Korean Dermocosmatic Marketing: How Science Meets Emotion in Product Pages

BeauticsLab

August 7, 2025

Table of Contents

Understanding Korean Dermocosmatic Market🔗

The dermocosmatic category at Olive Young represents a unique intersection of pharmaceutical science and cosmetic innovation. In week 31 of 2025, the top-performing mask pack products in this category demonstrate three distinctly different approaches to consumer persuasion, each reflecting broader trends in the Korean beauty market.

What makes Korean dermocosmatic marketing particularly interesting for global brands is its departure from the purely clinical approach common in Western markets. Korean brands have mastered the art of making science approachable and even enjoyable.

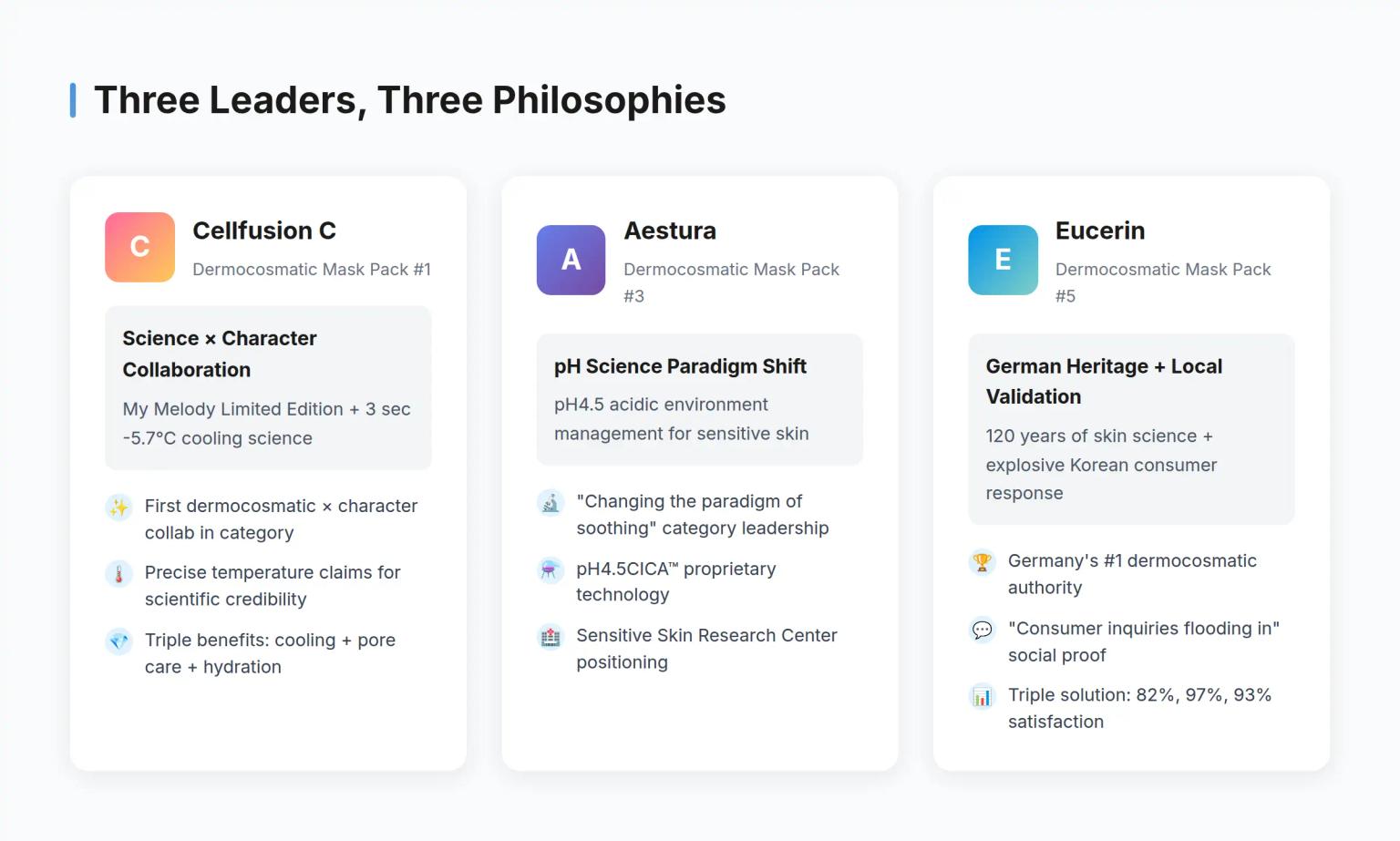

Three Leaders, Three Philosophies🔗

The analysis covers the top 3 products in the dermocosmatic mask pack subcategory:

