Product Page Playbook: Top 3 Moisturizer Persuasion Formulas

BeauticsLab

August 13, 2025

Table of Contents

Understanding Korean Moisturizer Marketing🔗

The moisturizer category at Olive Young showcases a distinctly Korean approach to skincare marketing that challenges Western conventions. In week 32 of 2025, the top three products demonstrate strategies that combine Italian luxury ingredients, dermatological heritage, and surprisingly, the moisture-retention principles of traditional Japanese castella cake.

What makes Korean moisturizer marketing particularly intriguing is its ability to blend ultra-premium positioning with scientific innovation and cultural references that would baffle Western marketers. Korean brands have mastered the art of making moisturizers not just functional products, but cultural experiences.

Three Leaders, Three Revolutionary Strategies🔗

The analysis covers the top 3 products in the skincare cream subcategory:

- d'Alba Vita Toning Capsule Cream (#1) - Italian truffle meets Korean innovation

- Dr.G Red Blemish Clear Soothing Cream (#2) - Dermatological authority with 10-Cica complex

- S.Nature Aqua Squalane Moisture Cream (#3) - Castella cake science phenomenon

Data Collection Methodology🔗

Product page images were processed using OCR technology to extract all text content. The analysis focuses on unique Korean marketing elements that differentiate these products from global competitors.

Detailed Brand Strategy Analysis🔗

1. d'Alba: The Italian-Korean Luxury Hybrid🔗

d'Alba has created a unique positioning that combines Italian luxury ingredients with Korean innovation technology.

d'Alba Vita Toning Capsule Cream Product Page Story Flow

Premium Hook

99% pure Vitamin C and 98% pure Glutathione in liposome form

Ingredient Storytelling

White truffles from pristine Piedmont region of Italy

Innovation Technology

Patented membrane-free Vita Capsule dual-layering system

Clinical Results

25.41% wrinkle reduction, 17.21% dark spot improvement in 2 weeks

Early Anti-aging Concept

Preventive care for those not ready for heavy anti-aging

Exclusive Offer

Olive Young exclusive set with 55g full size + 4 mini creams

Key Strategy Elements:

- "Early anti-aging" positioning: Targeting younger consumers with preventive care

- Italian luxury narrative: White truffles from Piedmont for premium appeal

- Purity percentages: 99% Vitamin C creates perception of pharmaceutical-grade quality

Cultural Context: The combination of Italian ingredients with Korean technology represents a uniquely Korean marketing approach - leveraging Western luxury associations while maintaining technological superiority. The "early anti-aging" concept (얼리 안티에이징) has become a major trend among Korean millennials who start anti-aging routines in their 20s, something relatively uncommon in Western markets.

2. Dr.G: Medical Authority Meets Mass Market🔗

Dr.G leverages dermatological heritage to build trust while maintaining accessibility.

Dr.G Red Blemish Clear Soothing Cream Product Page Story Flow

Authority Establishment

Dermatology heritage-based dermocosmatic No.1 brand

Problem Universalization

8 out of 10 people have sensitive skin - addressing 5 daily irritants

Scientific Solution

10-Cica complex provides powerful soothing for irritated skin

Triple Benefits

Moisture +22.6%, Heat soothing -6°C, Barrier improvement +102.5%

Long-lasting Effect

100-hour continuous moisture, penetrates 10 layers of stratum corneum

Market Validation

6 consecutive years Olive Young Awards, 26 million units sold

Key Strategy Elements:

- "5 daily irritants" framework: Physical, external, heat, mask, UV - highly specific problem definition

- 10-Cica complex: Using numbers (10) to imply comprehensiveness

- 100-hour moisture claim: Extreme duration promise uncommon in Western marketing

Cultural Context: The "8 out of 10" statistic taps into Korean collectivism - if most people have this problem, it's normal to seek solutions. The mask irritation reference is particularly relevant post-pandemic in Korea where mask-wearing remains common. The 26 million units sold is presented as social proof rather than boasting.

3. S.Nature: The Castella Cake Science Phenomenon🔗

S.Nature demonstrates Korea's unique ability to combine unexpected scientific references with mass appeal.

