Why Korean Serums Dominate: The 7-Step Persuasion Formula Behind Olive Young's Top 4

BeauticsLab

August 18, 2025

Table of Contents

The Science of Selling Functional Skincare🔗

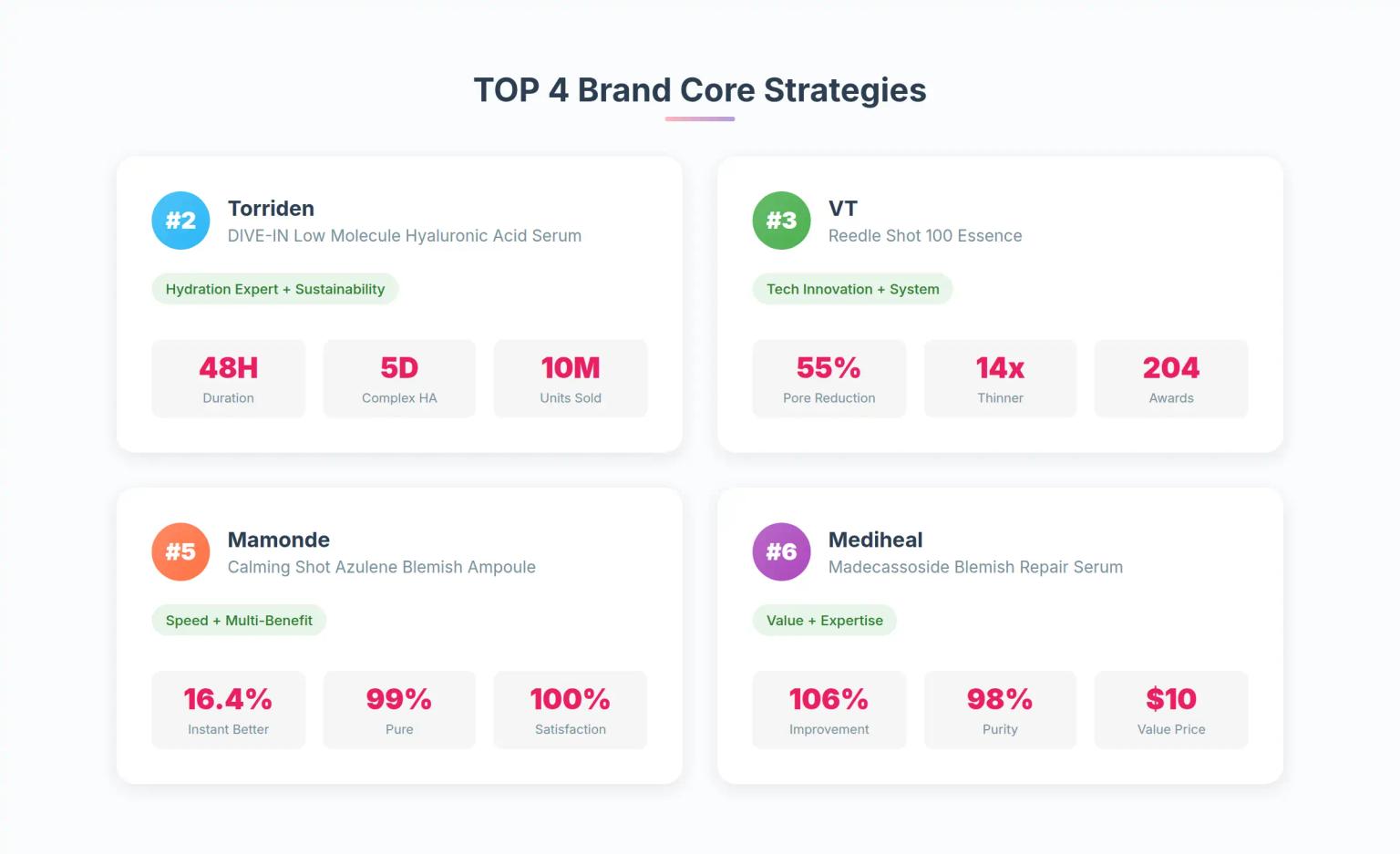

In Week 33 of 2025, four products dominated Olive Young's essence/serum/ampoule category. While they all offer similar functional benefits, each brand's approach to customer persuasion reveals dramatically different strategies that global beauty brands can learn from.

