Korean Suncare Marketing: Two New Brands, Two Different Approaches

BeauticsLab

September 8, 2025

Table of Contents

Two Conversations in Korean Suncare Market🔗

Week 36 of 2025 in Olive Young's suncare market reveals an intriguing contrast between two brands.

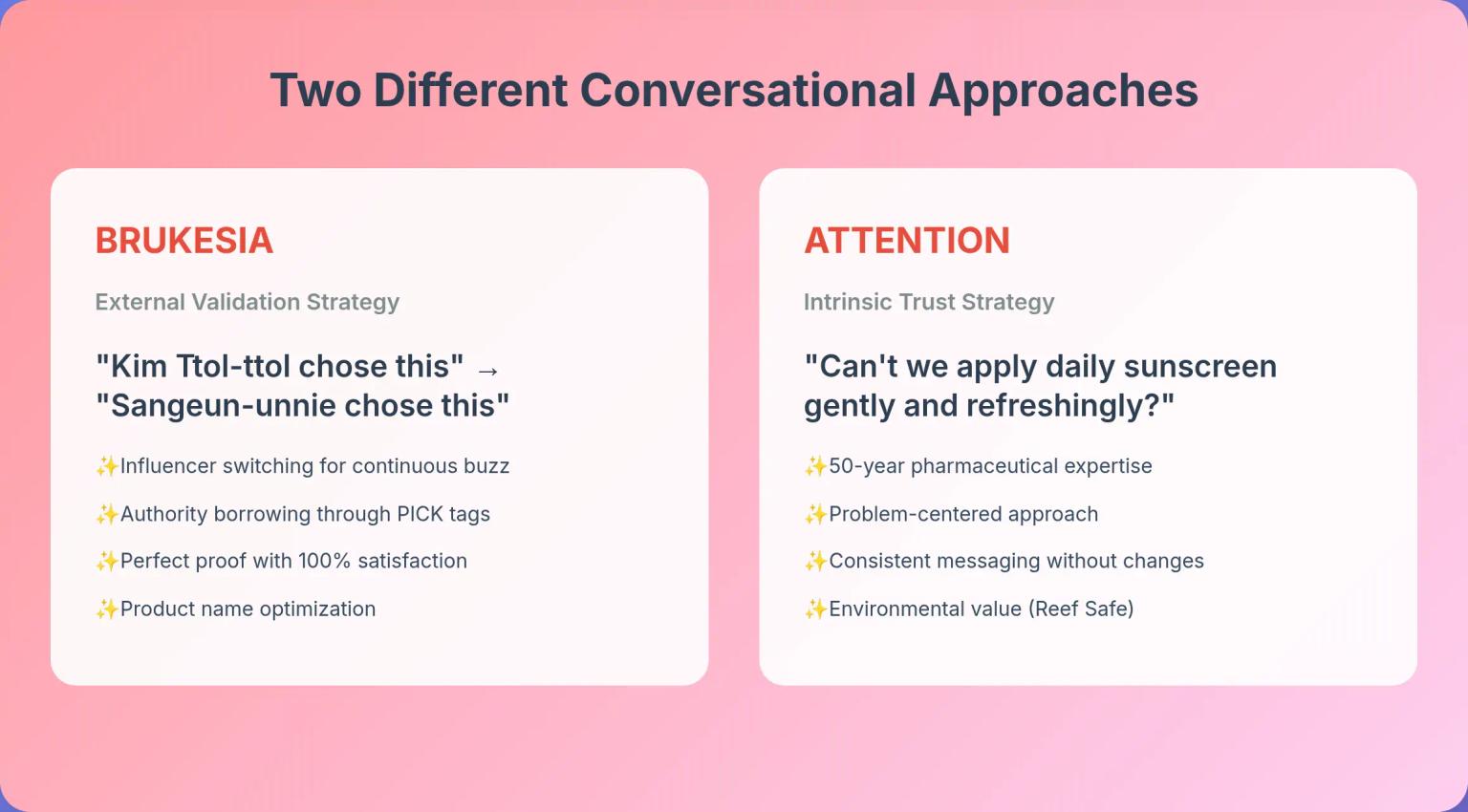

Brukesia says: "Kim Ttol-ttol chose this." Seven weeks later, it changes to: "Sangeun-unnie chose this." By switching influencers, they continuously emphasize being 'someone's choice'.

Attention asks: "Can't we apply daily sunscreen gently and refreshingly?" Then answers: "With 50 years of accumulated research and expertise." They try to explain 'why you should choose us' in their own language.

Same market, completely different conversational approaches. Let's examine the results each choice created.