S.Nature Aqua Squalane Moisture Cream Product Page Story Flow

Market Leadership

Olive Young #1 across all categories, 4 million units national phenomenon

Universal Problem

Finding the perfect moisturizer for all four seasons

Unexpected Science

Castella cake stays moist all day due to fructose - same principle applied

Premium Concentration

150,000ppm squalane - only 0.2% extracted from healthy olives

4-Season Solution

Moisture UP, Sebum DOWN - works for all skin types year-round

Safety Credentials

EWG all-green ingredients, Hwahae Awards 4-crown winner

Key Strategy Elements:

- Castella cake analogy: Using familiar dessert to explain complex hydration science

- "4 million national item" positioning: Framing as cultural phenomenon

- 150,000ppm squalane: Specific concentration creates scientific credibility

Cultural Context: The castella cake (카스텔라) reference brilliantly localizes complex science. This Japanese sponge cake is beloved in Korea, and using its moisture-retention as an analogy makes the product's mechanism instantly understandable. The "national item" (국민템) designation is a powerful Korean marketing concept that suggests universal adoption.

Common Success Patterns in Korean Moisturizers🔗

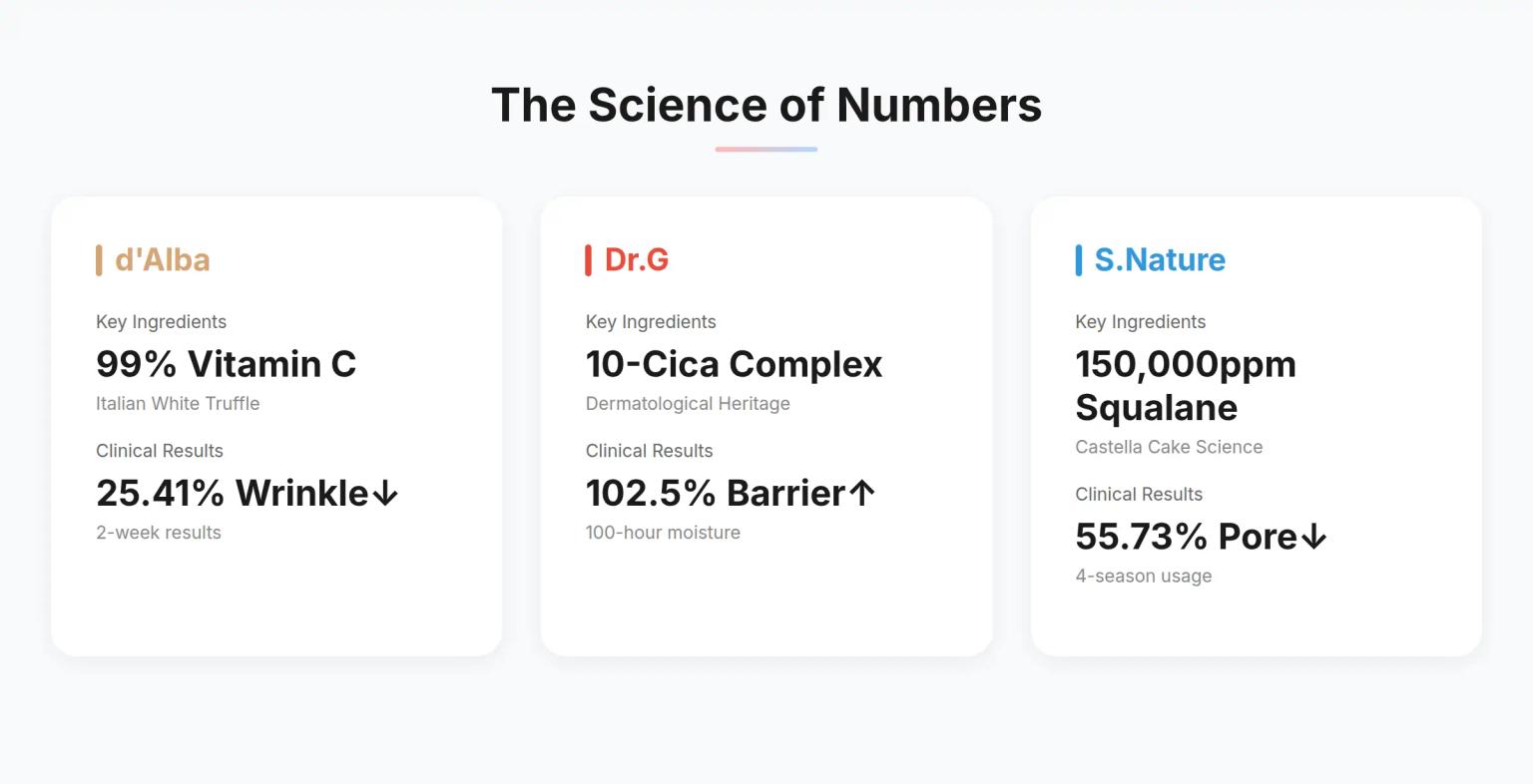

1. The Science of Numbers🔗

Korean brands use precise metrics to build credibility:

| Brand | Key Ingredients | Clinical Results | Duration Claims |

|---|---|---|---|

| d'Alba | 99% Vitamin C | 25.41% wrinkle reduction | 2-week results |

| Dr.G | 10-Cica complex | 102.5% barrier improvement | 100-hour moisture |

| S.Nature | 150,000ppm squalane | 55.73% pore reduction | 4-season usage |

2. Targeted Positioning Strategy🔗

| Brand | Target Audience | Core Concern | Solution Approach |

|---|---|---|---|

| d'Alba | 20-30s women | Early anti-aging | Premium ingredients + innovation |

| Dr.G | Sensitive skin | Daily irritation | Medical authority + 10-Cica |

| S.Nature | Practical consumers | Value + efficacy | Science + proven popularity |

3. The Olive Young Platform Effect🔗

🎯 Platform-Specific Strategies:

- Olive Young Awards leveraged as primary credibility marker

- Exclusive sets and special editions for platform differentiation

- Sales rankings used as social proof

- MD's Pick designations highlighted prominently

All brands optimize for Olive Young's unique position as Korea's beauty authority, using platform-specific achievements as marketing pillars.

What Global Brands Can Learn🔗

1. Ingredient Origin as Luxury Signifier🔗

d'Alba's Italian truffle story demonstrates how Korean brands leverage Western luxury associations while maintaining technological superiority. This dual heritage approach - European ingredients with Asian innovation - creates a unique premium positioning unavailable to purely Western or Asian brands.

2. Medical Authority Without Clinical Coldness🔗

Dr.G successfully combines dermatological authority with approachable marketing. Unlike Western medical brands that often feel clinical, Korean medical beauty maintains warmth through specific problem-solving narratives and social proof.

3. Cultural References as Scientific Explanations🔗

S.Nature's castella cake analogy shows how complex science can be made accessible through cultural references. This approach makes technical benefits instantly understandable and memorable.

4. Numbers as Storytelling Devices🔗

Korean brands don't just use numbers for credibility - they use them narratively:

- "Every 3 minutes" (production frequency)

- "10 layers deep" (penetration depth)

- "4 million users" (social phenomenon)

These numbers tell stories rather than just stating facts.

The Korean Moisturizer Success Formula🔗

Premium Story × Scientific Proof × Cultural Resonance = Market Domination🔗

The winning formula in Korean moisturizer market:

- Differentiated Story: Unique ingredient origins or scientific principles

- Quantified Benefits: Precise percentages and timeframes

- Cultural Connection: References that resonate locally

💡 Key Insight for Global Brands:

Korean moisturizer success transcends traditional skincare marketing by creating products that are simultaneously aspirational and accessible, scientific yet playful, premium but practical. The ability to combine Italian truffles with membrane-free capsules, or explain hydration through castella cake, shows how cultural fluency and scientific innovation can coexist.

Global brands entering the Korean market must understand that ingredient lists and clinical trials are just the beginning - success requires cultural storytelling that makes products feel both revolutionary and familiar.

Unique Korean Market Characteristics🔗

Beyond Western Marketing Paradigms🔗

- Early Prevention Culture: Anti-aging starting in the 20s as mainstream

- Texture Innovation: Capsule creams and transforming textures as differentiators

- Social Proof Metrics: Sales numbers as primary marketing tools

- Cultural Science: Using food analogies to explain complex mechanisms

These strategies reflect Korean consumers' sophisticated skincare knowledge combined with their desire for products that feel innovative yet culturally grounded. The market rewards brands that can balance scientific credibility with emotional resonance.

The Power of Platform-Specific Marketing🔗

Korean brands have mastered platform-specific optimization:

- Olive Young exclusives create artificial scarcity

- Platform awards become primary credibility markers

- Sales rankings drive further sales in virtuous cycles

This platform-centric approach differs markedly from Western omnichannel strategies, showing how market concentration can be leveraged for explosive growth.

This analysis is based on OCR data extraction from product detail pages and BeauticsLab's proprietary analytics for week 32, 2025.