- Torriden Dive-In Low Molecule Hyaluronic Acid Serum (#2)

- VT Reedle Shot 100 Essence (#3)

- Mamonde Calming Shot Azulene Blemish Ampoule (#5)

- Mediheal Madecassoside Blemish Repair Serum (#6)

Analysis Methodology🔗

Through detailed product page data analysis, we've decoded not just what these brands say, but how they structure their persuasion to convert browsers into buyers.

Brand-by-Brand Strategy Breakdown🔗

1. Torriden (#2) - Hydration Authority + Sustainability Play🔗

Torriden positions itself as "The synonym for #1 hydration serum", establishing category dominance through expertise and environmental consciousness.

Torriden Dive-In Low Molecule Hyaluronic Acid Serum Product Page Story Flow

Hook

10 million skins can't be wrong - #1 hydration serum

Social Proof

2023-2024 Olive Young Awards winner, 10M units sold

Problem-Solution

Dehydration: the root cause of all skin concerns

Innovation

5D-Complex Hyaluronic Acid for multi-layer hydration

Scientific Evidence

Clinical trials: 48-hour lasting hydration proven

Safety Trust

Sensitive skin tested, pH-balanced, Vegan certified

Usage Experience

Non-sticky texture perfect for layering

Core USP: 5D-Complex Hyaluronic Acid + Environmental messaging for dual appeal

Key Differentiators:

- Frames dehydration as the universal skin problem

- Scientific breakdown of high-mid-low molecular HA

- "YOUR SKIN IS OUR PLANET" resonates with Gen Z values

2. VT (#3) - Tech Innovation + Systematic Approach🔗

VT revolutionizes skincare with "Skin Home Training", transforming product application into a systematic regimen.

VT Reedle Shot 100 Essence Product Page Story Flow

Hook

Global K-Beauty leader, #1 'Wearable Device'

Authority Proof

204 awards won, Olive Young overall #1

Innovation Technology

CICA REEDLE Physical Derma Delivery System

Scientific Evidence

55% pore reduction in 2 weeks, 11.06% calming effect

Safety Testing

Suitable for sensitive & acne-prone skin, triple-tested

System Guidance

50-1000 graduated intensity system for personalized care

Usage Experience

Tingling sensation signals absorption, first-step booster

Core USP: CICA REEDLE 14x thinner than pores + Graduated product system

Key Differentiators:

- "Skin Home Training" concept makes skincare feel like fitness

- 50-1000 intensity levels create customer journey

- Reframes tingling sensation from negative to positive ("absorption signal")

3. Mamonde (#5) - Speed Results + Multi-Benefit Strategy🔗

Mamonde claims "Faster than Cica", targeting time-conscious consumers with immediate visible results.

Mamonde Calming Shot Azulene Blemish Ampoule Product Page Story Flow

Hook

#1 blemish-calming hydration ampoule

Problem Insight

Clear skin is the foundation of good-looking skin

Solution Innovation

Azulene faster than Cica + 4% Niacinamide synergy

Clinical Evidence

Single use: 16.4% pigmentation improvement, 100% satisfaction

Comprehensive Benefits

Hydration + cooling + blemish care in one

Safety Innovation

0.00 irritation score, Vegan certified for daily use

Texture Experience

Mashed water-jelly texture for lasting cooling

Core USP: 99% pure Azulene + 4% Niacinamide for instant calming and blemish care

Key Differentiators:

- Direct competitor comparison: "Faster than Cica"

- Mashed water-jelly as texture innovation

- Single-use efficacy data emphasizes immediacy

4. Mediheal (#6) - Value Champion + Expertise Strategy🔗

Mediheal boldly declares "God-tier value hydration-blemish serum", combining professional quality with aggressive pricing.

