Mung Bean vs Cell-Up vs Mugwort Rice Cake: TOP 3 Cleansing Foams' Completely Different Persuasion Methods

BeauticsLab

August 11, 2025

Table of Contents

Understanding Korean Cleansing Foam Market🔗

The cleansing foam category at Olive Young showcases a uniquely Korean approach to skincare marketing that would perplex Western marketers. In week 32 of 2025, the top three products demonstrate strategies that combine astronomical sales figures, ancient Korean history, and texture innovations that reference traditional desserts.

What makes Korean cleansing foam marketing particularly fascinating is its departure from the clinical, ingredient-focused approach common in Western markets. Korean brands have mastered the art of making basic cleansing a cultural phenomenon.

Three Leaders, Three Distinct Strategies🔗

The analysis covers the top 3 products in the cleansing foam/gel subcategory:

- Beplain Mung Bean pH-Balanced Cleanser (#1) - "National Cleanser" phenomenon

- Lagom Cellup Micro Foam Cleanser (#2) - African acacia innovation

- Hanyul Artemisia Rice Cake Pack Foam (#3) - Seasonal targeting with texture play

Data Collection Methodology🔗

Product page images were processed using OCR technology to extract all text content. The analysis focuses on unique Korean marketing elements that differentiate these products from global competitors.

Detailed Brand Strategy Analysis🔗

1. Beplain: The "10 Million Sold" Cultural Phenomenon🔗

Beplain has achieved what Western brands rarely attempt - turning a cleanser into a national identity marker.

Beplain Mung Bean pH-Balanced Cleanser Product Page Story Flow

Sales Milestone Hook

10 million sold - 1 in 5 Koreans have used this product

Historical Storytelling

In the Silla Dynasty era, when there was no cleanser, people used mung beans

Continuous Production

One unit produced every 3 minutes for 6 consecutive years

Comprehensive Solution

6 clinical trials completed for all-in-one cleansing

Korean Ingredient Pride

100% Korean mung beans with pH-balanced formula

Award Validation

Multiple beauty awards confirming national cleanser status

Key Strategy Elements:

- "National Cleanser" positioning: Using sales figures as social proof

- Historical narrative: Connecting to Silla Dynasty (57 BC - 935 AD) for authenticity

- Production metrics: "Every 3 minutes" creates urgency and popularity perception

Cultural Context: The "10 million sold" milestone is particularly significant in Korea, a country of 51 million people. This translates to roughly 20% market penetration - a figure that Western brands would typically never highlight so prominently. In Korean marketing, these milestones ("백만 돌파" - million breakthrough) are celebrated events that create FOMO and social validation.

2. Lagom: Scientific Innovation with African Storytelling🔗

Lagom takes a different approach, combining exotic ingredient storytelling with hard science.

Lagom Cellup Micro Foam Cleanser Product Page Story Flow

Achievement Display

1.5 million sold, 23 beauty awards, Olive Young #1

Ingredient Innovation

African Acacia that maintains green leaves in extreme conditions

Scientific Mechanism

Aqualicia activates aquaporins for 24-hour hydration

Triple Efficacy

99% ultra-fine dust removal, 98% pore cleansing, 24hr moisture

Clinical Validation

Korean Dermatology Research Institute certified

pH Innovation

Slightly alkaline but low-irritation formula

Key Strategy Elements:

- Exotic origin story: African acacia surviving in extreme conditions

- Scientific terminology: "Aquaporin activation" appeals to educated consumers

- Precise percentages: 99%, 98% effectiveness claims

Cultural Context: Korean consumers have high scientific literacy and appreciate detailed mechanisms of action. The African acacia story taps into the Korean fascination with ingredients from extreme environments, similar to how Western brands might use Arctic or deep-sea ingredients.

3. Hanyul: Seasonal Marketing with Texture Innovation🔗

Hanyul demonstrates Korea's unique approach to seasonal beauty products.