- Brukesia Breeze Fit Tone-up Sun Base (1,532 reviews)

- Attention Motherwort UV Tone-up Sunscreen (68 reviews)

Brukesia's Choice: The 'Someone's Choice' Strategy🔗

Brukesia chose "building trust through external validation." They created continuous buzz through influencer switching and product name optimization.

Brukesia Breeze Fit Tone-up Sun Base Product Page Story Flow

Authority Hook

Kim Ttol-ttol PICK → Sangeun-unnie PICK influencer switching strategy

Perfect Proof

100% satisfaction after use, sweat-proof human application test completed

Multi-Function

3-in-1 multi base - tone-up + makeup base + sunscreen

Technical Excellence

Sauna 40℃ 20 minutes 2 rounds clinical test, lightweight airware texture

Certification Trust

Korean vegan official certification, safe for sensitive skin

The Precision of Influencer Switching Strategy🔗

Brukesia's product name change history reveals meticulous marketing strategy:

- Week 27: Brukesia Fade-free Sun Base

- Week 28: [Kim Ttol-ttol PICK] Brukesia Fade-free Sun Base → Reviews surged from 16→327

- Week 29-34: [Kim Ttol-ttol PICK/Fade-free] Brukesia Breeze Fit Tone-up Sun Base (sustained for 7 weeks)

- Week 35-36: [Sangeun-unnie PICK/Fade-free] Brukesia Breeze Fit Tone-up Sun Base (influencer switch)

Core Strategy:

- External validation dependency: Influencer recommendations as the core of trust

- Continuous optimization: Product names changed according to marketing performance

- Perfection emphasis: Perfect numbers like 100% satisfaction, clinical tests completed

Attention's Choice: The 'Why Should You Choose Us' Strategy🔗

Attention selected "building empathy through intrinsic trust." They focused on brand story and solving user problems.

Attention Motherwort UV Tone-up Sunscreen Product Page Story Flow

Problem Empathy

Can't we apply daily sunscreen gently and refreshingly?

Brand Heritage

50 years of accumulated pharmaceutical research and expertise (Kyungdong Pharma)

Target Clarity

For Dry and Sensitive Skin - clear target specification

Gentle Solution

Mineral low-irritation formula, comfortable soothing with motherwort extract

Environmental Value

Reef Safe eco-friendly values, choice for oceans and coral reefs

Consistency of User-Centered Messaging🔗

Attention maintained consistent messaging without product name changes:

- All weeks: Attention Motherwort UV Tone-up Sunscreen SPF50+ PA++++ 40ml

- Unchanging core: Brand name + key ingredient + function

Core Strategy:

- Intrinsic trust: Solid background of 50-year pharmaceutical expertise

- Problem-centered approach: Starting from users' actual concerns

- Consistency maintenance: Not frequently changing product names or messages

How Top Performers Did It: Category-Redefining Approach🔗

What approach did proven top-tier suncare products take? They employed both external validation and category innovation simultaneously.

Top-Tier Success Pattern (Bring Green/Obzee) Product Page Story Flow

Social Proof First

2 million units sold + Dex recommendation for verified popularity

Category Innovation

Aloe pack dedicated item + oil blotting sun stick creating new categories

Impact Numbers

Impactful figures like -4.9°C instant cooling, 24-hour durability

Usage Revolution

Usage innovations like refrigerated aloe pack, oil control stick

Complete Solution

Total solution beyond simple UV protection

Comparative Analysis of Three Approaches🔗

| Aspect | External Validation (Brukesia) | Intrinsic Trust (Attention) | Category Redefinition (Top Performers) |

|---|---|---|---|

| Trust Building Method | Influencer PICK | Brand Expertise | Sales Volume + Innovation |

| Differentiation Method | Emphasizing someone's choice | Problem-solving ability | Category redefinition |

| Core Message | "○○ chose this" | "You know why you need this" | "This is different" |

| Sustainability | High influencer dependency | Brand asset accumulation type | Market leading |

| Initial Entry Speed | Fast buzz creation | Gradual growth | Explosive growth |

Market Response Data Analysis🔗

We analyzed actual market response through weekly review growth patterns.

| Timing | Brukesia | Attention | Notable Points |

|---|---|---|---|

| Launch Period | Week 27 (July) | Week 35 (August) | 8-week difference |

| First Week Response | 16 reviews | 23 reviews | Attention performed better |

| Marketing Turning Point | Week 28 Kim Ttol-ttol PICK 16→327 reviews (20x) | Week 36 current 23→68 reviews (3x) | Stark influencer effect |

| Maximum Growth Rate | Week 28: +1,944% | Week 36: +196% | Reflects approach differences |

| Week 36 Current | 1,532 reviews | 68 reviews | 22x difference |

📊 Immediate Effect of Influencer Marketing: Brukesia saw a 20x surge in reviews immediately after adding the Kim Ttol-ttol PICK tag. Meanwhile, Attention shows steady but relatively gradual growth.