Mediheal Madecassoside Blemish Repair Serum Product Page Story Flow

Hook

God-tier value serum, 1+1 deal at ₩10,000 per bottle

Authority Awards

2024 H2 Awards triple crown, Olive Young #1

Core Technology

98% pure Madecassoside + 20,000ppm Niacinamide

Clinical Proof

2 weeks: 106.56% blemish improvement, 116.63% melanin reduction

Comprehensive Benefits

Hydration + blemish + calming + value = hexagon serum

Safety Certification

Hypoallergenic, non-comedogenic certified

Developer Message

Developer's personal message: 'Made for people like you'

Core USP: 98% pure Madecassoside + 1+1 pricing for professional quality at mass-market prices

Key Differentiators:

- "God-tier value" - unusually direct pricing language

- Developer's personal message adds authenticity

- "Hexagon serum" creates memorable multi-benefit positioning

Common Success Patterns🔗

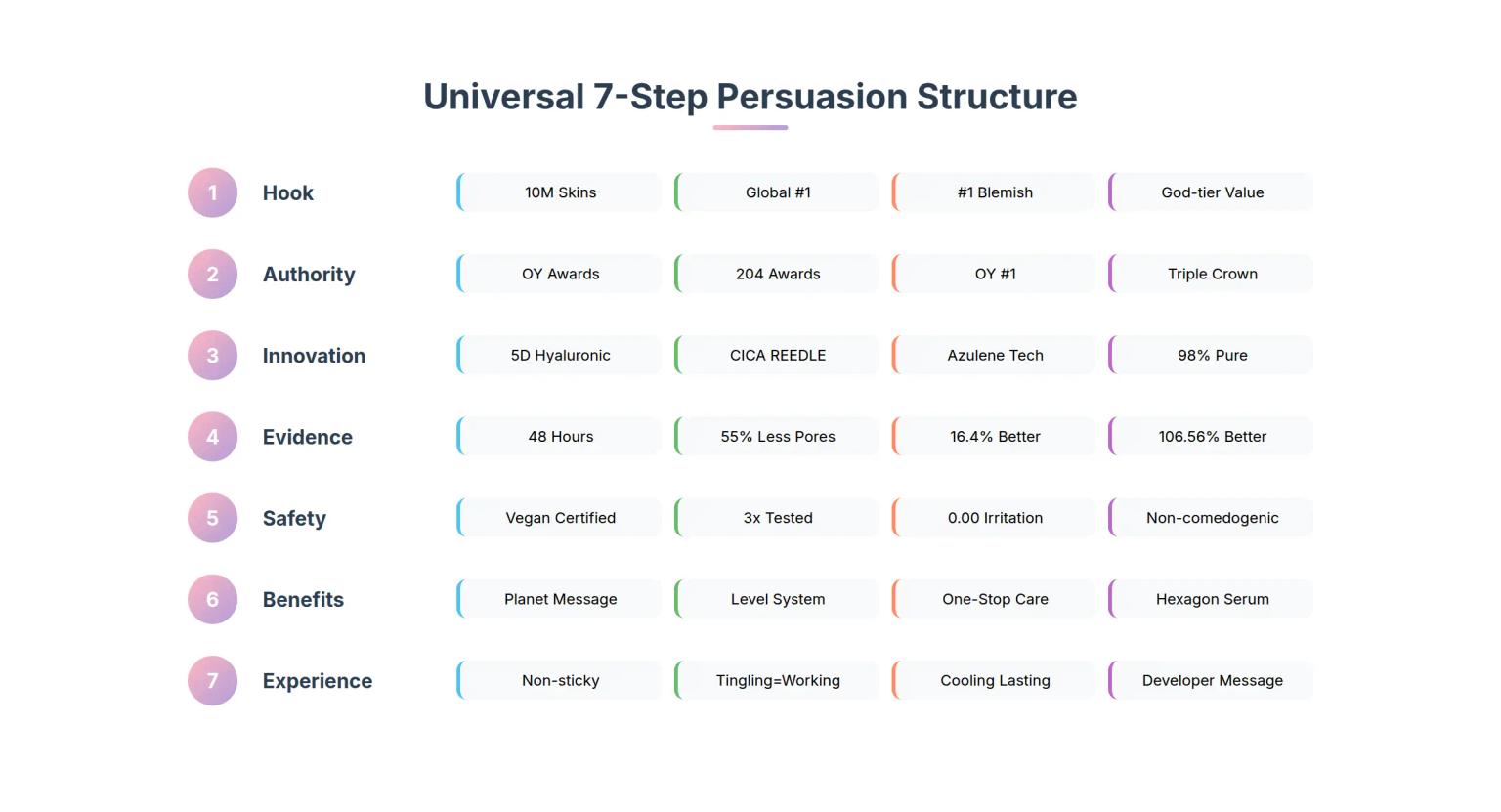

The Universal 7-Step Persuasion Structure🔗

| Stage | Torriden | VT | Mamonde | Mediheal |

|---|---|---|---|---|

| 1. Hook | 10M skins | Global #1 | #1 blemish | ₩10,000 value |

| 2. Authority | OY Awards | 204 awards | OY #1 | Triple crown |

| 3. Innovation | 5D HA | CICA REEDLE | Azulene tech | 98% purity |

| 4. Evidence | 48 hours | 55% reduction | 16.4% improvement | 106.56% better |

The Power of Specific Numbers🔗

Korean brands don't just claim efficacy - they prove it with precision:

📊 Number Marketing Examples:

- Torriden: 48-hour duration, 5D-Complex HA

- VT: 14x thinner than pores, 55% pore reduction

- Mamonde: 16.4% improvement, 99% pure Azulene

- Mediheal: 106.56% improvement, 98% pure Madecassoside

Specific percentages build trust and justify premium pricing.

