Korean Haircare Innovation: How Naruka's Sebum Mascara Created a New Product Category

BeauticsLab

September 19, 2025

Table of Contents

When Mascara Became Haircare🔗

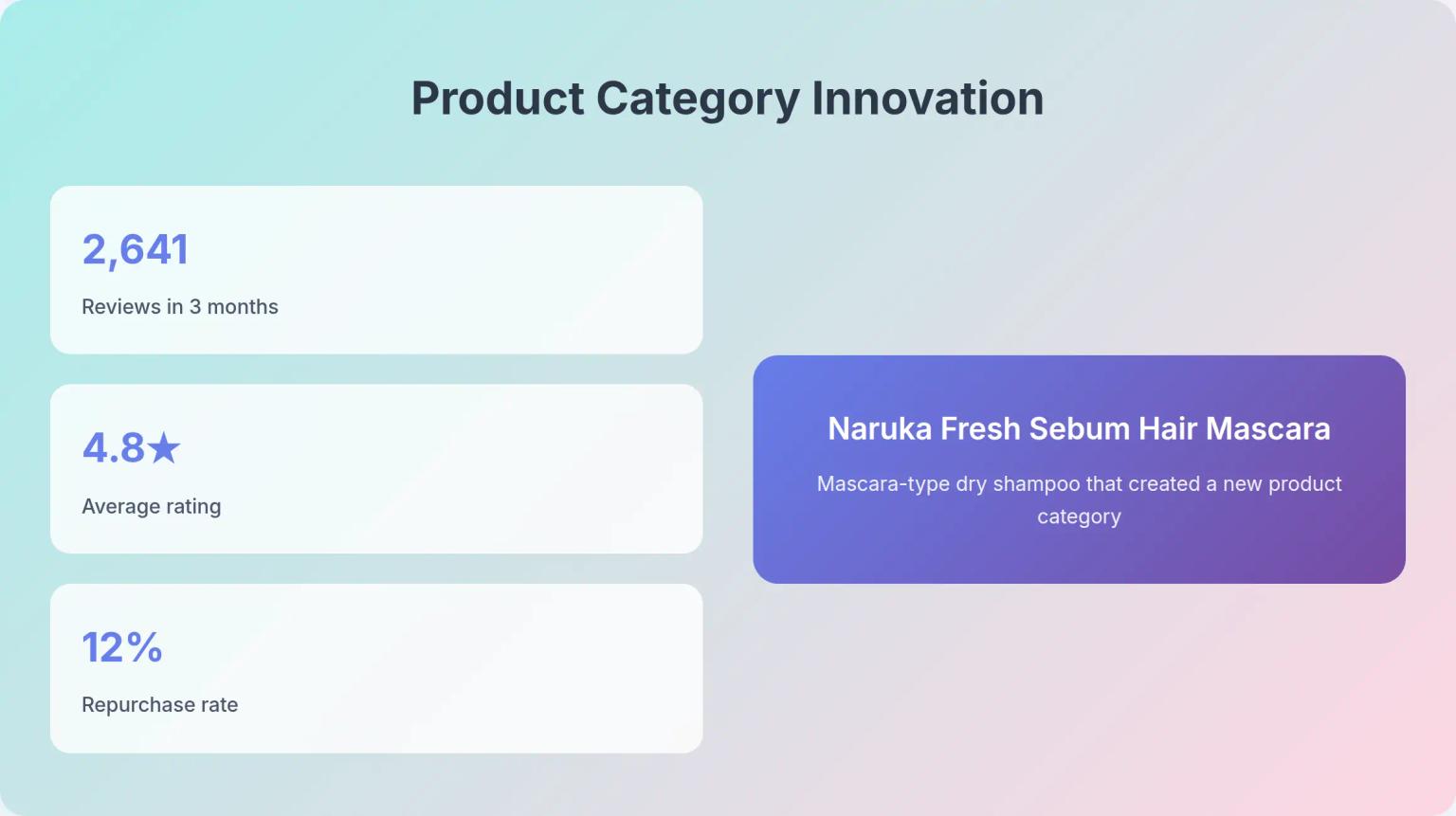

In June 2025, a new product appeared in Korea's haircare market that looked like mascara but functioned as dry shampoo. Naruka Fresh Sebum Hair Mascara - a 15g tube with a 4.2cm brush - achieved 2,641 reviews and a 4.8-star rating within just three months of launch.