Conclusion: Evolution, Not Just Choice🔗

The cases of Brukesia and Attention demonstrate the diversity of marketing strategies with no single right answer.

External validation creates quick buzz, while intrinsic trust builds solid foundations. However, the common lesson from top-performing products is that true success comes from innovation that redefines categories.

For new brands, the realistic approach would be to select a first strategy that fits their situation, then gradually evolve toward category-redefining innovation based on market response.

The suncare market continues to grow. Regardless of which strategy you choose, what matters is maintaining consistency and authenticity while building trust with consumers.

💡 Frequently Asked Questions (FAQ)🔗

Q. Which strategy should new suncare brands choose for market entry?

A. Choose between two approaches based on your brand situation. If you have access to influencer collaborations and need quick buzz, use the 'external validation' approach like Brukesia. Build trust through authority borrowing with "○○ chose this" messaging. However, if you have pharmaceutical expertise or unique brand stories like Attention, the 'intrinsic trust' approach is more effective. Start with user problems like "Can't we apply daily sunscreen gently and refreshingly?" and present your unique solution.

Q. When should you choose the intrinsic trust strategy (Attention's approach)?

A. It's effective when three conditions are met. First, when you have solid brand background (Kyungdong Pharma's 50-year expertise). Second, when you have clear target segments (dry & sensitive skin). Third, when aiming for long-term brand asset building. Implementation method: Start with users' actual concerns ("daily sunscreen, gentle and refreshing") and consistently deliver your brand's unique answer. Don't change product names frequently, and differentiate with additional values like eco-friendly benefits (Reef Safe).

Q. When should you evolve to the category-redefining strategy?

A. Evolve after successfully entering the market with your first strategy. Like top performers (Bring Green, Obzee), you need innovation that breaks existing category boundaries. Implementation method: Present new usage methods like aloe pack dedicated items, oil blotting sun sticks, or create recognition that "this is different" through impactful differentiation like -4.9°C cooling. The key is providing total solutions beyond simple UV protection.

This analysis is based on BeauticsLab dashboard data and detailed page analysis for Week 36, 2025.

Related Articles

Discover more insights on similar topics.

