Korea's Heartleaf Revolution: How 4 Brands Drive 600-Product Market Innovation

BeauticsLab

September 12, 2025

Table of Contents

Heartleaf: The New K-Beauty Standard🔗

Few ingredients in Korean cosmetics have shown the explosive expansion power of heartleaf (Houttuynia cordata). As of September 2025, 600 products contain this ingredient, signaling its evolution from trend to new market standard.

What's remarkable is heartleaf's category expansion. Starting with toners and creams, heartleaf now spans mask packs, sun care, cleansing, and even hair care and foot care products across the entire K-beauty spectrum.

The expansion reveals completely different brand approaches. ABIB dominates with 13 products building overwhelming market control in toners, while ANUA deploys 11 products across all categories for diversification. GOODAL executes a premium strategy with 4 carefully selected products featuring Disney collaborations and refill systems, and HeyNature breaks through with 5 products using 3rd generation upgrade stories and spray innovation.

Let's analyze the market landscape created by 600 products, brand-specific innovation strategies, and consumer responses revealed through 18,739 reviews.

Market Landscape: Competition by Numbers🔗

Product Count-Based Brand Market Share🔗

Clear hierarchy emerges when examining brand influence by product count in the heartleaf market.

Tier 1: Market Dominators

- ABIB: 13 products (21.7%) - Toner category focus

- ANUA: 11 products (18.3%) - All-category diversification

Tier 2: Specialists

- HeyNature: 5 products (8.3%) - Toner-centered niche

- GOODAL: 4 products (6.7%) - Cream/sun care specialization

ABIB and ANUA control 40% of all heartleaf products, forming a duopoly. Notably, ABIB concentrates on toners while ANUA diversifies across toners, creams, and ampoules.

Brand Portfolio Strategy Analysis🔗

Each brand's product portfolio reveals distinct strategic differences.

Product Count Strategy Analysis:

- ABIB: 13 products (21.7%) - Market domination through toner focus

- ANUA: 11 products (18.3%) - All-category diversification strategy

- HeyNature: 5 products (8.3%) - Strong performance for smaller brand

- GOODAL: 4 products (6.7%) - Premium focus with select products

ABIB secures overwhelming volume with 13 products building toner category dominance, while ANUA places 11 products across diverse categories to expand brand influence. GOODAL takes a premium positioning strategy with 4 carefully selected products.

Heartleaf Position vs. Competing Ingredients🔗

Heartleaf's position within the calming ingredient market:

| Rank | Ingredient | Products | Market Share | Avg Price | Features |

|---|---|---|---|---|---|

| 1st | Panthenol | 3,092 | 28.0% | ₩22,556 | Universal use |

| 2nd | Centella/Cica | 1,601 | 14.5% | ₩20,590 | Traditional calming |

| 3rd | Tea Tree | 390 | 3.5% | ₩18,551 | Trouble care |

| 4th | Heartleaf | 600 | 5.4% | ₩20,610 | Rapid growth |

| 5th | Aloe | 490 | 4.4% | ₩18,578 | Hydration focus |

Heartleaf ranks 4th among calming ingredients, recording 4.0% recent product count growth rate - ranking #1 among all ingredients. This shows 5x faster growth than centella (0.6%) and panthenol (0.8%).

Brand Innovation Strategy Deep Dive🔗

1. ABIB - Stable Market Domination Strategy🔗

ABIB positions as "The standard of calming care" while consolidating market dominance.

ABIB Heartleaf Calming Toner Skin Booster Product Page Story Flow

Hook

Double hydration calming deal (200ml+200ml)

Authority Proof

Olive Young Awards winner, high customer satisfaction

Origin Story

Premium heartleaf grown in Jirisan Mountain

Scientific Evidence

Proven -3.95°C cooling effect

Product Range

Various options from 200ml basic to 500ml large size

Usage Experience

Skin booster function maximizes next-step absorption

Core Strategy: Market dominance through toner category focused investment

Key Differentiators:

- Premium positioning with Jirisan origin story

- Large size strategy (500ml) for customer loyalty

- Trust building through award history

2. ANUA - Aggressive Expansion Strategy🔗

ANUA pursues "All-category diversification" to expand brand influence.