Hanyul Artemisia Rice Cake Pack Foam Product Page Story Flow

Seasonal Problem

For hot, humid summer oil explosion

Category Leadership

Olive Young Cleansing #1, multiple beauty awards

Texture Innovation

Rice cake-like chewy texture that transforms pack-to-foam

Immediate Results

One use: -48.5% sebum, -92.3% pore impurities

Korean Ingredients

100% Korean artemisia through softening process

Dual Mechanism

Warming opens pores, cooling closes them

Key Strategy Elements:

- "Summer oil destroyer" positioning: Hyper-specific seasonal targeting

- Rice cake texture reference: Using familiar Korean dessert for texture description

- Two-step mechanism: Warming then cooling for pore management

Cultural Context: The "rice cake" (떡) texture reference would be lost on Western consumers but immediately resonates with Koreans. This texture innovation - a cleanser that feels like a traditional dessert - exemplifies Korea's playful approach to beauty products.

Common Success Patterns in Korean Cleansing🔗

1. The Power of Numbers🔗

Korean brands use specific metrics differently than Western counterparts:

| Brand | Sales Milestone | Efficacy Numbers | Time Metrics |

|---|---|---|---|

| Beplain | 10 million units | 6 clinical trials | Every 3 minutes |

| Lagom | 1.5 million units | 99% dust, 98% pore | 24-hour hydration |

| Hanyul | Multiple #1 rankings | -48.5% sebum | One-time use effect |

2. Ingredient Storytelling: Beyond Origin🔗

🌿 Korean Ingredient Narratives:

- Beplain: Historical legitimacy through Silla Dynasty reference

- Lagom: Survival story from African extreme conditions

- Hanyul: Seasonal specificity with summer oil control

Unlike Western brands that focus on ingredient purity or concentration, Korean brands create emotional narratives around ingredients.

3. Texture as Experience🔗

Korean cleansing products treat texture as a key differentiator:

- Rice cake texture: Familiar dessert reference creates positive associations

- Micro bubbles: Scientific visualization of cleansing action

- Pack-to-foam: Transformation creates engagement and novelty

What Global Brands Can Learn🔗

1. Sales Figures as Social Proof🔗

Korean brands prominently display sales milestones in ways that would seem boastful in Western markets. However, in collectivist Korean culture, these numbers provide crucial social validation - "everyone is using this."

2. Historical and Cultural Anchoring🔗

The Silla Dynasty reference by Beplain would be equivalent to a Western brand referencing Roman baths or Egyptian beauty rituals. This historical anchoring provides authenticity that transcends trends.

3. Seasonal Hyper-Targeting🔗

While Western brands might have "summer" products, Korean brands create highly specific seasonal solutions like "summer oil explosion" products. This specificity resonates with consumers facing exact problems.

4. Playful Science🔗

Korean brands successfully combine serious efficacy claims with playful elements (character collaborations, dessert textures). This approach makes skincare less intimidating and more enjoyable.

The Korean Cleansing Formula🔗

Efficacy × Gentleness × Story = Korean Cleansing Success🔗

The winning formula in Korean cleansing foam market:

- Proven Efficacy: Specific percentages and clinical trials

- Gentle Formula: pH-balanced, low-irritation for sensitive skin

- Compelling Story: Historical, scientific, or seasonal narrative

💡 Key Insight for Global Brands:

Korean cleansing foam success isn't just about cleaning power or gentleness - it's about creating a cultural phenomenon. The "National Cleanser" concept, texture innovations referencing local foods, and seasonal hyper-targeting show how deeply localized marketing can drive massive success.

Global brands entering the Korean market need to understand that product efficacy is table stakes - the real differentiation comes from cultural resonance and social proof.

Unique Korean Market Characteristics🔗

Beyond Western Marketing Conventions🔗

- Sales Milestones as Marketing: "Million seller" badges are promotional tools

- Traditional References: Ancient dynasties and traditional foods as modern marketing

- Texture Innovation: Cleansers that feel like desserts

- Seasonal Precision: Products for specific weather conditions

These strategies reflect Korean consumers' desire for products that are simultaneously innovative and culturally grounded, effective yet enjoyable, scientific but accessible.