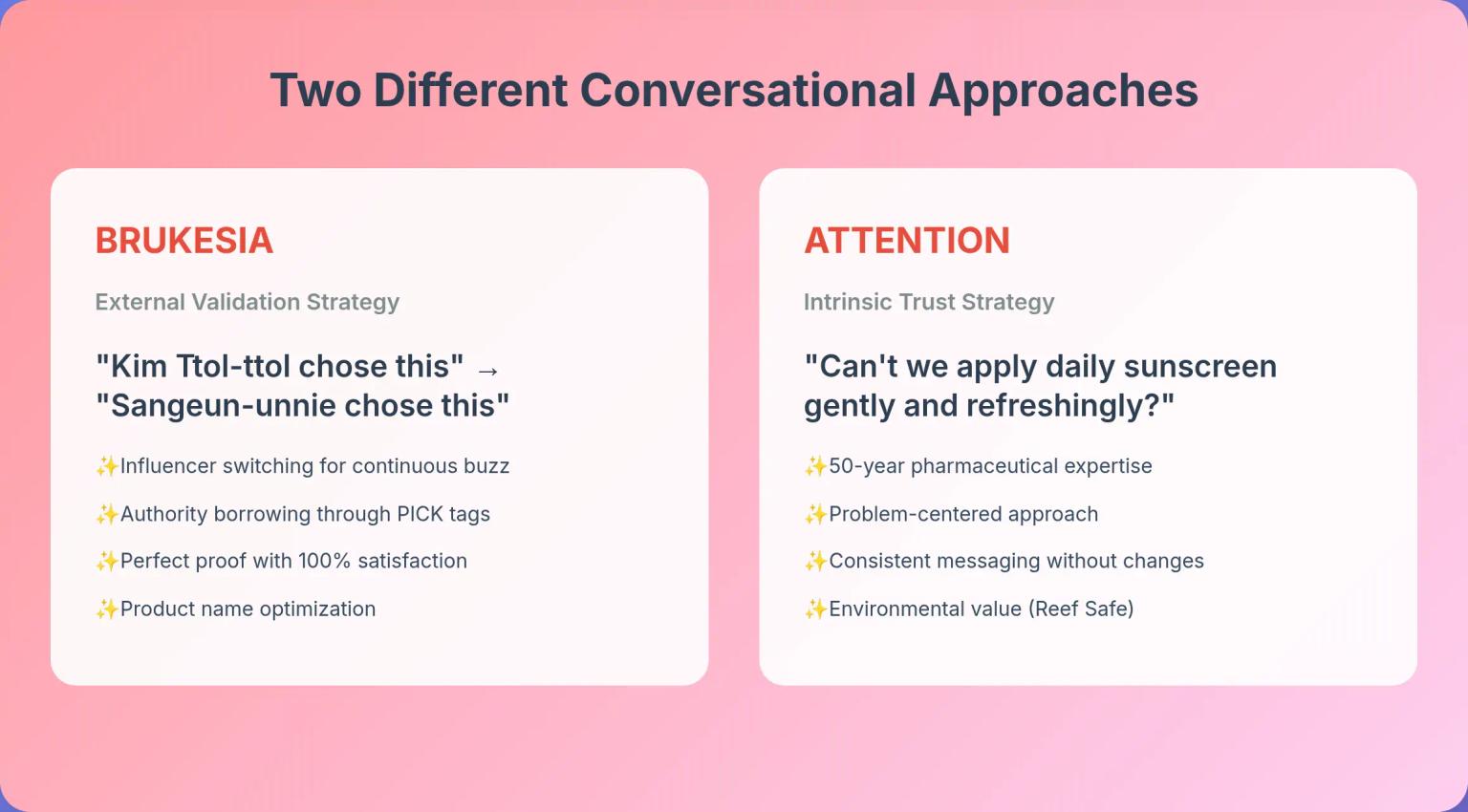

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

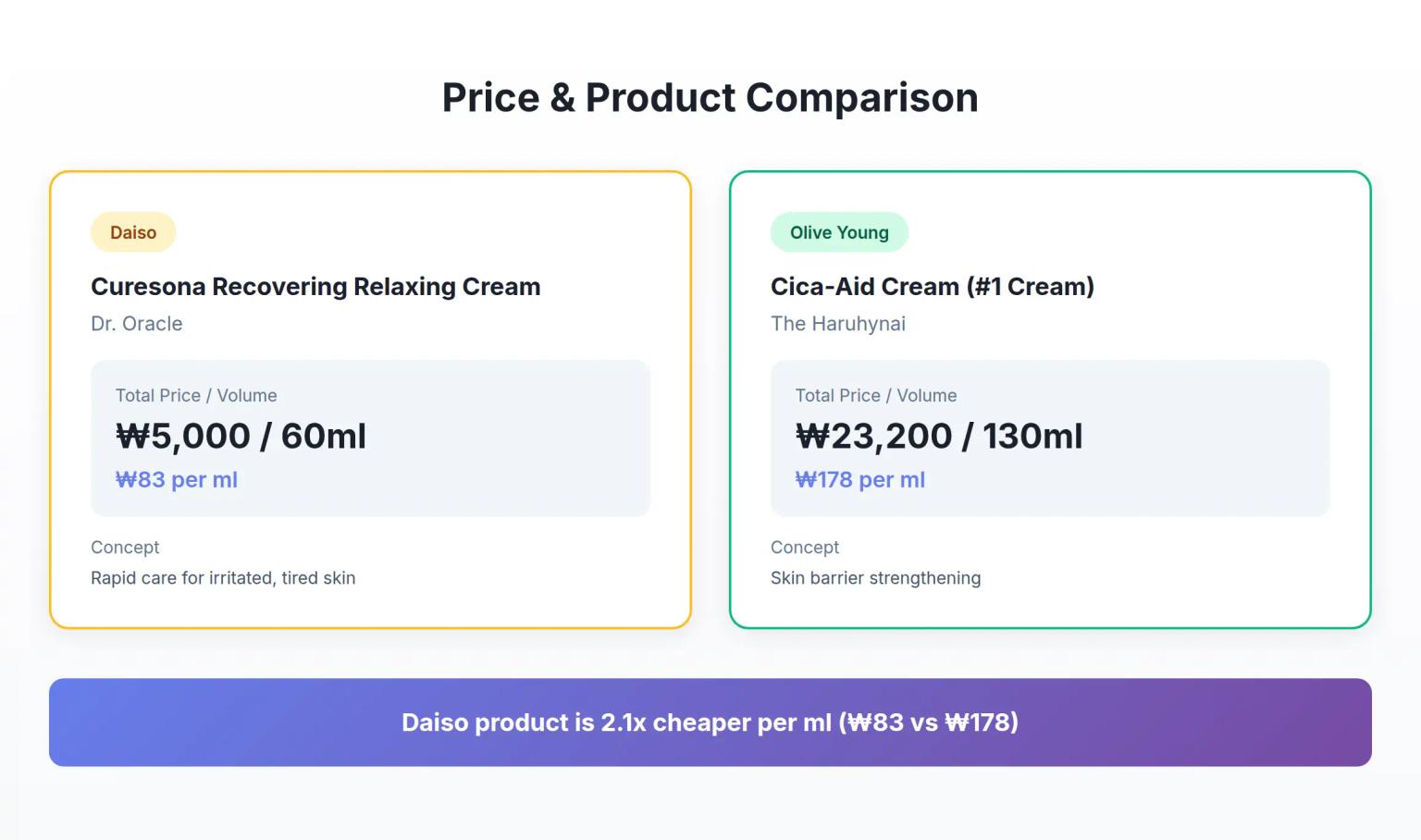

