Why 'Moisturizing' Kills Sales: How Korean Body Care Brands Win by Solving 'Dark Heels' and 'Deep Dryness'

BeauticsLab

August 22, 2025

Table of Contents

The Trap of "Moisturizing" - A Word Count Analysis🔗

In Week 33 of 2025, we analyzed the product pages of Olive Young's top 4 body care products. The results challenged everything we thought we knew about body care marketing.

Instead, here's what these brands lead with:

- Illiyoon: "100-hour moisture"

- NOT4U: "Clear body troubles from the root"

- Beyond: "Turn dark heels white!"

- Bioderma: "End deep dryness in just 2 hours"

Why do similar body lotions use such dramatically different language?

The Time Paradox: 100 Hours vs 2 Hours🔗

The most intriguing discovery is the time strategy. Illiyoon emphasizes "100 hours", while Bioderma highlights "2 hours".

| Brand | Time Strategy | Target Problem | Consumer Psychology |

|---|---|---|---|

| Illiyoon | 100-hour lasting | Daily application fatigue | "Apply once, forget for days" |

| Bioderma | 2-hour resolution | Deep dryness tightness | "I need relief right now" |

Same moisturizing benefit, opposite time frames. The reason is clear: They're solving different problems.

- 100 hours: For those wanting longevity → Solves "inconvenience"

- 2 hours: For those needing immediate relief → Solves "urgency"

Brand-by-Brand Extreme Problem-Solving Strategies🔗

1. Illiyoon - The Secret of "100-Hour Moisture"🔗

Illiyoon Ceramide Ato Lotion is the only TOP 4 product that directly mentions "moisturizing." But it's not just moisturizing.

Illiyoon Ceramide Ato Lotion Product Page Story Flow

Hook

4 years consecutive Olive Young body care #1

Problem

Tired of applying body lotion daily

Solution

#100h moisture - 100-hour long-lasting

Evidence

1 sold every 30 seconds, 40M cumulative sales

Trust

40 years sensitive skin research, baby-safe

Core Strategy: Redefining basic moisturizing as extreme durability

2. NOT4U - Zero "Moisturizing", All About Troubles🔗

NOT4U Clear Body Mist never uses the word "moisturizing."

NOT4U Clear Body Mist Product Page Story Flow

Hook

6 years consecutive body mist sales #1

Problem

Recurring body troubles on back and chest

Solution

Clear troubles from the root completely

Innovation

360° spray reaches back alone

Evidence

40.21% dead skin reduction in 7 days

Core Strategy: Focus on specific problem (troubles) instead of moisturizing

3. Beyond - "Turn Dark Heels White!"🔗

Beyond Body Vitamin Lotion takes a visual approach.

Beyond Body Vitamin Lotion Product Page Story Flow

Hook

Olive Young overall #1 in 3 months after launch

Problem

Dark elbows, knees, and heels

Solution

Dark heels to white heels! Pigmentation brightening

Innovation

5% Niacinamide maximum concentration

Evidence

Clinical proof: elbow pigmentation improved in 2 weeks

Core Strategy: Solving visually apparent problems with extreme expressions

4. Bioderma - "End Deep Dryness in 2 Hours"🔗

Bioderma Atoderm Ultra Cream creates a new problem category.

Bioderma Atoderm Ultra Cream Product Page Story Flow

Hook

Verified by 150,000+ dermatologists worldwide

Problem Definition

Not regular dryness but 'deep dryness'

Solution

End deep dryness in just 2 hours

Evidence

76% moisture increase in 2 hours

Trust

Safe from newborns, 19 harmful ingredients FREE

Core Strategy: Creating a new problem category called "deep dryness"

