Korean Fragrance Market Product Page Analysis: Top 3 Category Leaders at Olive Young

BeauticsLab

August 4, 2025

Table of Contents

Korean Fragrance Market Overview🔗

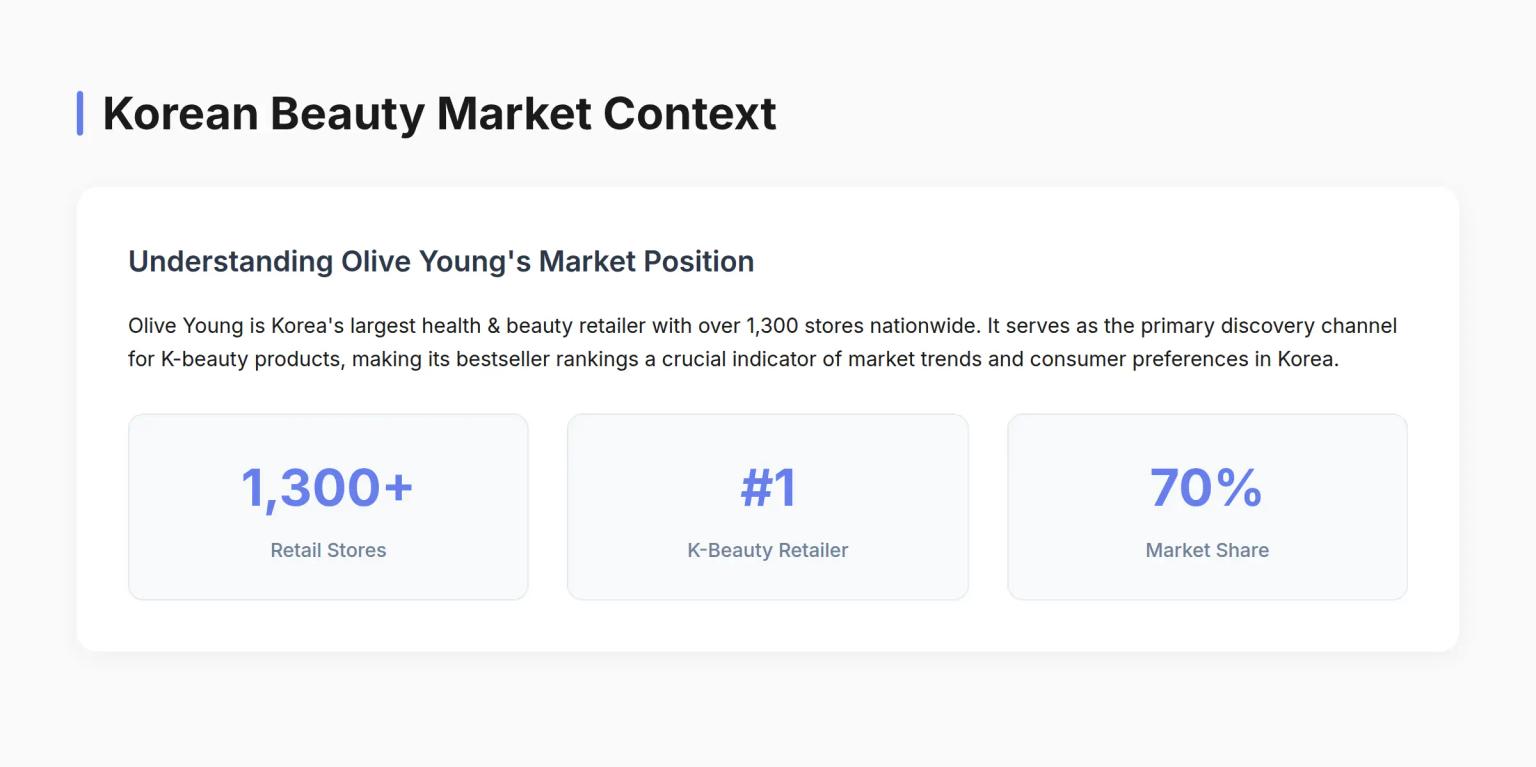

In the Korean beauty market, fragrance products face a unique challenge: conveying scent through digital channels. This analysis examines the product detail pages of the top 3 products in fragrance/diffuser subcategories at Olive Young for week 30 of 2025.

