytosterol combined with exclusive ingredients (Palmitoyl Palmitamide MEA, N-Decanoyl Serinol) to create skin barrier-mimicking structures. This allows Atopalm to claim unique efficacy in atopic and sensitive skin care.

Q. How do Korean OEM companies differ from Western ones?A. Korean OEMs like Neopharm often develop their own branded products alongside client manufacturing, creating sophisticated multi-brand portfolios with distinct formulation strategies. This contrasts with Western OEMs that typically focus purely on contract manufacturing without proprietary brands.

This analysis was created based on the BeauticsLab database from October 2025.

Related Articles

Discover more insights on similar topics.

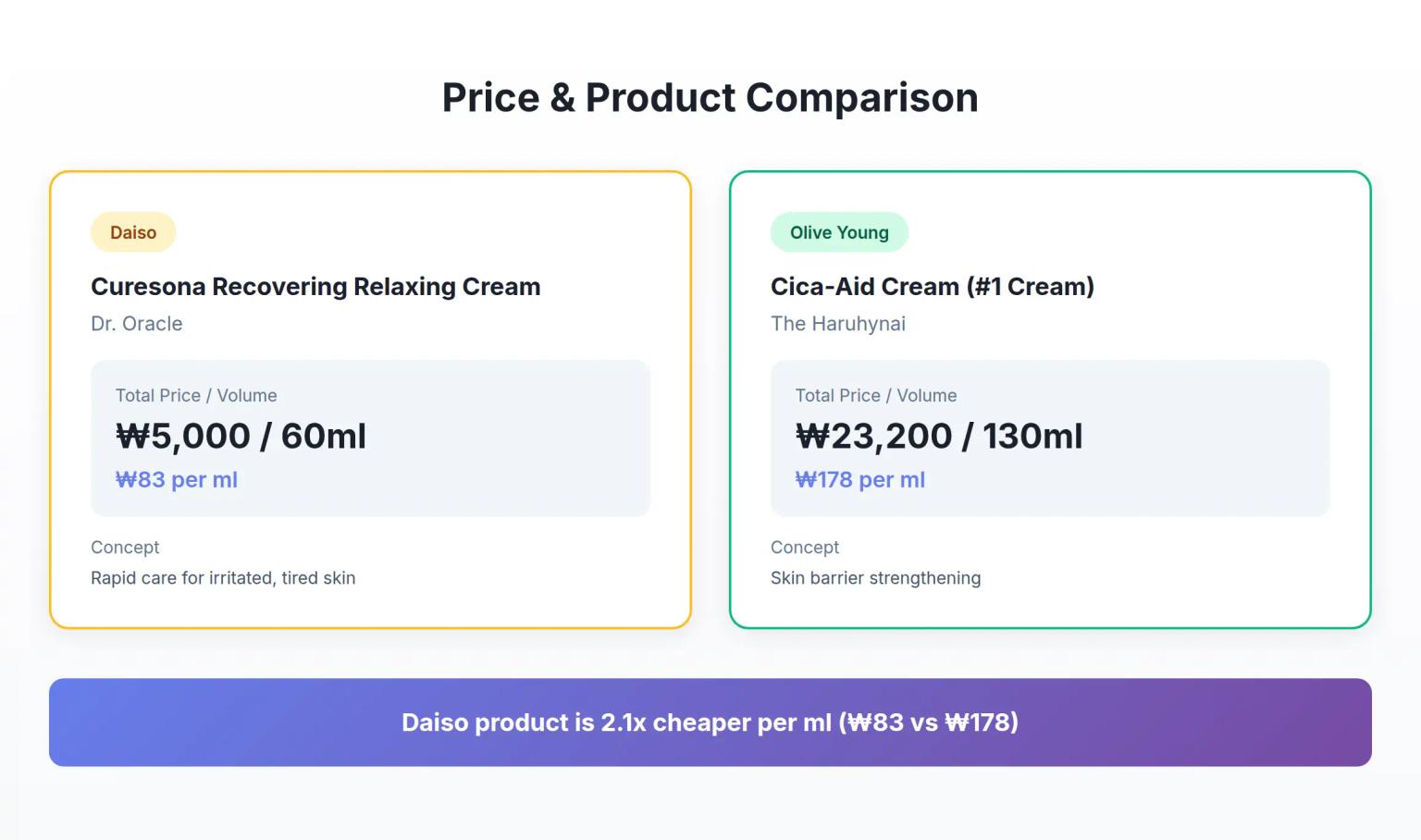

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

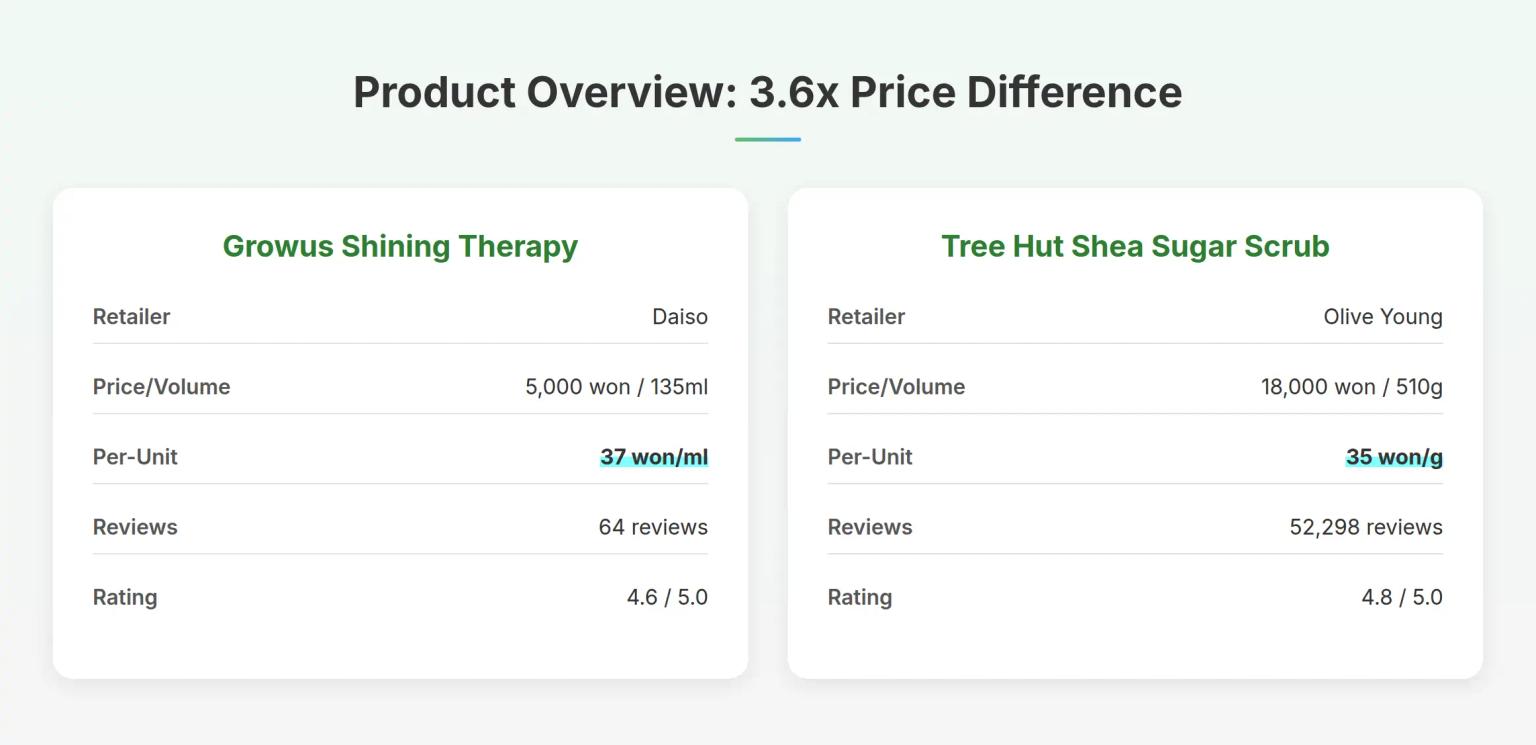

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.