Common Success Pattern: What They Gained by Abandoning "Moisturizing"🔗

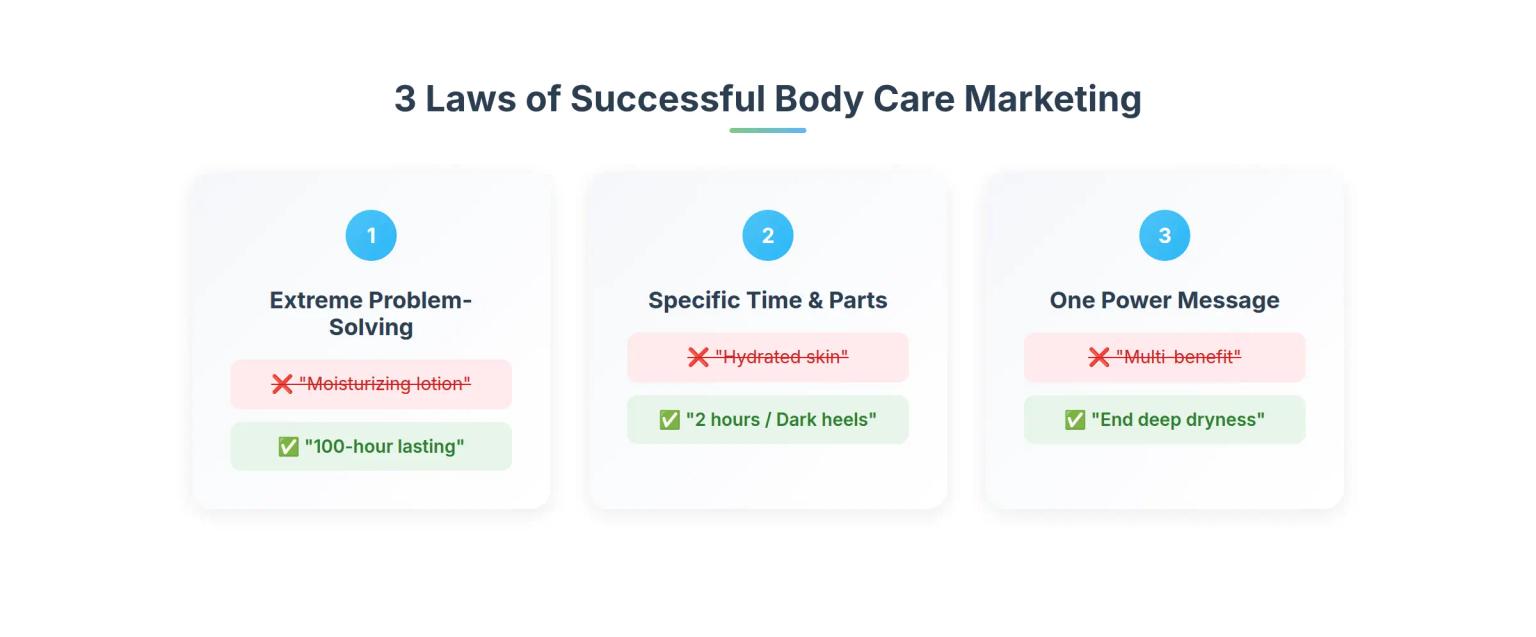

💡 3 Laws of Successful Body Care Product Pages

-

Generic Benefits → Extreme Problem-Solving

- ❌ "It's a moisturizing lotion"

- ✅ "100-hour lasting" / "Clear troubles from root" / "Dark heels to white"

-

Abstract Promises → Specific Time/Body Parts

- ❌ "Hydrated skin"

- ✅ "In 2 hours" / "In 7 days" / "Elbow pigmentation"

-

Feature Lists → One Powerful Message

- ❌ "Moisturizing + Whitening + Soothing + Nourishing"

- ✅ "End deep dryness" / "Trouble terminator"

Why Sales Explode When You Abandon "Moisturizing"🔗

1. Problem Specification🔗

"Moisturizing" is too generic. Every body lotion says it. But "dark heels," "deep dryness," and "back troubles" are specific.

| Generic Expression | Specific Problem | Consumer Response |

|---|---|---|

| Dry skin | Deep dryness | "Yes, I feel tight even after applying..." |

| Dull skin | Dark heels | "Right, my heels have turned dark" |

| Troubled skin | Back troubles | "I keep breaking out on my back" |

2. Time Clarification🔗

Specific times like "100 hours" and "2 hours" are more convincing than vague "long-lasting."

- 100 hours = 4+ days = "Apply just twice a week"

- 2 hours = Immediate effect = "Quick relief when urgent"

- 7 days = One week = "You'll see change next week"

3. Category Leadership🔗

Being #1 in "moisturizing lotions" vs being #1 in "deep dryness specialists"

The latter is much easier. Create a new category, and you automatically become its leader.

Key Takeaways: The Paradigm Shift in Body Care Marketing🔗

Our analysis of Olive Young's TOP 4 body care products reveals clear success patterns:

🎯 Strategic Directions for Global Brands

-

Abandon generic "moisturizing" claims

- What everyone says, no one hears

-

Solve one specific problem extremely well

- Target clear issues like dark heels, deep dryness, back troubles

-

Specify time and body parts

- Be concrete with 2 hours, 100 hours, elbows, back

-

Define new problems

- Create new categories like "deep dryness"

-

Don't fear extreme expressions

- Bold copy like "dark heels to white heels" works

Conclusion: Consumers Want Problem-Solving, Not Moisturizing🔗

The body care market has shifted from "the era of moisturizing" to "the era of problem-solving."