- Cellfusion C Post Alpha Cooling Pad (#1) - Science meets character collaboration

- Aestura Acica365 Cooling Soothing Pad pH4.5 (#3) - pH paradigm shift

- Eucerin UltraSensitive Repair Soothing Mask Pack (#5) - German heritage localized

Data Collection Methodology🔗

Product page images were processed using OCR technology to extract all text content. The analysis focuses on storytelling structures, scientific claims, and emotional triggers used by each brand.

Detailed Brand Strategy Analysis🔗

1. Cellfusion C: The Unexpected Collaboration🔗

Cellfusion C breaks dermocosmatic conventions by partnering with My Melody, a Sanrio character popular in Korea.

Cellfusion C Post Alpha Cooling Pad Product Page Story Flow

Character Hook

My Melody limited edition creates immediate emotional connection

Scientific Claim

3 seconds to -5.7°C temperature reduction with glacier water

Clinical Evidence

100% satisfaction rate in heat relief, 35.5% pore improvement

Triple Benefits

Cooling + pore care + hydration in one product

Safety Assurance

Non-menthol cooling for sensitive skin compatibility

Key Strategy Elements:

- Character collaboration: Unusual for dermocosmatic category, targets younger consumers

- Precise temperature claims: "3 seconds to -5.7°C" provides scientific credibility

- Summer positioning: "Sunlight Research Center" branding for seasonal relevance

Cultural Context: The My Melody collaboration is significant because it challenges the traditional seriousness of dermocosmatic products. This approach would be unusual in Western markets but resonates with Korean consumers who appreciate "healing" and "cute" aesthetics even in functional products.

2. Aestura: Redefining the Category🔗

Aestura positions itself as a category innovator with pH science.

Aestura Acica365 Cooling Soothing Pad pH4.5 Product Page Story Flow

Paradigm Shift

Changing the paradigm of soothing with pH4.5 science

Problem Education

Sensitive skin is 3x more red with higher pH levels

Scientific Solution

pH4.5CICA™ technology maintains acidic environment for 12 hours

Clinical Validation

32% redness improvement, 3-minute quick cooling to -5.9°C

Extensive Testing

108 days, 38 participants comprehensive safety verification

Key Strategy Elements:

- Educational approach: Teaching consumers about pH and skin sensitivity

- Proprietary technology: pH4.5CICA™ as brand signature

- Research institute positioning: "Sensitive Skin Research Center" for authority

Market Differentiation: While Western brands often focus on single ingredients (retinol, vitamin C), Aestura's pH-centric approach represents a systems-level solution that's characteristic of Korean skincare innovation.

3. Eucerin: Localizing German Authority🔗

Eucerin leverages its 120-year German heritage while adapting to Korean market preferences.

Eucerin UltraSensitive Repair Soothing Mask Pack Product Page Story Flow

Heritage Authority

Germany's No.1 Dermocosmatic with 120 years of skin science

Social Proof

Consumer inquiries flooding in, explosive customer response

Triple Solution

82% immediate soothing, 97% dryness improvement, 93% barrier strengthening

Scientific Ingredients

SymSitive™ and Madecassoside for proven efficacy

Safety Guarantee

Non-comedogenic, suitable for acne-prone skin

Key Strategy Elements:

- Heritage storytelling: 120-year history as trust anchor

- Korean market validation: Emphasizing local consumer response

- Percentage-based claims: Multiple satisfaction metrics (82%, 97%, 93%)

Localization Strategy: Eucerin successfully balances German scientific authority with Korean consumer preferences for multiple benefits and social proof, demonstrating effective glocalization.