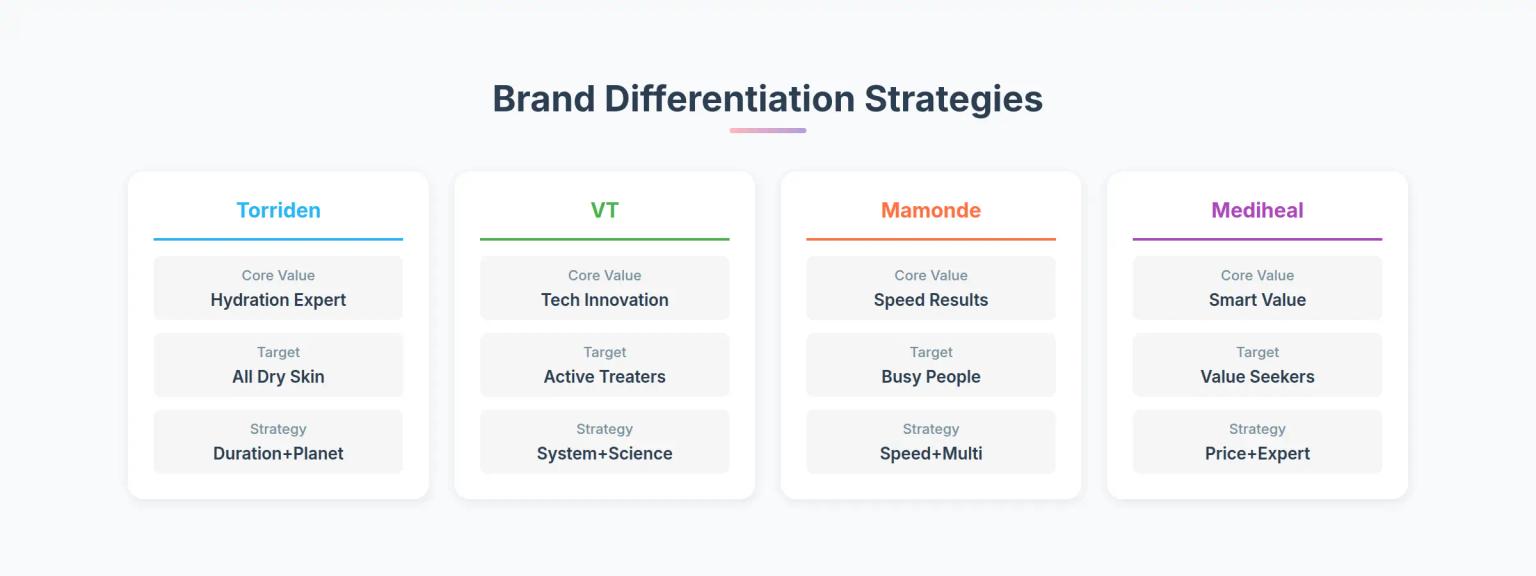

Differentiation Strategy Matrix🔗

| Axis | Torriden | VT | Mamonde | Mediheal |

|---|---|---|---|---|

| Core Value | Hydration Expert | Tech Innovation | Speed Results | Smart Value |

| Target Customer | All dry skin | Active treaters | Busy professionals | Value seekers |

| Persuasion Style | Duration+Planet | System+Science | Speed+Multi | Price+Expert |

| Visual Identity | Blue freshness | Black premium | Green natural | White clinical |