Consumers no longer search for "hydrating lotions." They search for:

- "Products that fix my dark heels"

- "Products that eliminate back troubles"

- "Products I can apply once and forget for days"

- "Products that relieve tightness immediately"

This is the secret behind Olive Young's TOP 4 body care brands' success in abandoning "moisturizing."

Frequently Asked Questions🔗

Q. Can "100-hour lasting" and "2-hour deep dryness resolution" really both be popular simultaneously?

A. Yes, absolutely. Consumers want different solutions based on their skin conditions and lifestyles. Those tired of daily application choose 100-hour lasting products, while those needing immediate post-shower relief choose 2-hour resolution products. Illiyoon (#1) and Bioderma (#4) being in the TOP 5 simultaneously proves this.

Q. Isn't "dark heels to white heels" an exaggeration?

A. This expression precisely captures consumers' real concerns. Many people are embarrassed by dark heels and elbows, but "whitening" sounds too medical. "Dark heels to white heels" is an intuitive expression showing both problem and solution, key to Beyond achieving #1 within 3 months of launch.

Q. Why do trouble care products not mention moisturizing at all?

A. NOT4U used "moisturizing" 0 times yet ranks #2. The reason is clear: people with back troubles want "trouble solutions," not "moisturizing." There's even a perception that sticky moisturizing products might worsen troubles, so they emphasized refreshing resolution with a 360° spray mist format.

Q. What's the difference between deep dryness and regular dryness?

A. It's a new problem category defined by Bioderma. It refers to complex dryness where the surface is oily but the inside feels tight. They created a new market for people who find regular dry skin products too heavy and oily skin products insufficiently moisturizing. The specific time promise of "end deep dryness in 2 hours" successfully differentiated them.

This analysis is based on product page data from the top 4 products in Olive Young's body care category for Week 33, 2025.

Related Articles

Discover more insights on similar topics.