-

RoundAround Cypress Clean Spray

(Home Fragrance Category #1) -

Sennok Perfume 6 Types & Solid Perfume 2 Types

(Fragrance Category #1) -

AfterBlow Eau de Parfum 09 Aqua Tangerine

(Mini/Solid Fragrance Category #1)

Data Collection Methodology🔗

Product page images were processed using BeauticsLab's technology to extract all text content. The analysis focuses on how each brand presents fragrance information in the Korean market.

Product Page Content Analysis🔗

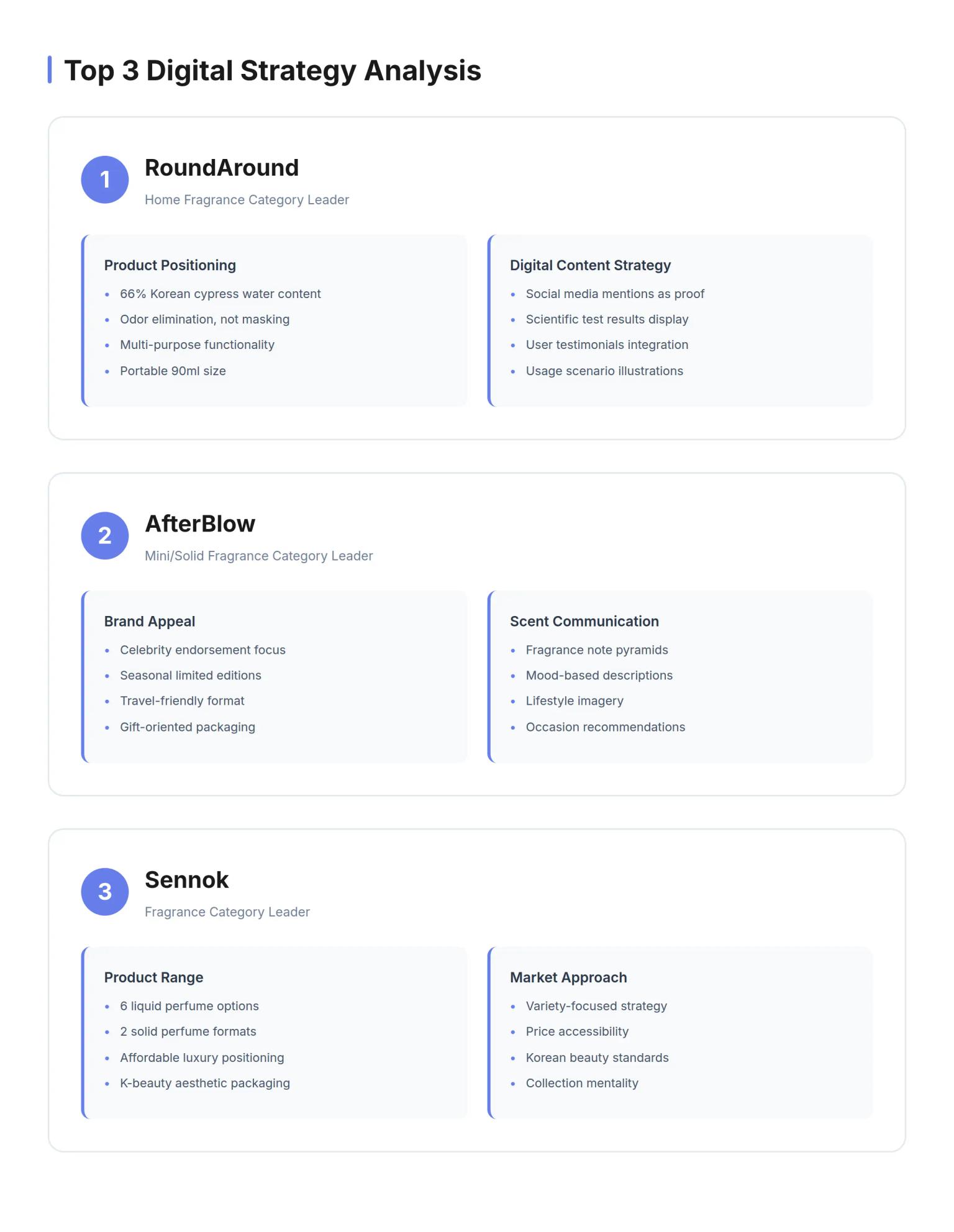

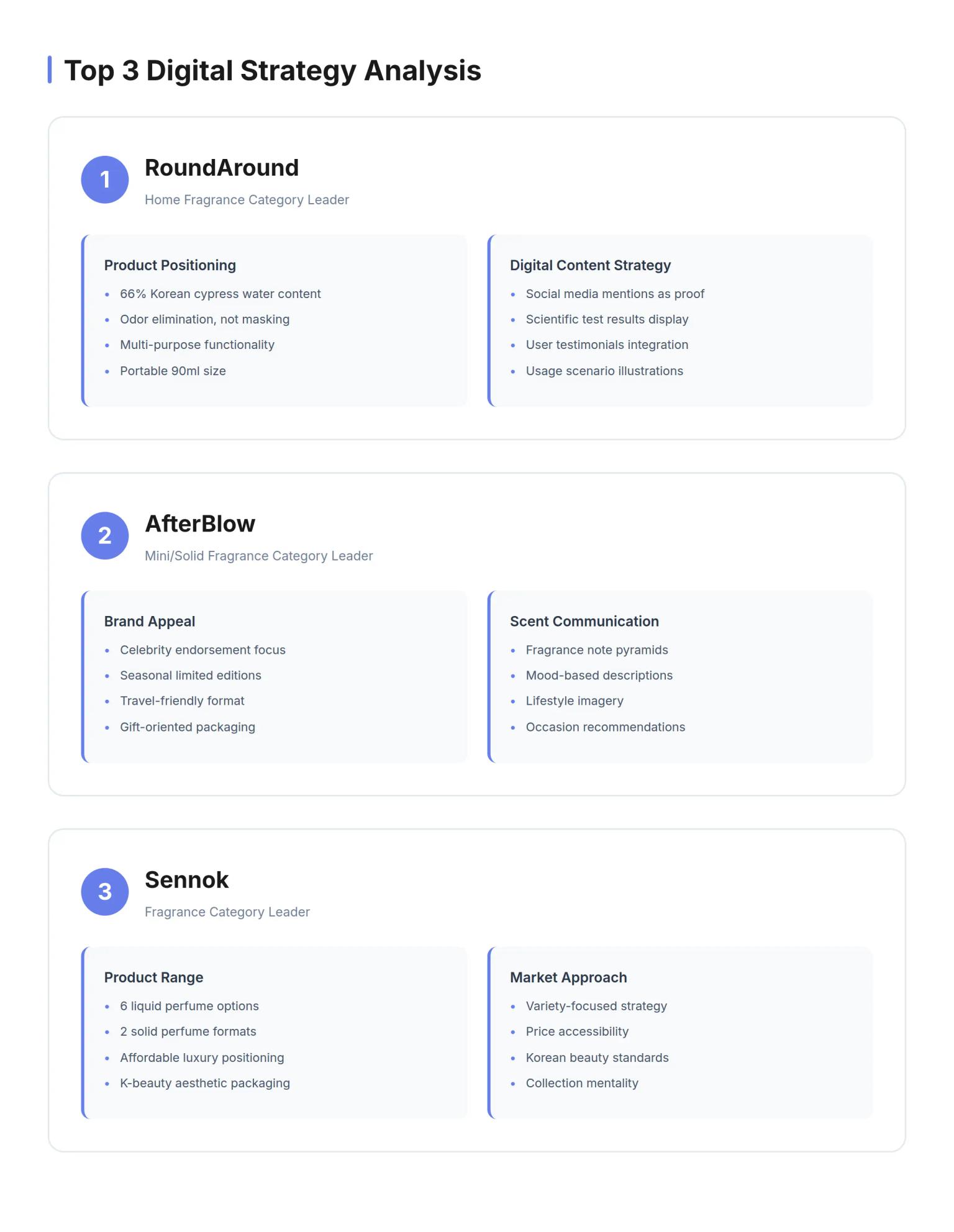

1. RoundAround (Home Fragrance Category Leader)🔗

RoundAround's product page emphasizes social media mentions and scientific testing results.