Conclusion: The Korean Serum Success Formula🔗

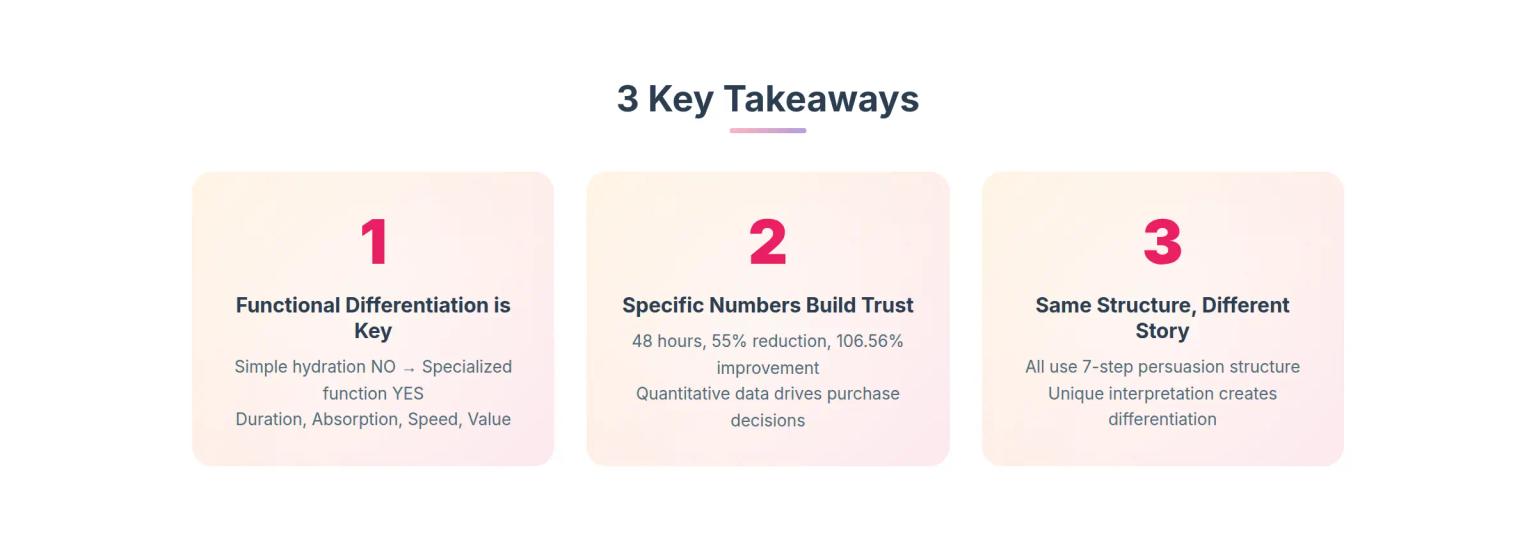

💡 3 Key Takeaways:

- Functional differentiation is survival: Simple hydration NO → Specialized function YES

- Specific numbers create trust: 48 hours, 55% reduction, 106.56% improvement - precision sells

- Same structure, different story: All use the 7-step formula, but unique interpretation creates differentiation

This analysis is based on 2025 Week 33 BeauticsLab product page analysis data from Olive Young, Korea's leading beauty retailer.