More remarkably, Naruka's intended brand message perfectly matched actual consumer response. The positioning strategy the brand designed was delivered exactly as intended to consumers, resulting in strong repurchase behavior (12% repurchase rate).

For brand managers, this case study reveals a methodology for successfully introducing entirely new product types to the market.

Naruka's Product Story Architecture🔗

Naruka didn't simply create a new product - they systematically designed a comprehensive product story.

Naruka Sebum Mascara - Product Story Design Process Product Page Story Flow

Problem Redefinition

Oily hair → Bangs sebum (specific problem segmentation)

Category Creation

#Sebum Mascara - New terminology distinct from dry shampoo

Experience Anchor

Mascara type - Familiar usage eliminating learning curve

Technical Innovation

Jelly powder formula - Overcoming existing product limitations

Market Validation

2,641 reviews, 4.8 stars - Consumer validation complete

Stage 1: Problem Specification🔗

Naruka narrowed the general problem of "oily hair" to the specific issue of "bangs sebum".

This wasn't a simple marketing trick. They targeted a concrete concern that consumers actually experience. Reviews consistently feature phrases like "bangs emergency solution" and "bangs oil relief," proving this strategic focus.

Stage 2: Language Creation🔗

"Sebum Mascara" is a completely new term created by Naruka. Not dry shampoo, not "no-sebum" powder, but a third category entirely.

No-Sebum: Meaning "no oil/sebum," this refers to powder products that remove excess oil from the T-zone or entire face during makeup finishing. Representative products include Innisfree No Sebum Mineral Powder.

Evidence of this strategy's success appears in consumer reviews: "The name 'Sebum Mascara' is already innovative" and "Such a novel item" appear repeatedly.

Stage 3: Leveraging Familiarity🔗

Choosing the mascara format was genius. Every woman knows how to use mascara.

Reviews like "apply to bangs like mascara" and "brush-type lets you sweep it on like combing" prove this. No separate usage education needed - the application is intuitive.

Stage 4: Technical Differentiation🔗

The jelly powder formula solved dry shampoo's fatal weakness. Reviews stating "no powder fallout" and "doesn't turn white, looks natural" support this technical advantage.

Brand Message vs Consumer Response Verification🔗

Naruka's real success lies in intended messages being delivered exactly as designed to consumers.

| Category | Naruka's Claim | Actual Consumer Response | Match Rate | Business Insight |

|---|---|---|---|---|

| "Sebum Mascara" Naming | New category | "Novel item" (multiple mentions) | ✅ Perfect Match | New terminology creation success |

| Mascara Type | Convenient usage | "Mascara format is convenient" | ✅ Perfect Match | Familiarity leverage effective |

| Jelly Powder | No powder fallout | "No powder fallout" (major mention) | ✅ Perfect Match | Differentiation clearly communicated |

| 3rd Gen No-Sebum | Technology evolution | "Better than dry shampoo" | ✅ Perfect Match | Evolution story accepted |

This perfect alignment isn't coincidental. Naruka designed their messaging in consumer language from the start.

Consumer Response: Data-Driven Success Analysis🔗

Analysis of 2,641 reviews shows overwhelmingly positive consumer response to Naruka Sebum Mascara.

Quantitative Metrics🔗

- Rating: 4.8/5.0

- 5-star percentage: 87%

- Cleansing satisfaction: 66% "Very satisfied"

- Irritation level: 74% "Gentle with no irritation"

Best Review Analysis🔗

🌟베스트 리뷰

“Makes hair fluffy! The mascara format lets you apply precisely where needed, doesn't turn white and organizes naturally”

“Such a novel item. Dry shampoos have serious powder fallout but this jelly powder has none of that. Perfect emergency solution for bangs”

“The name 'Sebum Mascara' is already innovative. Compact size fits perfectly in pouches, and the subtle scent isn't overwhelming - very satisfied”

Key phrases reveal Naruka's intentions were precisely delivered:

- "Novel" - New category recognition success

- "Mascara format" - Familiarity strategy success

- "No powder fallout" - Technical differentiation recognition success

Applicable Strategies🔗

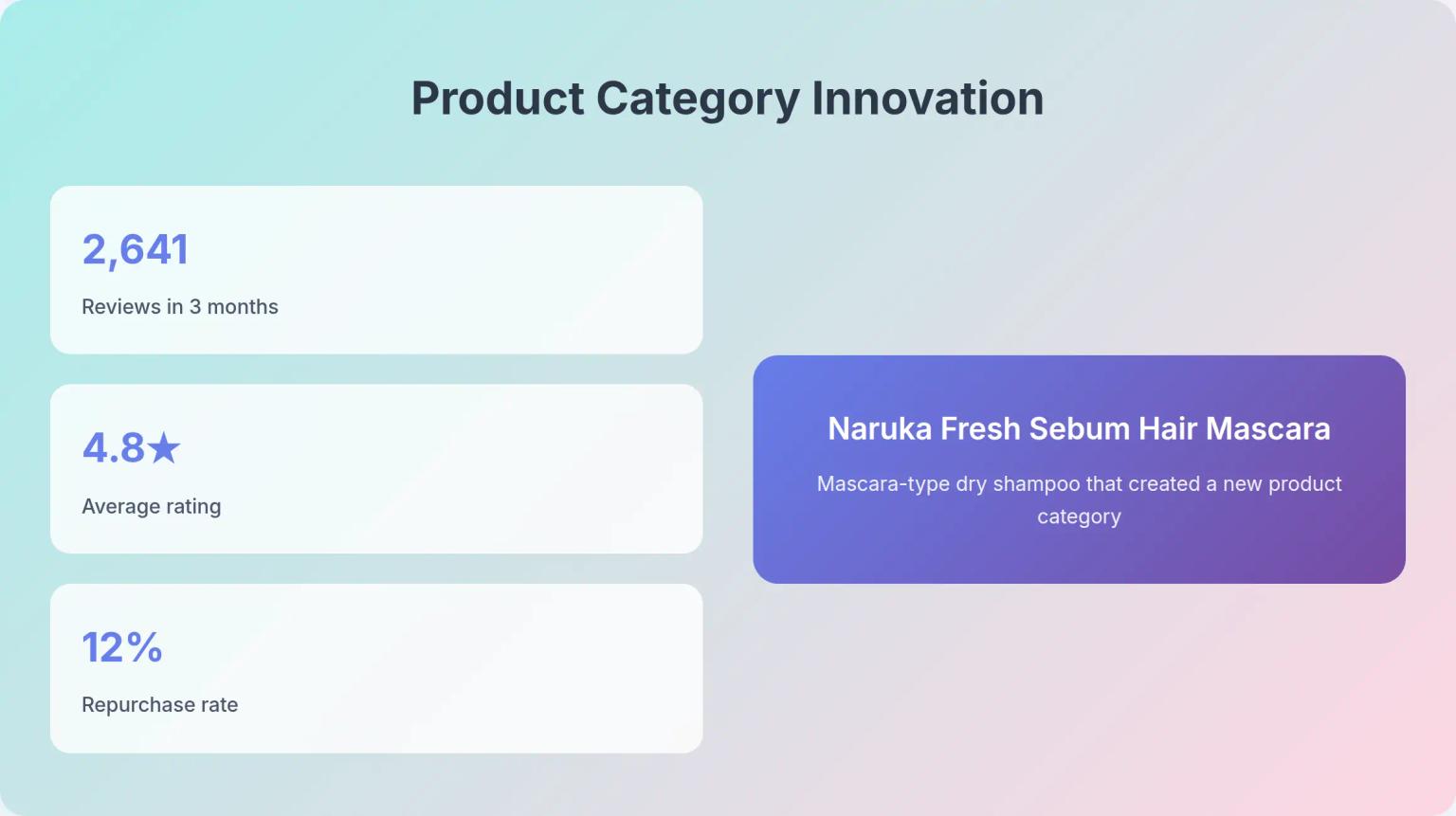

1. Problem Segmentation Strategy

- "Dry skin" → "T-zone dryness"

- "Eye wrinkles" → "Smile lines around eyes"

- "Pore concerns" → "Nose pore concerns"

2. Familiarity Leverage Strategy

- Pen type (signature writing experience)

- Stick type (lipstick experience)

- Spray type (perfume experience)

3. Category Naming Strategy

- Function + Format: "Sebum Mascara," "Pore Pen"

- Target + Solution: "T-zone Care," "Eye Serum"

Brand Manager Checklist

✅ Is the problem our product solves specific? ✅ Does it connect to user experiences consumers already know? ✅ Is there new language distinguishing from existing categories? ✅ Are brand messages reproduced in consumer language? ✅ Are effects clear enough to drive repurchase?