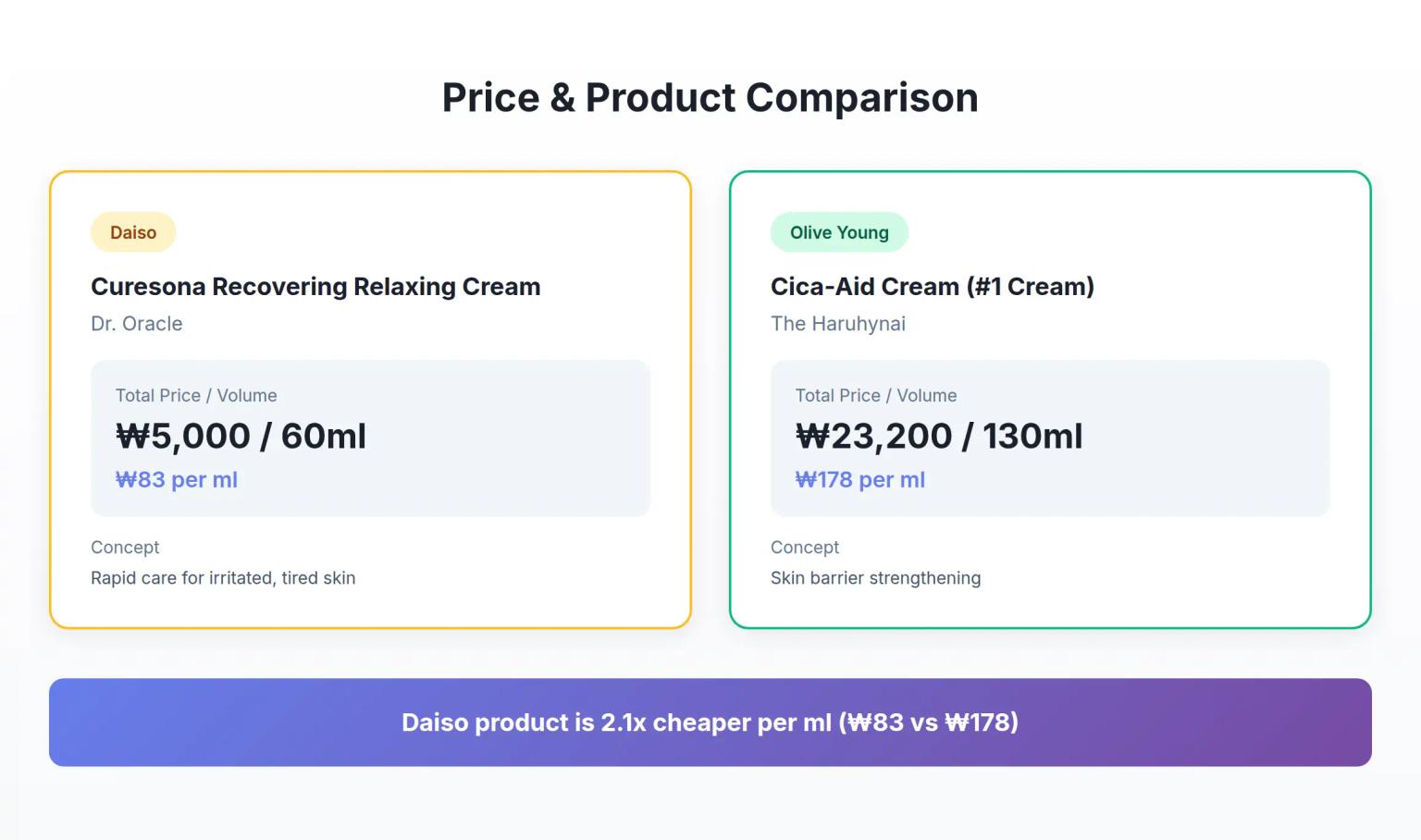

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

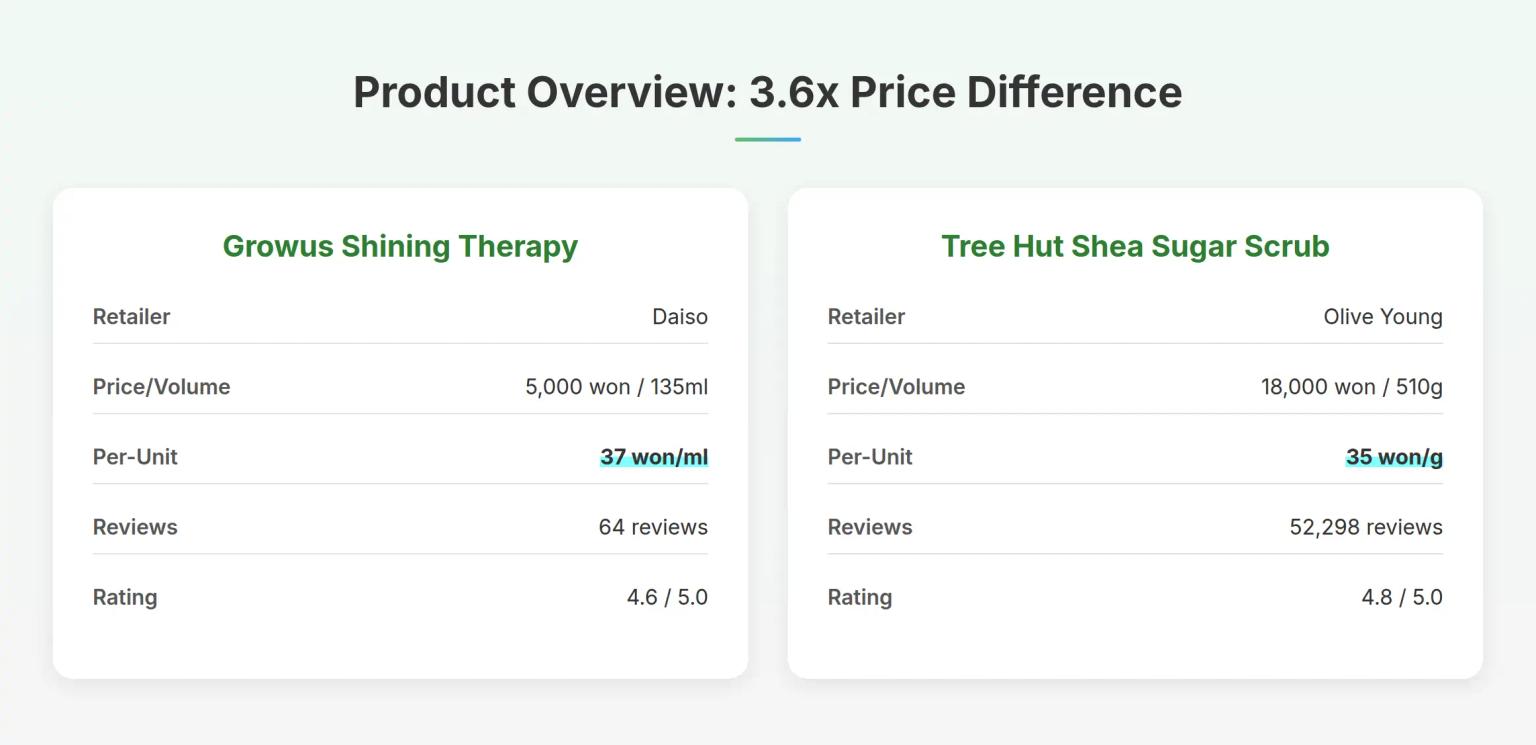

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.