Related Articles

Discover more insights on similar topics.

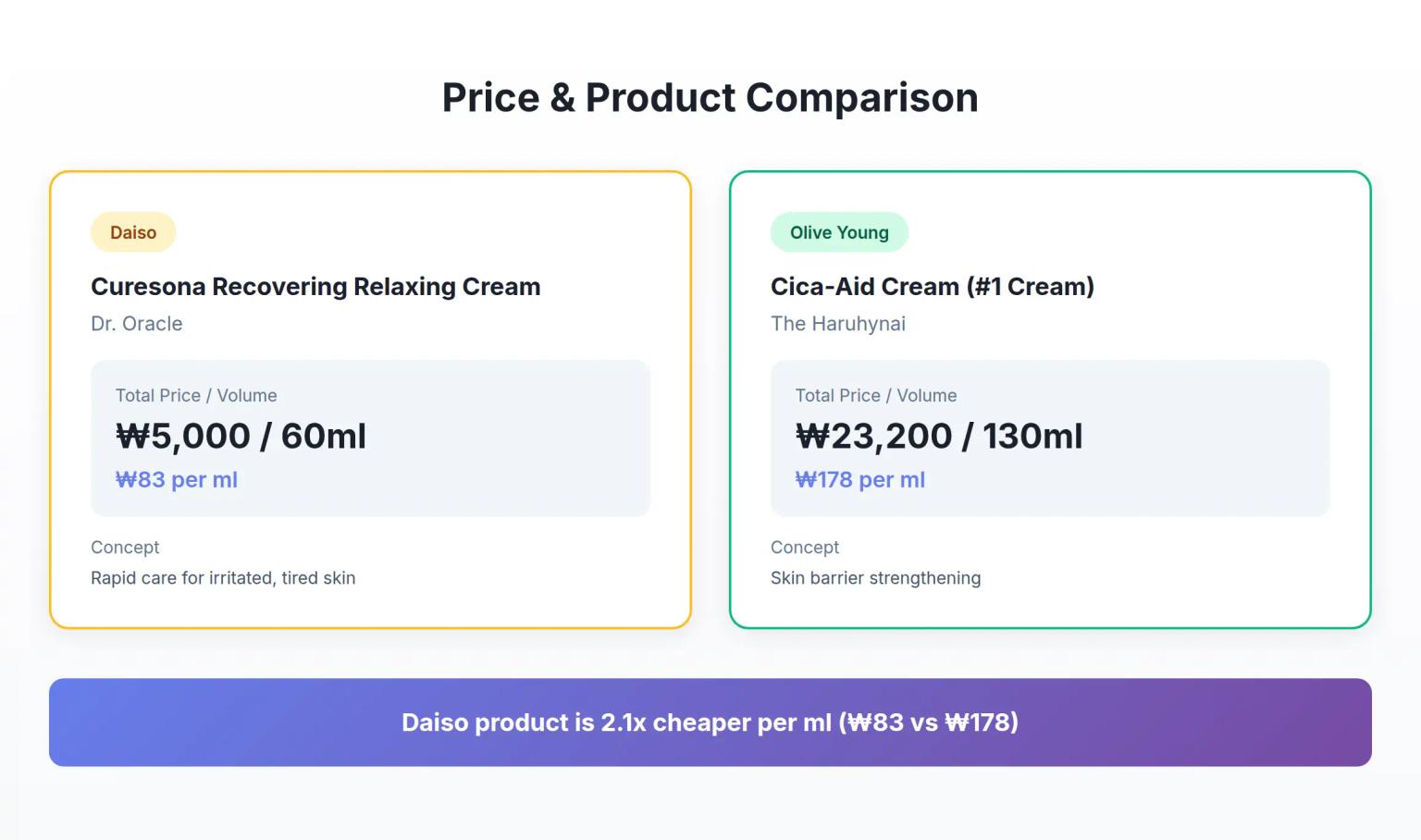