Common Success Patterns in Korean Dermocosmatic🔗

1. Multi-Layered Scientific Evidence🔗

All three brands present scientific claims in hierarchical layers:

| Brand | Immediate Effect | Clinical Data | Technology/Ingredient |

|---|---|---|---|

| Cellfusion C | 3 sec -5.7°C | 35.5% pore improvement | Glacier water + Hyaluronic acid |

| Aestura | 3 min -5.9°C | 32% redness reduction | pH4.5CICA™ technology |

| Eucerin | 82% immediate soothing | 30 participants tested | SymSitive™ + Madecassoside |

2. Temperature Quantification as Trust Signal🔗

🌡️ Cooling Effect Comparison:

- Cellfusion C: 3 seconds to -5.7°C (fastest effect)

- Aestura: 3 minutes to -5.9°C (largest reduction)

- Eucerin: No temperature claim, focuses on "82% immediate soothing"

The specific temperature measurements serve as tangible proof points that differentiate Korean dermocosmatic marketing from vaguer Western claims like "cooling sensation" or "refreshing feel."

3. Sensitive Skin as Universal Target🔗

Unlike Western markets where dermocosmatic products often target specific conditions (acne, rosacea), Korean brands universally position for "sensitive skin" - a broader, more inclusive category that doesn't pathologize skin concerns.

Key Insights for Global Brands🔗

The Korean Formula: Science + Emotion + Convenience🔗

Korean dermocosmatic success follows a three-pillar structure:

- Scientific Credibility: Specific numbers, clinical data, ingredient analysis

- Emotional Connection: Character collaborations, brand stories, social proof

- Practical Convenience: Simple usage, immediate effects, daily applicability

💡 Core Learning:

Korean dermocosmatic brands excel at "translating science into stories." While Western brands often lead with clinical authority, Korean brands wrap scientific claims in approachable, even playful narratives that make professional-grade skincare feel accessible and enjoyable.

This approach is particularly effective with younger consumers who want efficacy without the intimidation factor of traditional pharmaceutical brands.

Market Entry Recommendations🔗

For international brands entering the Korean dermocosmatic market:

- Quantify everything: Vague claims don't resonate; specific numbers do

- Layer your evidence: Immediate + clinical + technological proof points

- Embrace approachability: Science doesn't have to be serious

- Localize authority: Global heritage needs local validation

- Target broadly: "Sensitive skin" over specific conditions

Cultural Adaptation Strategies🔗

| Western Approach | Korean Adaptation | Example |

|---|---|---|

| Clinical sterility | Scientific playfulness | My Melody × dermocosmatic |

| Single hero ingredient | System solutions | pH environment management |

| Professional endorsement | Consumer testimonials | "Inquiries flooding in" |

| Problem-focused | Prevention-oriented | Daily sensitive care |

Conclusion: The Future of Dermocosmatic Marketing🔗

The Korean dermocosmatic market offers valuable lessons for global beauty brands. The success of these top-performing products at Olive Young demonstrates that consumers increasingly seek products that deliver both emotional satisfaction and scientific efficacy.

The three brands analyzed - Cellfusion C's character collaboration, Aestura's pH revolution, and Eucerin's localized authority - each represent viable strategies for bridging the gap between pharmaceutical credibility and cosmetic desirability.

As the global beauty market continues to evolve, the Korean approach of making science approachable, quantifiable, and even fun may well become the new standard for dermocosmatic marketing worldwide.

🎯 Key Takeaway for Global Marketers:

The Korean dermocosmatic market proves that scientific authority and emotional appeal are not mutually exclusive. Success comes from understanding that today's consumers want products that are both clinically proven and culturally relevant. The brands that can deliver hard science with a soft touch will win in this evolving category.

This analysis is based on OCR data extraction and market analysis from BeauticsLab's proprietary beauty market intelligence platform, focusing on Olive Young's dermocosmatic category performance in week 31 of 2025.

Related Articles

Discover more insights on similar topics.

Korean Men's Care Market Visual Strategy: How Top Brands Use Before/After at Olive Young

Analysis of product detail pages from Objet, Dashu, and Gillette - the top-ranking products in men's care subcategories at Olive Young, Korea's leading beauty retailer. This report examines how Korean men's care brands leverage visual proof to drive conversions.