This analysis is based on OCR data extraction from product detail pages and BeauticsLab's proprietary analytics for week 32, 2025.

Related Articles

Discover more insights on similar topics.

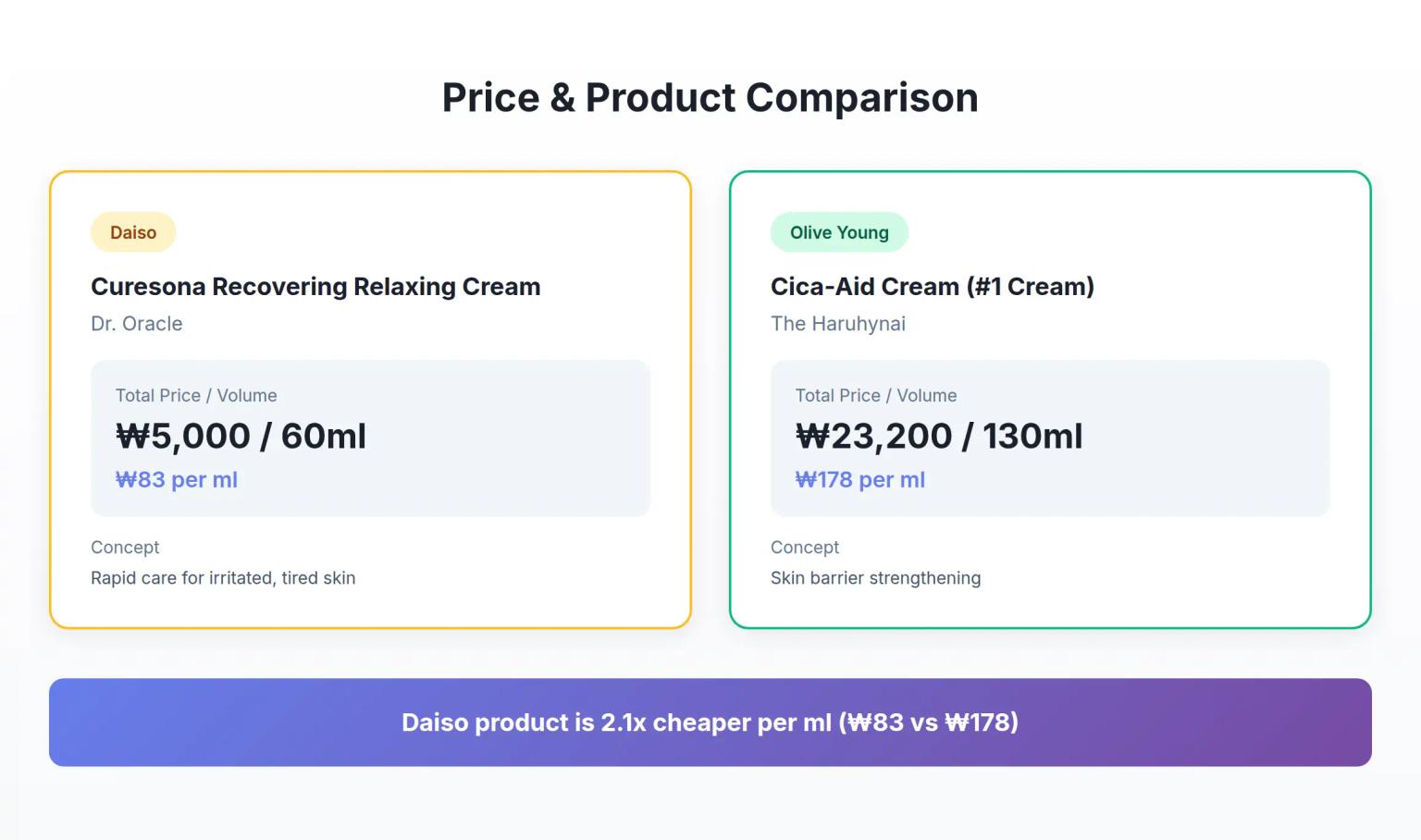

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

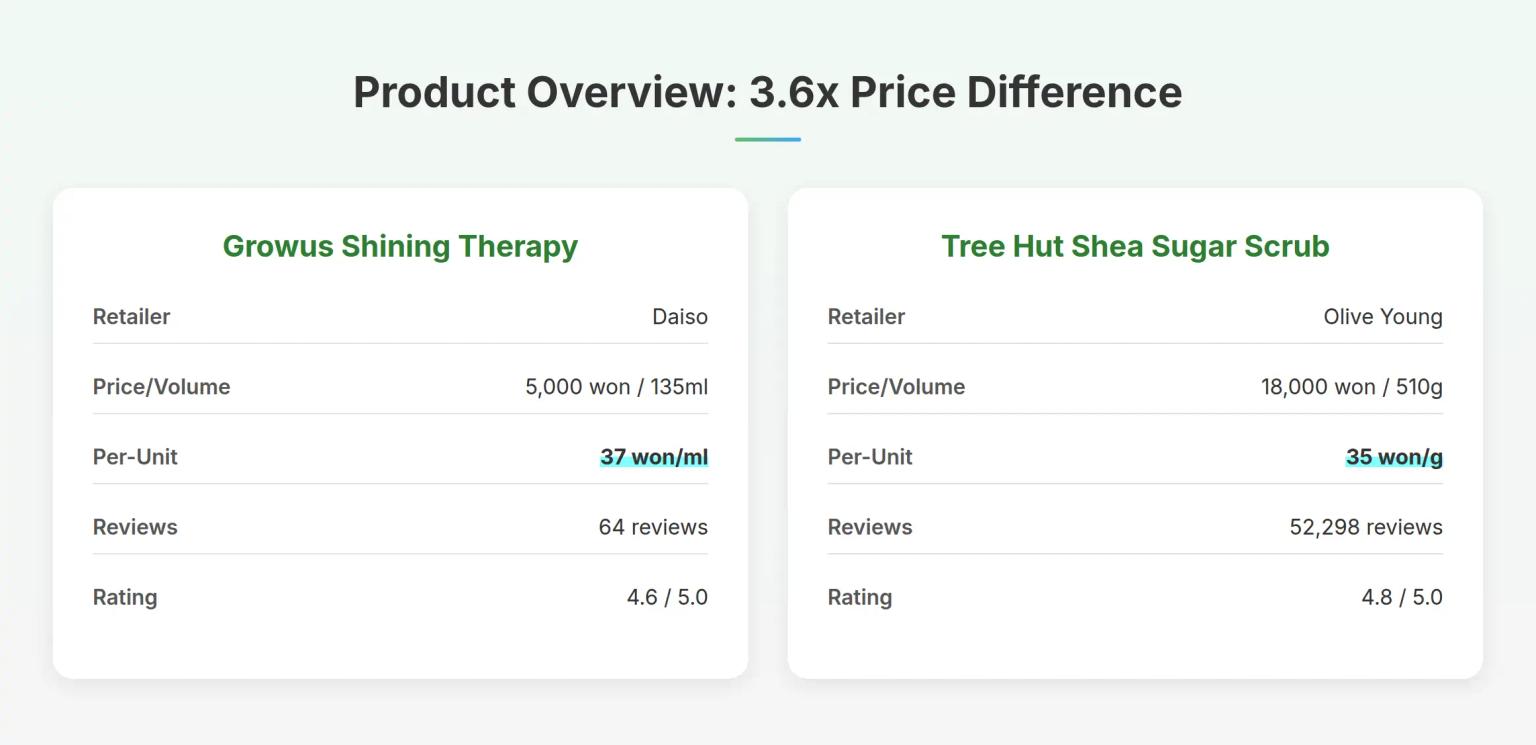

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.