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

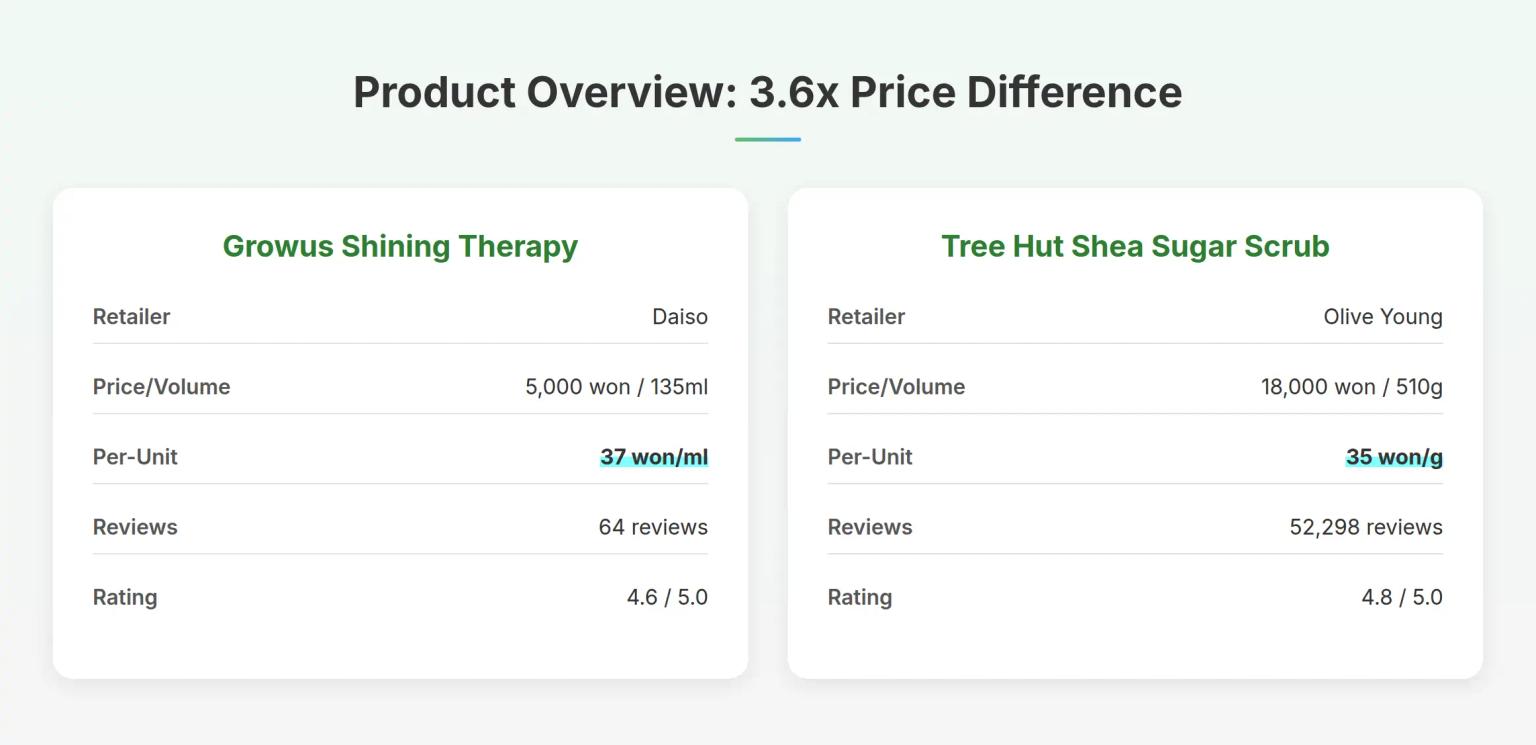

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.