ANUA Heartleaf 77 Soothing Toner Product Page Story Flow

Hook

September Olive Young Pick, 1 bottle sold every second

Impressive Numbers

#1 nation's peeled egg toner, cumulative sales emphasis

Innovation Technology

Proprietary HEARTLEAF+™ ingredient development

Scientific Evidence

High-concentration heartleaf for maximum calming effect

Product Range

250ml basic to 350ml refill pack expansion

Immediate Effect

Instant calming effect and hydration supply

Core Strategy: Brand influence expansion through 11 products across all categories

Key Differentiators:

- Tech appeal with proprietary HEARTLEAF+™ ingredient

- Buzz maximization through Olive Young Pick marketing

- Sustainability emphasis with refill pack system

3. GOODAL - Premium Differentiation Strategy🔗

GOODAL builds premium positioning through "Select premium strategy" focusing on 4 core products.

GOODAL Heartleaf Hyaluron Soothing Cream Product Page Story Flow

Hook

Stitch Edition Disney collaboration

Impressive Numbers

100-hour lasting moisturization

Innovation Technology

Heartleaf and hyaluronic acid dual care system

Scientific Evidence

-4.2℃ cooling effect, immediate skin temperature reduction

Eco Value

Eco-friendly usage with refill system

Limited Edition

Collectible value with limited mini bag gift

Core Strategy: Premium positioning through 4 core products with Disney collaboration and eco-friendly systems

Key Differentiators:

- Gen Z appeal through character collaboration

- Functionality emphasis with 100-hour durability

- MZ generation values alignment with refill packaging

4. HeyNature - Niche Innovation Strategy🔗

HeyNature breaks through small brand limitations with "Technology evolution story".

HeyNature Heartleaf Skin Moisturizer Toner Product Page Story Flow

Hook

3rd generation upgraded heartleaf toner

Innovation Story

1st gen→2nd gen→3rd gen evolution storytelling

Origin Story

100% organic certified heartleaf usage

Innovation Technology

Spray format introduction for maximum convenience

Scientific Evidence

200ml planning set for expanded trial opportunities

Added Value

Total care proposal with 2 heartleaf mask sheets

Core Strategy: Niche targeting through technology evolution story and format innovation

Key Differentiators:

- Tech appeal through 3rd generation upgrade story

- Usage innovation with spray format introduction

- Ingredient differentiation with organic heartleaf

Innovation Strategy Comparison Analysis🔗

| Category | ABIB | ANUA | GOODAL | HeyNature |

|---|---|---|---|---|

| Core Strategy | Market Domination | Aggressive Expansion | Premium Differentiation | Niche Innovation |

| Product Count | 13 (21.7%) | 11 (18.3%) | 4 (6.7%) | 5 (8.3%) |

| Product Portfolio | 13 (Focused) | 11 (Diversified) | 4 (Selected) | 5 (Expanding) |

| Main Category | Toner focus | All categories | Cream/sun care | Toner-centered |

| Core Message | Jirisan heartleaf | HEARTLEAF+™ | Disney collab | 3rd gen upgrade |

| Differentiators | Large size strategy Award history | Proprietary ingredient OY Pick marketing | Character IP Refill system | Spray innovation Organic source |

| Average Ranking | 4th (Top tier) | 23-24th (Mid tier) | 77-78th (Mid-low tier) | 109th (Lower tier) |

| Target Strategy | Stable dominance | Market share expansion | MZ premium | Small brand breakthrough |

Innovation Pattern Analysis🔗

1. Product Portfolio Strategy

- ABIB: 13 products for overwhelming volume, toner category domination

- ANUA: 11 products diversified placement for brand influence expansion

- GOODAL: 4 selected products for premium focused strategy

2. Category Approach

- ABIB: Toner focus for market dominance

- ANUA: All-category balanced placement for brand influence maximization

- GOODAL: Cream/sun care specialization for premium market targeting

3. Marketing Message Differentiation

- Ingredient differentiation (Jirisan, organic)

- Tech innovation (proprietary ingredient, spray)

- Emotional appeal (Disney, 3rd gen story)

Consumer Response and Market Insights🔗

Brand Satisfaction from 18,739 Reviews🔗

Satisfaction Rankings:

- GOODAL: 4.9 rating (92% 5-star ratio) - Hydration + calming balance

- ANUA: 4.8 rating (88% 5-star ratio) - High-concentration ingredients

- ABIB: 4.8 rating (84% 5-star ratio) - Calming specialization

- HeyNature: 4.7 rating (82% 5-star ratio) - Gentleness expertise

Key Purchase Decision Factors🔗

1. Heartleaf Ingredient Trust (40%)

- Firm perception that "calming = heartleaf" is established

- Positioned as essential ingredient for sensitive, troubled skin

2. Brand Recognition (25%)

- ABIB's market dominance translates to consumer trust

- Olive Young Pick, Awards significantly influence purchase decisions

3. Price-to-Volume Ratio (20%)

- Increasing preference for large-size products (500ml)

- Refill system economic appeal effectiveness

4. Review Ratings (15%)

- High ratings of 4.8+ act as purchase motivation

Category-Specific Consumer Response Differences🔗

Toners: Satisfaction with watery texture and immediate calming effects

Creams: Preference for non-sticky cooling sensation and lasting moisturization

Mask Packs: Immediate post-use calming effect appreciation

Sun Care: Satisfaction with dual functionality of heartleaf + UV protection

Practical Application: Heartleaf Market Entry Strategies🔗

1. Category Expansion Opportunities🔗

High Success Probability:

- Sun Care: 53 products showing expansion, dual functionality appeal possible

- Hair Care: 49 products, scalp calming care needs surging

- Cleansing: 46 products, post-cleansing calming effect differentiation

Unexplored Areas:

- Mask Packs: Only 46 heartleaf vs 159 centella products - opportunity exists

- High Price Point: Only 8 products above ₩50,000 - premium opportunity

2. Brand Positioning Strategies🔗

New Entry Brands:

- Benchmark ANUA's all-category diversification strategy

- Differentiate through proprietary ingredient development

- Utilize buzz marketing like Olive Young Pick, limited editions

Existing Brand Expansion:

- Reference ABIB's volume focus and category dominance strategy

- Benchmark GOODAL's select premium positioning

- Strengthen trust elements like award history, sales records

3. Product Development Direction🔗

Essential Considerations:

- Cooling Effect: -3~4℃ temperature reduction as basic spec

- Durability: Prove 24+ hour calming/moisturizing persistence

- Texture: Preference for non-sticky, fresh texture

- Safety: Sensitive skin testing completion required

Differentiation Points:

- Ingredient story (regional specialty, organic certification)

- Format innovation (spray, gel, emulsion)

- Packaging innovation (refill, large size, portable)

Conclusion: Heartleaf's Future Beyond 600🔗

The heartleaf market has evolved beyond a simple ingredient trend to become a new K-beauty standard. The scale of 600 products demonstrates heartleaf's establishment as synonymous with calming care.

Particularly noteworthy is how each brand employs completely different innovation strategies. ABIB's stable dominance, ANUA's aggressive expansion, GOODAL's premium differentiation, HeyNature's niche innovation - each strategy achieves its own success.

The future heartleaf market will develop toward more specialized expertise and innovative product formats. Expansion in mask pack markets, premium line development, and advancement into new categories will continue.

The key is not simply adding heartleaf, but creating your own heartleaf language. Consumers already have firm trust in heartleaf. Now, how to develop that trust into your own brand story becomes the key to success.

Frequently Asked Questions🔗

Q. What's the most effective strategy for entering the heartleaf market?

A. Market analysis shows three effective strategic choices. Aggressive Expansion Strategy (ANUA model): Launch multiple new products across various categories within 3 months to capture market attention. Niche Innovation Strategy (HeyNature model): Differentiate through format innovations like spray, airy textures. Premium Strategy (GOODAL model): Target MZ generation through character collaborations, refill systems for premium positioning. The key is avoiding direct competition with existing leaders (ABIB) and building your own territory.

Q. What's the most important differentiation point for heartleaf products?

A. Consumer review analysis shows quantified cooling effects are most important. Presenting specific temperature reduction data like ABIB (-3.95°C), GOODAL (-4.2°C) significantly increases credibility. Next comes ingredient differentiation (Jirisan vs organic vs proprietary extraction) and durability emphasis (24 hours, 100 hours). The key is creating "our unique heartleaf story" rather than simply "contains heartleaf." Specifically stating ingredient origin, extraction method, concentration enables differentiation from competing products.