Related Articles

Discover more insights on similar topics.

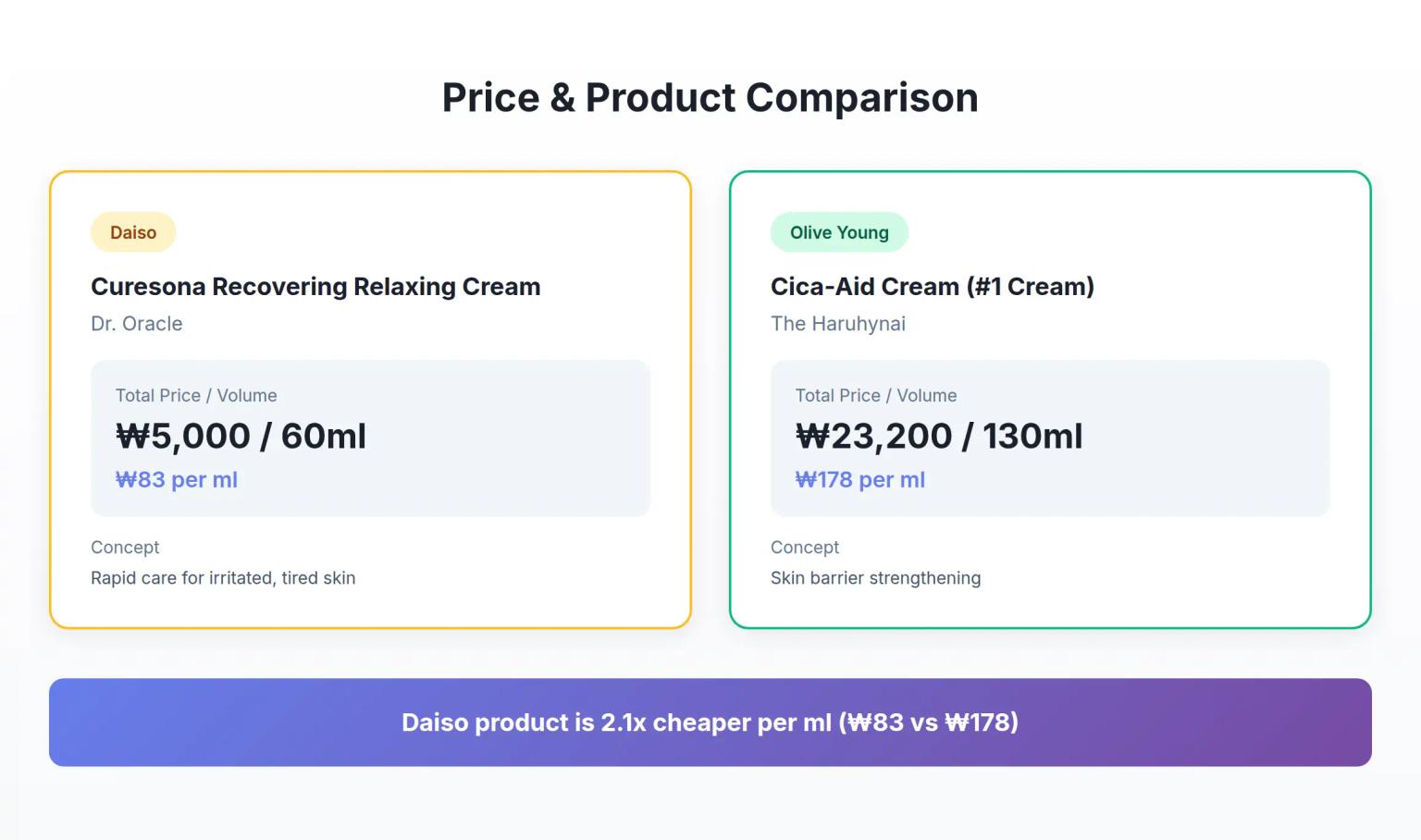

Korean Cica Cream Marketing: How 4 Key Ingredients Challenge Premium Pricing

Analysis of Dr. Oracle Curesona Cream (5,000 won) vs The Haruhynai Cica-Aid Cream (23,200 won) reveals how budget Korean cica creams include the same 4 key ingredients as premium products - strategies that redefine value propositions in K-beauty's soothing cream segment.