Product Page Structure:

- Social media mentions as opening statement

- Multi-purpose deodorizing functionality claims

- User testimonials section

- Key ingredient highlight: 66% Korean cypress water

- Portable 90ml size specification

- Test results: deodorizing efficacy, 48-hour duration, skin irritation tests

- Usage instructions for different scenarios

Key Product Features:

- Contains 66% domestic cypress water

- Available in 3 fragrance options

- Marketed as odor elimination rather than masking

2. AfterBlow (Mini/Solid Fragrance Category Leader)🔗

AfterBlow features celebrity endorsement and seasonal marketing elements.

Product Page Structure:

- Celebrity endorsement: DAY6 member Wonpil collaboration highlighted

- Sales ranking display: Olive Young overall #1 and category #1

- Limited edition gift promotion

- Product lineup: 9 eau de parfum varieties

- Fragrance description: "Refreshing sunshine with fresh tangerine"

- Technical composition: TOP-MID-DRY note structure

- Format options: Both eau de parfum and solid perfume available

Key Product Features:

- Celebrity collaboration with K-pop idol

- 9 fragrance varieties in the collection

- Available in liquid and solid formats

3. Sennok (Fragrance Category Leader)🔗

Sennok organizes products by lifestyle categories and daily moments.

Product Page Structure:

- Brand philosophy statement: "Natural cleanliness and comfort"

- Product categorization: 3 lifestyle categories - Bath&Life, Natural&Pure, Bath House

- Signature product highlight: "After Bath" fragrance

- Scent descriptions linked to specific situations

- Technical composition: TOP-HEART-BASE fragrance structure

- Safety certification: Skin irritation test results

- Sustainability features: FSC certified packaging, soy ink usage

Key Product Features:

- 6 perfume types and 2 solid perfume options

- Products grouped into 3 lifestyle categories

- Eco-friendly packaging with FSC certification

Common Challenges in Korean Online Fragrance Market🔗

Analysis of how top brands address online fragrance sales challenges:

Challenge 1: Inability to test scent before purchase

- RoundAround approach: Describes scent as "fresh cypress forest" and links to "clean space satisfaction"

- AfterBlow approach: "Tangerine scent" described as "refreshing summer sunshine feeling"

- Sennok approach: "After Bath" scent described as "warmth of being wrapped in a towel after bathing"

Challenge 2: Diverse personal preferences

- RoundAround: Offers 3 fragrance options (Cypress forest, Citrus, Cotton)

- AfterBlow: 9 eau de parfum types plus 7 solid perfume types

- Sennok: 6 types organized into 3 lifestyle categories

Challenge 3: Price sensitivity

- RoundAround: 90ml portable size option

- AfterBlow: Solid perfume format as lower-priced entry point

- Sennok: 15ml mini size available

Fragrance Description Patterns in Korean Market🔗

Common copywriting patterns observed in top-selling products:

Common formula identified: [Specific Situation] + [Emotional State] + [Natural Imagery]

Example 1: Sennok Product Description🔗

Original text: "A warm scent capturing the gentle warmth from a freshly bathed body on a languid morning"

- Situation element: "Languid morning, freshly bathed body"

- Emotional element: "Gentle warmth"

- Natural element: "Natural scent from the body"

Example 2: AfterBlow Product Description🔗

Original text: "Romantic rose scent tinted in pink as you stroll through a garden with an armful of roses"

- Situation element: "Strolling through a garden with roses"

- Emotional element: "Romantic feeling tinted in pink"

- Natural element: "Armful of roses, garden"

Example 3: RoundAround Product Description🔗

Original text: "The clear and cool scent of cypress forest lingers in your space"

- Situation element: "Scent lingering in space"

- Emotional element: "Clear and cool"

- Natural element: "Cypress forest"

Marketing Positioning Analysis🔗

Observed Positioning Strategies:🔗

RoundAround: Focuses on "clean space" concept

- Core product: Cypress Clean Spray

- Marketing emphasis: Clean and fresh daily environment

AfterBlow: Targets youth culture and fandom

- Core product: Eau de Parfum collection

- Marketing emphasis: Celebrity association and youthful identity

Sennok: Centers on post-bathing relaxation

- Core product: Perfume collection organized by daily moments

- Marketing emphasis: Comfort and daily rituals

Common pattern: All three brands connect fragrances to specific lifestyle moments rather than focusing solely on scent characteristics.