Korean Fragrance Market Product Page Analysis: Top 3 Category Leaders at Olive Young

Analysis of product detail pages from RoundAround, AfterBlow, and Sennok - the top-ranking products in fragrance/diffuser subcategories at Olive Young, Korea's leading beauty retailer. This report examines how Korean fragrance brands communicate scent through digital content.

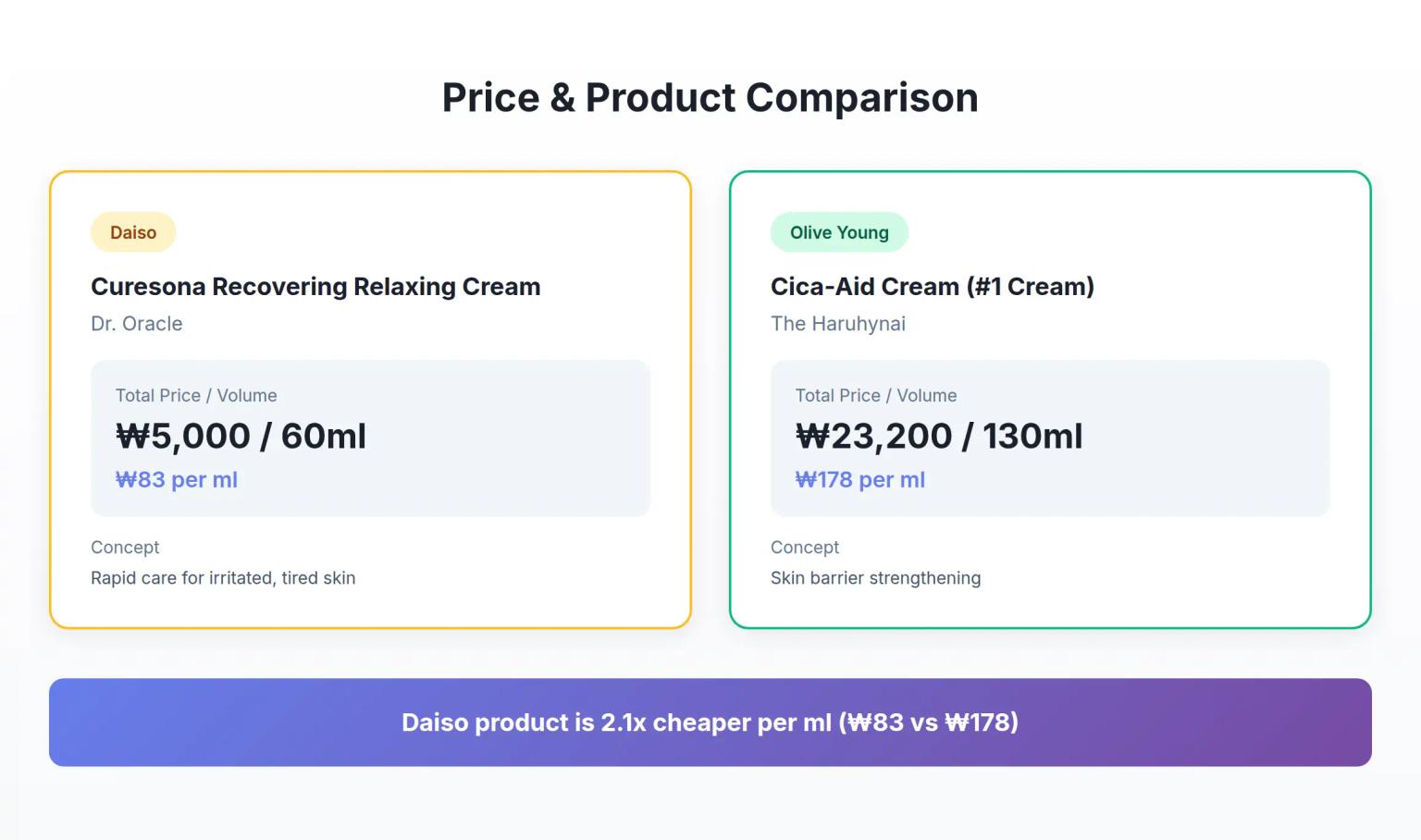

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.