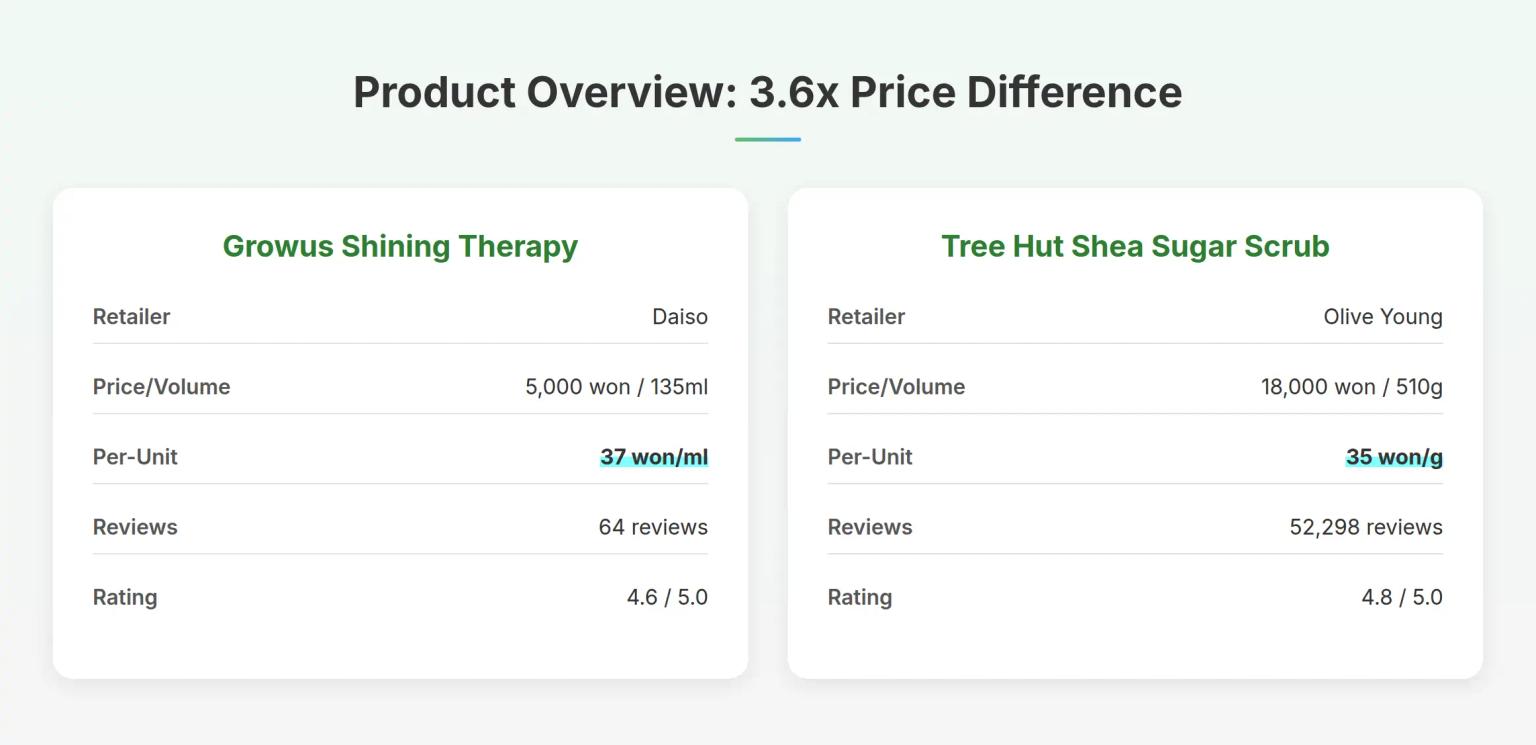

Korean Body Scrub Marketing: How LHA Changes the 5,000 Won Game

Analysis of Growus Shining Therapy Shimmer Body Scrub (5,000 won) vs Tree Hut Shea Sugar Scrub (18,000 won) reveals how Korean body scrub brands use chemical exfoliation ingredients to challenge physical scrub dominance - strategies that redefine value propositions in the budget beauty segment.

Korean Peel-Off Pack Marketing: Why Price Doesn't Tell the Full Story

Analysis of Fromderskin Glow Peel-Off Pack (3,000 won) vs Mefactory Pig Cement Peel-Off Pack (10,800 won) reveals how Korean skincare brands use ingredient positioning and skin type targeting to create distinct market segments - strategies that challenge conventional price-value assumptions.