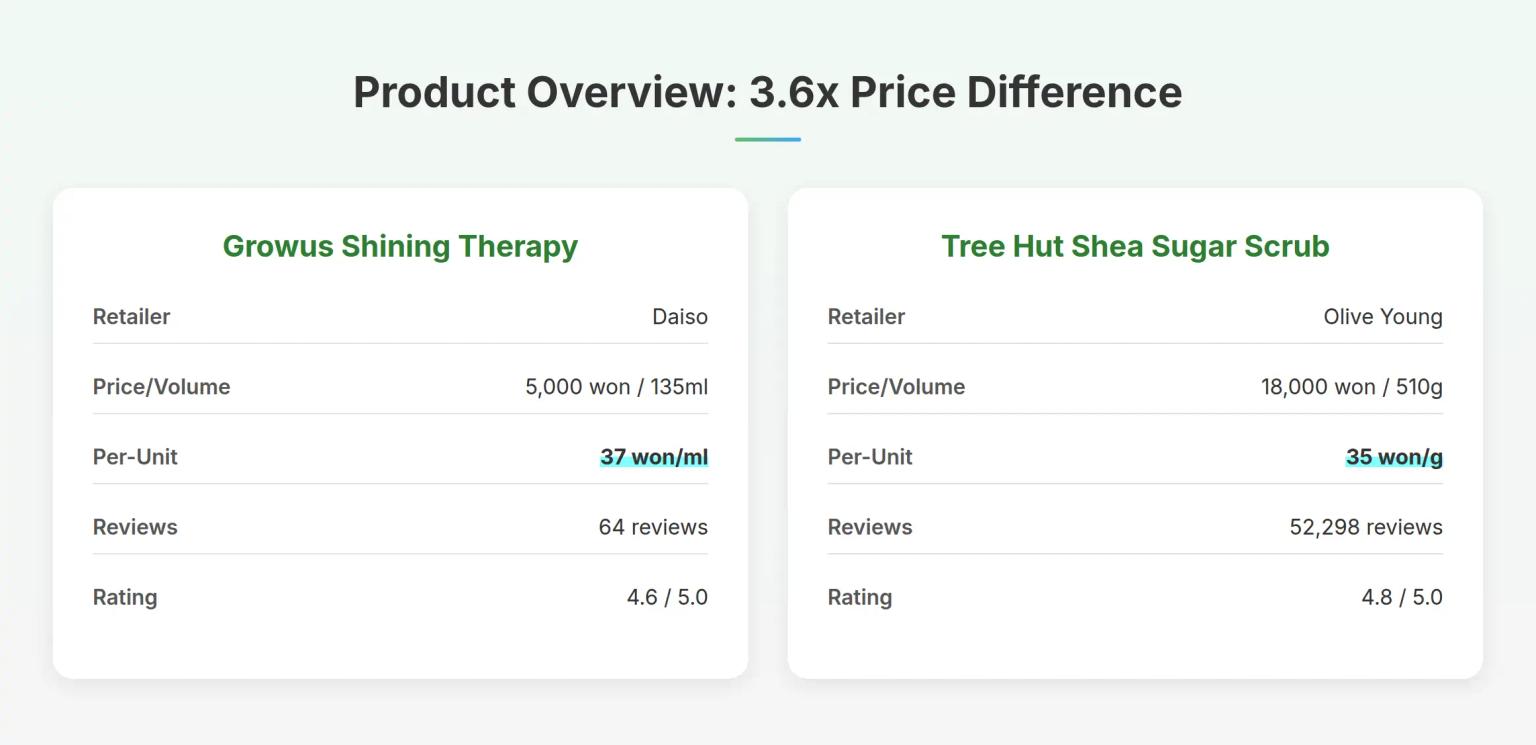

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.