Q. Which expansion category has the most potential in the heartleaf market?

A. Data analysis reveals mask pack category offers the greatest opportunity. Currently heartleaf products (46) are only 1/3 the level of centella products (159), showing significant market expansion potential. Sun care (53 products) also enables easy differentiation through dual functionality (UV protection + calming). Hair care (49 products) represents a blue ocean due to surging scalp calming needs. However, toners are dominated by ABIB making entry difficult, while creams have GOODAL's premium position secured. New entrants should consider starting with mask packs then gradually expanding.

This analysis is based on 2025 Week 36 BeauticsLab product analysis data from Olive Young, Korea's leading beauty retailer.

Related Articles

Discover more insights on similar topics.

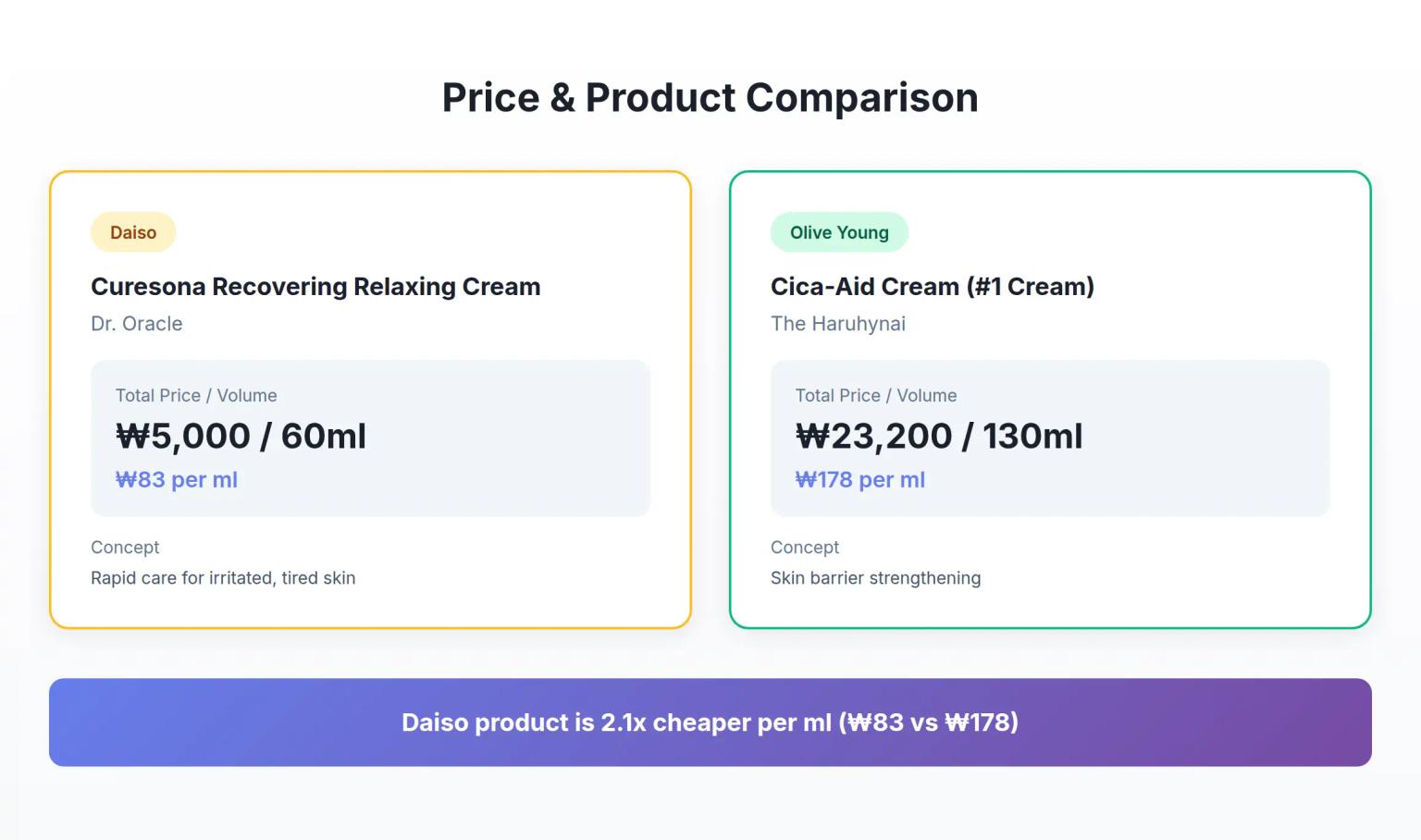

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

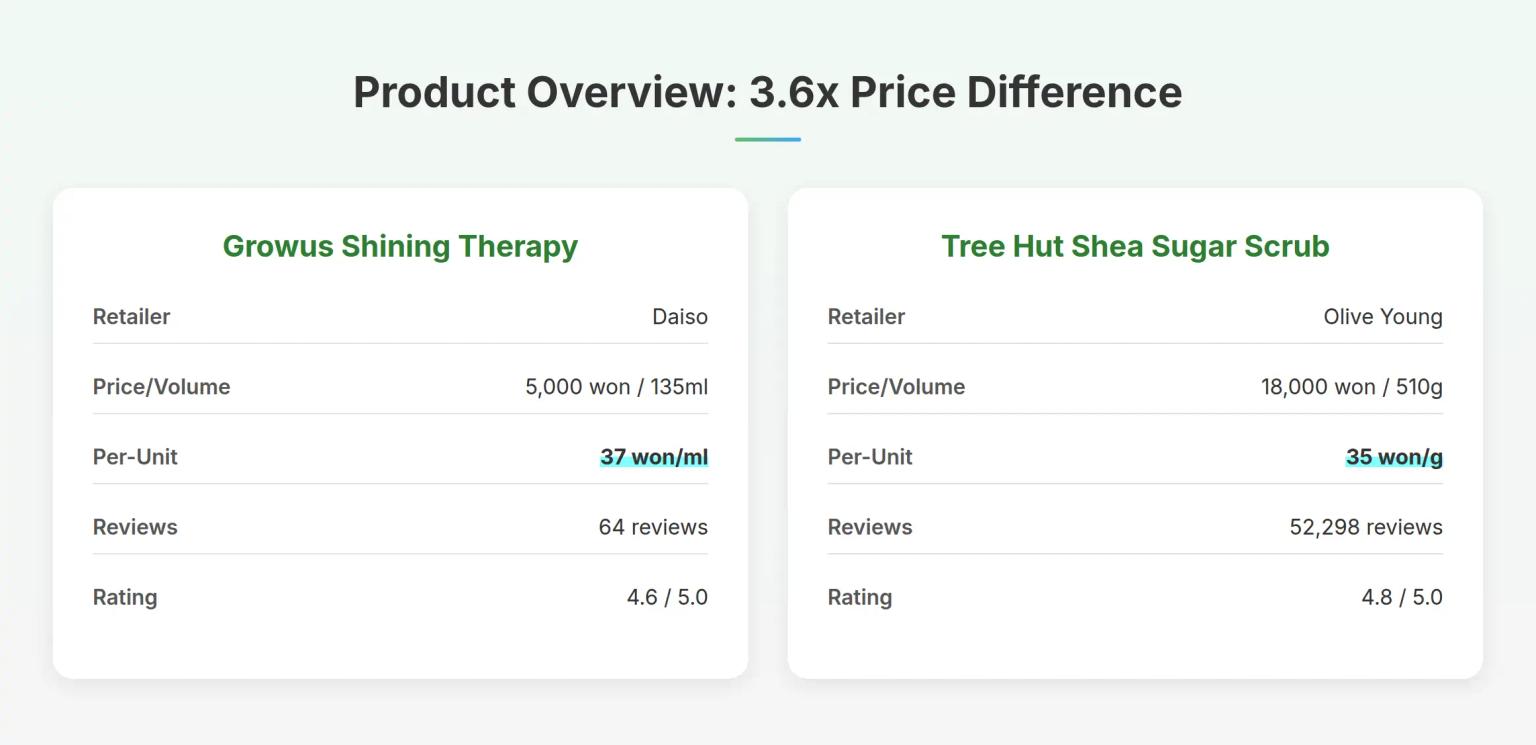

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.