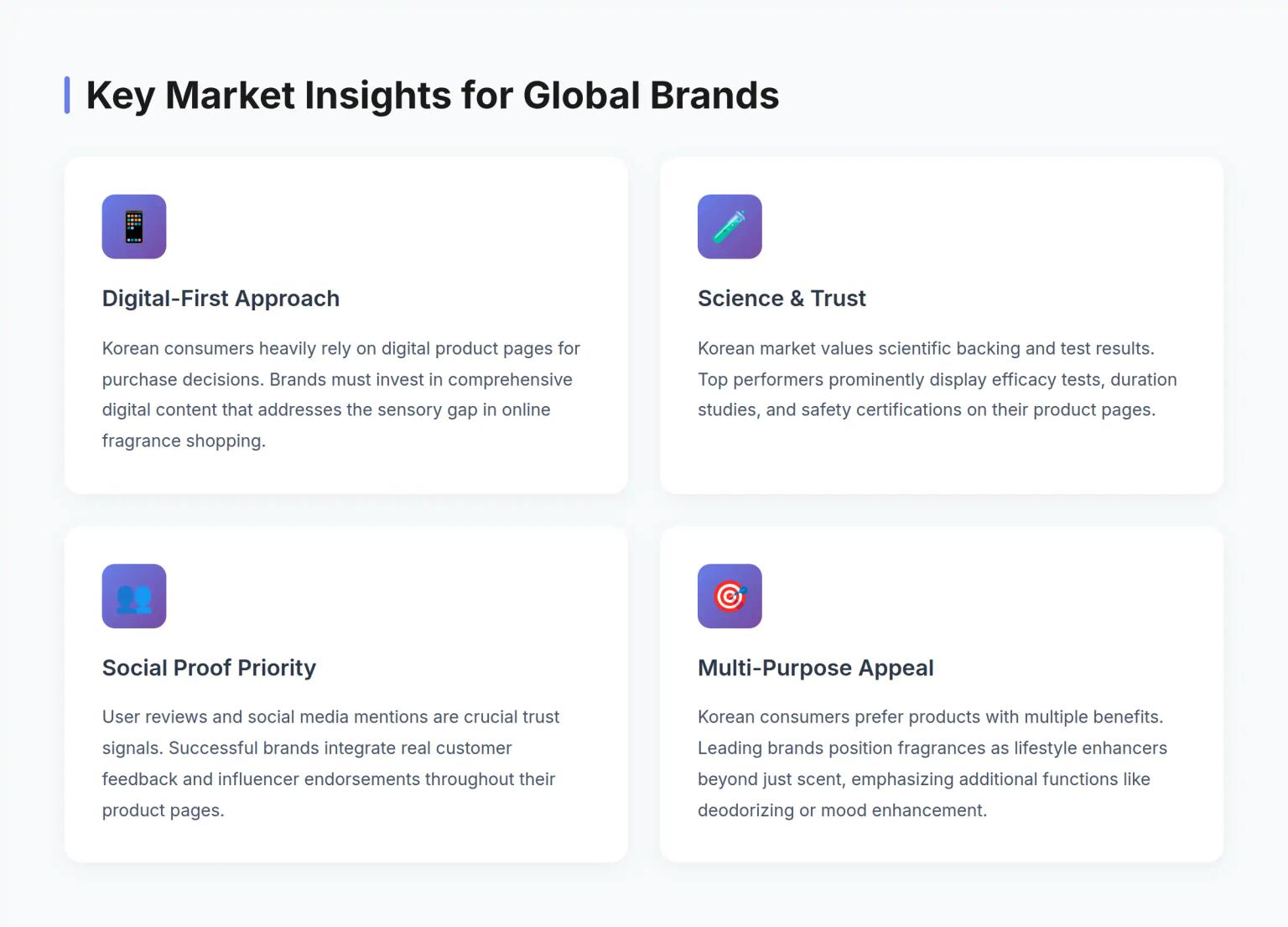

Key Findings Summary🔗

Product page content patterns in Korean fragrance market:

-

Moment-based messaging: Products are presented within specific daily contexts rather than focusing on fragrance composition alone

-

Emotional language: Scent descriptions commonly use emotional and sensory terms rather than technical fragrance terminology

-

Lifestyle positioning: All three market leaders position their products as lifestyle enhancers rather than traditional fragrances

Market characteristics:

- Strong emphasis on social proof and user testimonials

- Celebrity endorsements play significant role in youth-targeted products

- Multiple size and format options address price sensitivity

- Eco-friendly packaging emerging as differentiator

Data source: Olive Young sales data for week 30 of 2025. Product page content extracted via BeauticsLab's technology.

Related Articles

Discover more insights on similar topics.

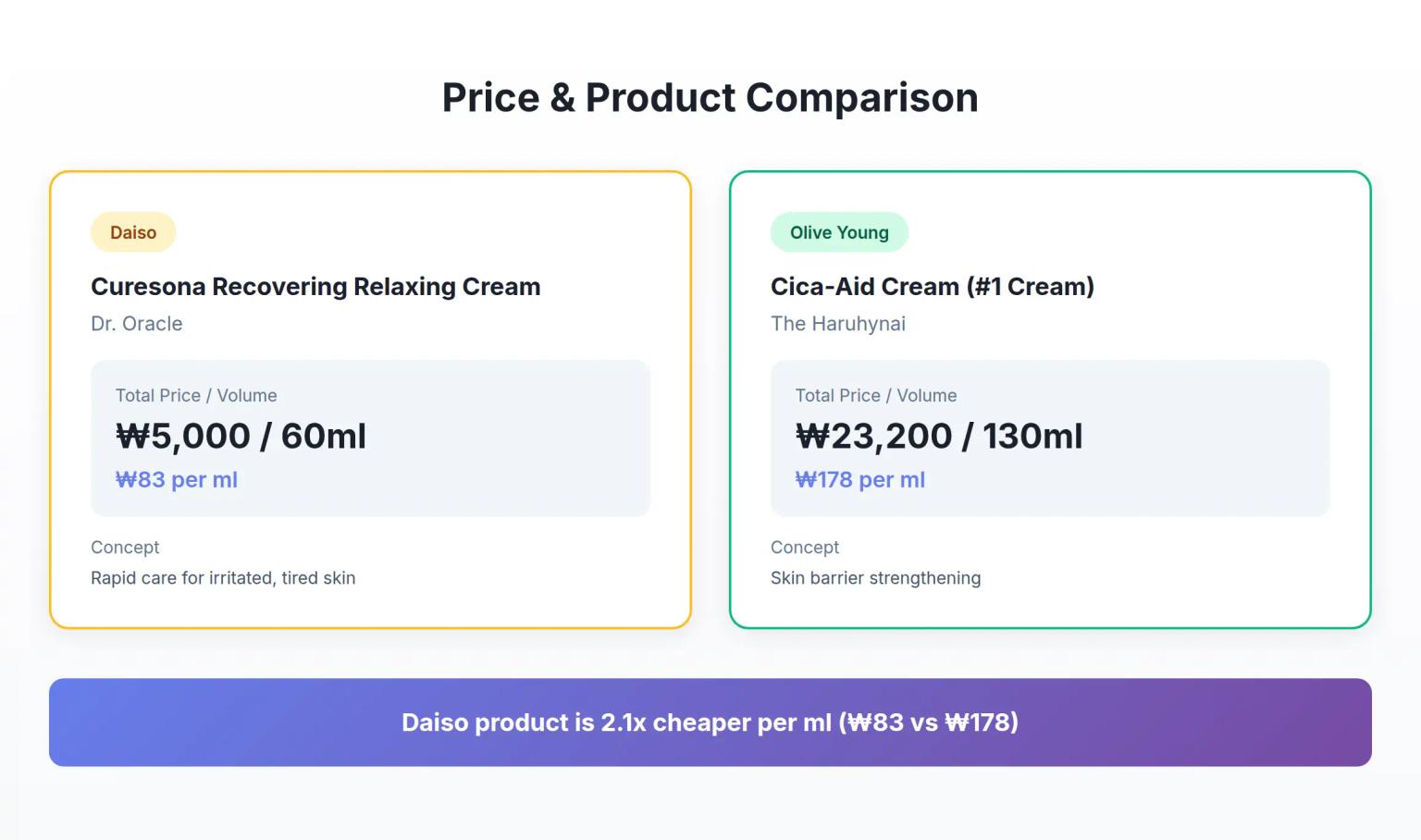

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

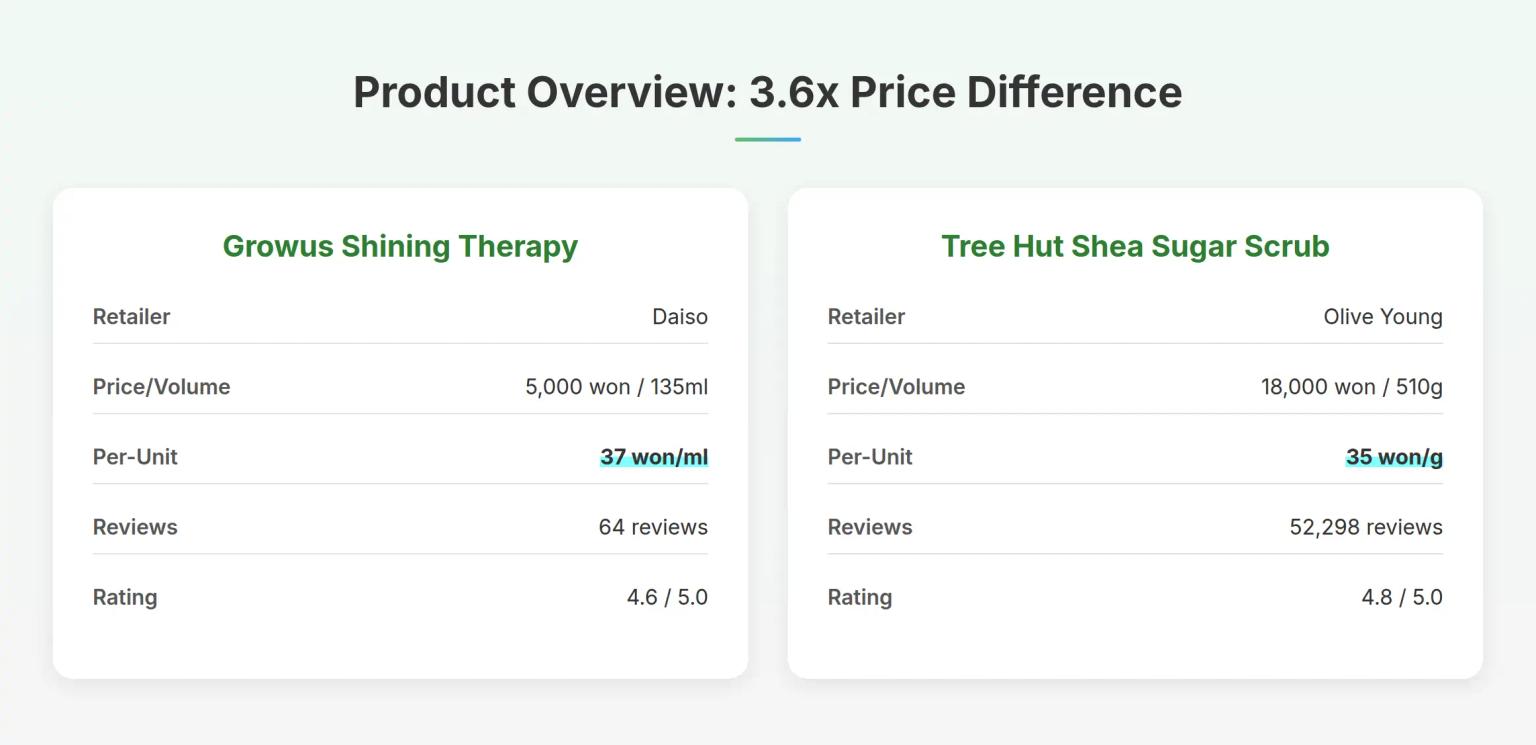

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.