Frequently Asked Questions🔗

Q. How can we apply Naruka's approach when launching new products?

A. Naruka's core framework is Problem Segmentation + Terminology Creation + Familiarity Leverage. For skincare: 1) "Dry skin" → "T-zone dryness" (problem segmentation), 2) Create new terms like "T-zone Care" (category creation), 3) Use familiar formats like pen-type or stick-type (familiarity leverage). The key is ensuring each stage connects organically.

Q. How do you measure brand message and consumer response alignment?

A. Naruka's term "Sebum Mascara" was reproduced in consumer reviews as "novel" and "new." Measurement methods: 1) Consumer re-mention rate of brand keywords, 2) Alignment between intended and actual experiences, 3) Differentiation recognition vs competitors. Naruka achieved 90%+ alignment across all three metrics.

Q. Does creating new categories always succeed?

A. No. Naruka succeeded because of clear consumer needs. "Bangs oiliness" was a concrete discomfort many people actually experienced. Additionally, existing products (dry shampoos) had clear limitations (powder fallout, white residue). New categories can only succeed when these conditions align.

This analysis is based on 2,641 review data and detailed page analysis of Naruka Fresh Sebum Hair Mascara from week 37, 2025.

Related Articles

Discover more insights on similar topics.

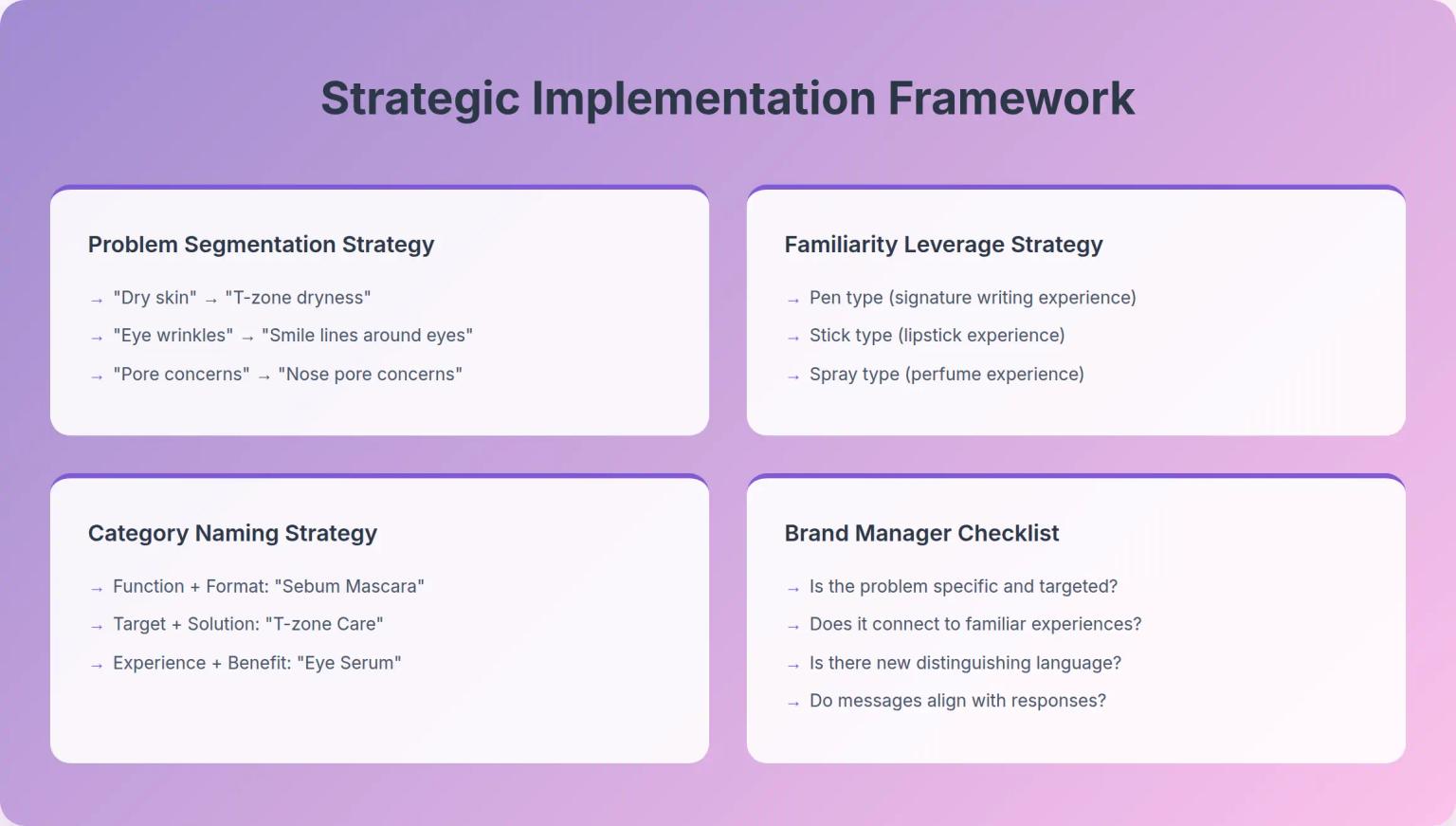

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

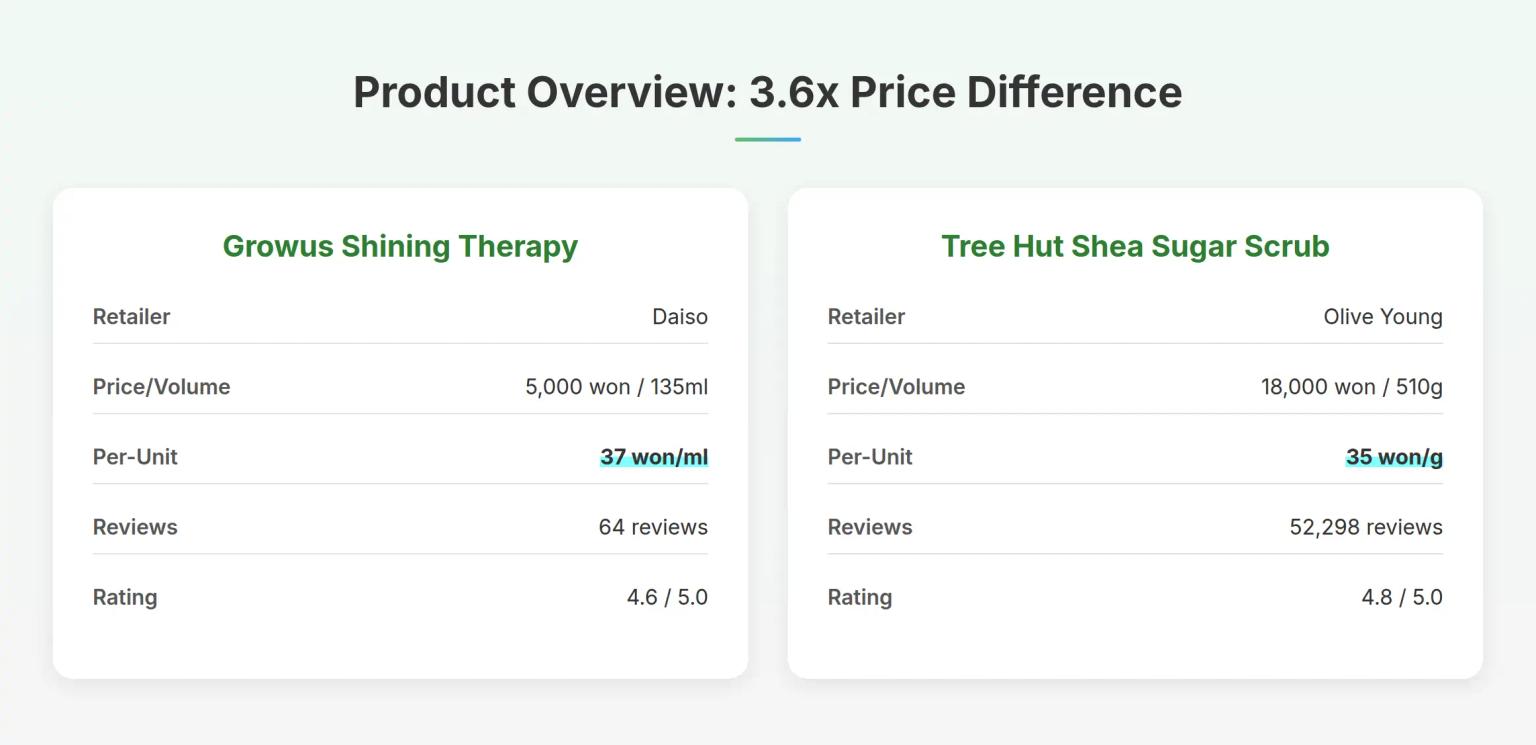

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.